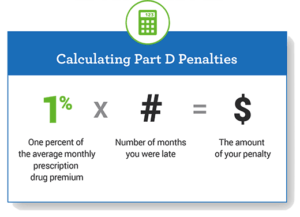

Learn how the Part D late enrollment penalty is calculated and more about the ways to avoid the penalty. Generally a penalty of 1 percent per month will be added to the Part D monthly premium for each month you could have enrolled but did not enroll or have coverage at least as good as Medicares also known as creditable coverage.

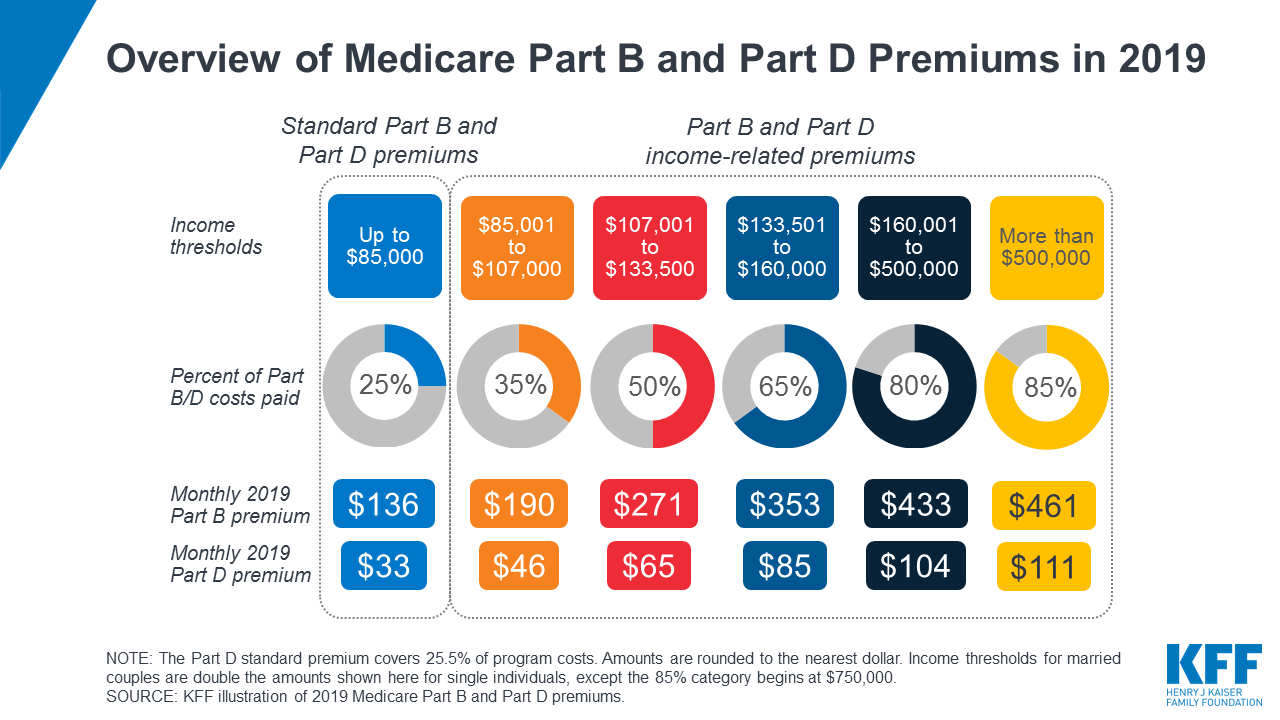

Medicare S Income Related Premiums Under Current Law And Changes For 2019 Kff

Medicare S Income Related Premiums Under Current Law And Changes For 2019 Kff

How Much Is the Medicare Part D Late Penalty.

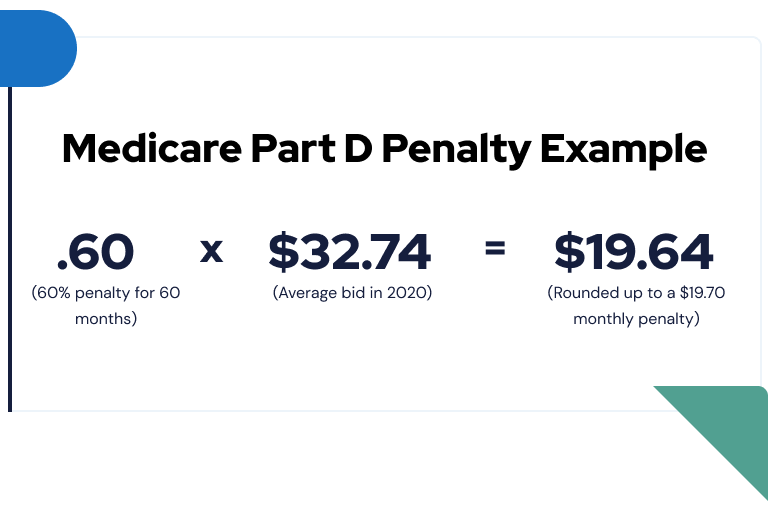

How much is medicare part d penalty. The Part D penalty is calculated as 1 percent of the national base beneficiary premium That amount changes every year and is multiplied by the number of months you went without creditable prescription drug coverage rounded up to the nearest 10 cents. Based on the current Medicare Part D penalty formula using Rustys example if you waited 36 months to buy your penalty TAX would be 1260 per month in addition to your Medicare Part D premium. Ray joined a Medicare drug plan before the end of his Part D Initial Enrollment.

Multiply this number of months by 1 percent. Annons Protect the best years ahead. This is a tax not a surcharge that goes to the insurance carrier that issues your Part D.

Medicare calculates the penalty by multiplying 1 of the national base beneficiary premium 3306 in 2021 times the number of full uncovered months you didnt have Part D or creditable coverage. Count the number of months you didnt have prescription drug coverage. In general youll have to pay this penalty for as long as you have a Medicare drug plan.

The Medicare Part D penalty is calculated by multiplying 1 of the national base beneficiary premium 3306 in 2021 by the number of full months that you were eligible for but didnt enroll in a Medicare Prescription Drug Plan and went without other creditable prescription drug coverage. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Medicare rounds this amount up to the.

Here is how the late enrollment penalty is calculated. Annons Protect the best years ahead. Since the national base beneficiary premium may increase each year the penalty amount may also increase each year.

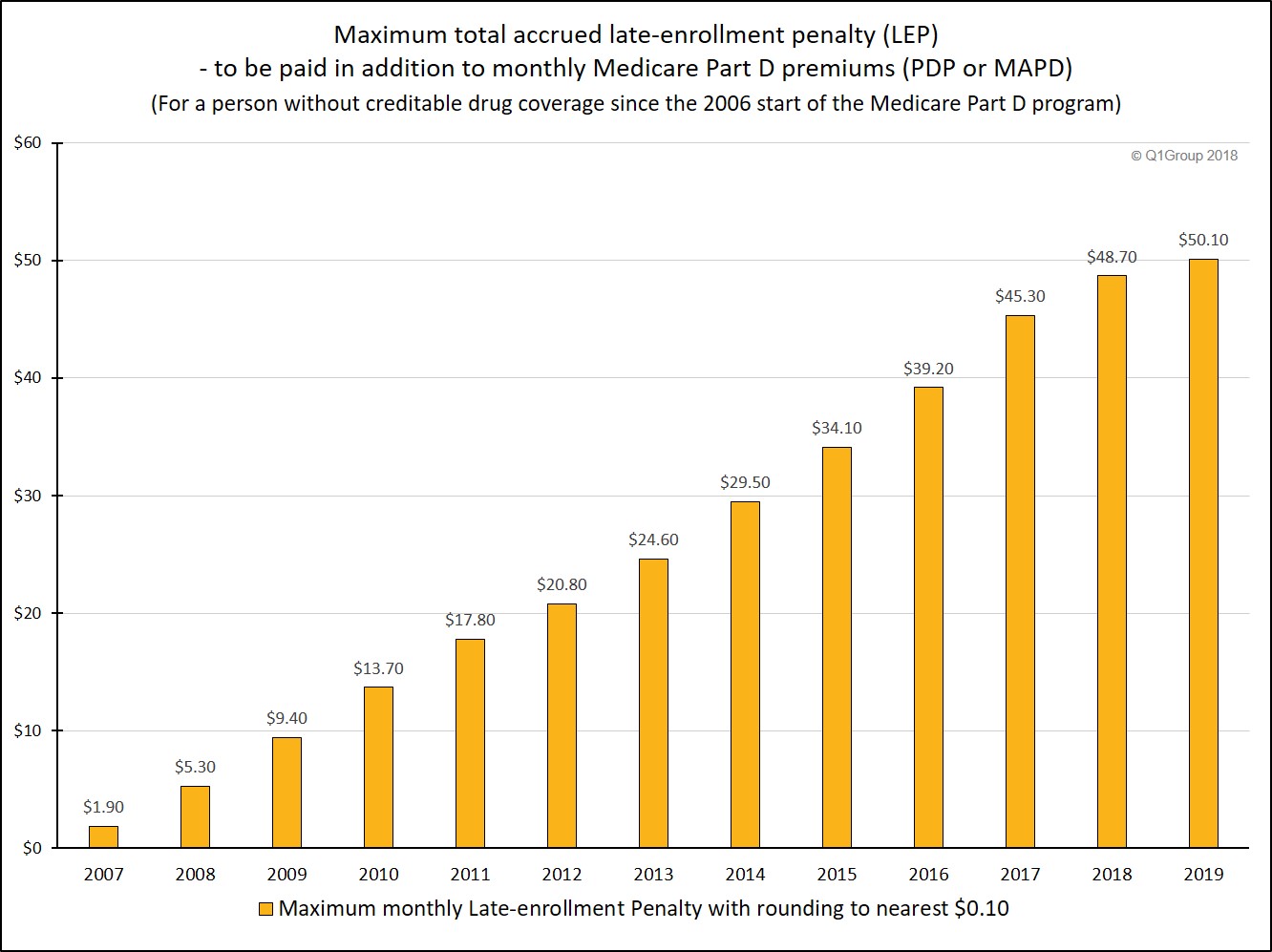

Get advice from our licensed insurance agents at no cost or obligation to enroll. Here is an example chart showing how a Medicare Part D late-enrollment penalty can increase over the years - and the cost of waiting to enroll in a Part D plan. This would be calculated as 3306 x33 1090.

After you enroll in Medicare drug coverage the plan will tell you if. The monthly penalty is rounded to the nearest 010 and added to the monthly Part D premium. The national base beneficiary premium for 2020 is 3274.

This means that youd pay an extra 790 per month in addition to your regular Part D monthly premium for the rest of your life. The final amount is rounded to the nearest 10 and added to your monthly premium. Medicare Part D Penalty For Late Enrollment If youre looking for a Part D penalty calculator Amplicare has a useful one.

The Part D penalty is rounded to the nearest 10 cents. As mentioned above the average. The monthly penalty is always rounded to the nearest 010.

Shop 2021 Medicare plans. 51 rader How much does Medicare Part D cost. Get advice from our licensed insurance agents at no cost or obligation to enroll.

How much is the Part D penalty. The cost of the late enrollment penalty depends on how long you went without creditable prescription drug coverage. The late enrollment penalty is an amount added to your Medicare Part D premium How much is the Part D penalty.

Youll pay this penalty in addition to your Part D Premium. Your penalty for 2021 would be 33 cents x 12 for the 12 months of 2020 you werent covered or 396. Shop 2021 Medicare plans.

The figure is rounded to the nearest 010. For each full uncovered month that the person didnt have Part D or other creditable coverage. The national base beneficiary premium may go up each year so the penalty amount may also go up every year.

So rounding to the nearest 10 260 would be added to your monthly Medicare Part D premium. In 2021 the maximum late-enrollment penalty can reach as high as 69480 per year - paid in addition to your Medicare plan premium and coverage. One percent of 3306 is 033 x 8 months about 264.

The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Your Part D penalty would be 33 percent of the national beneficiary premium one percent for each of the 33 months you waited.

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

Medicare Part D Costs 2019 My Medicare Supplement Plan

Medicare Part D Costs 2019 My Medicare Supplement Plan

Medicare Cost What To Know Medicare Usa

Medicare Cost What To Know Medicare Usa

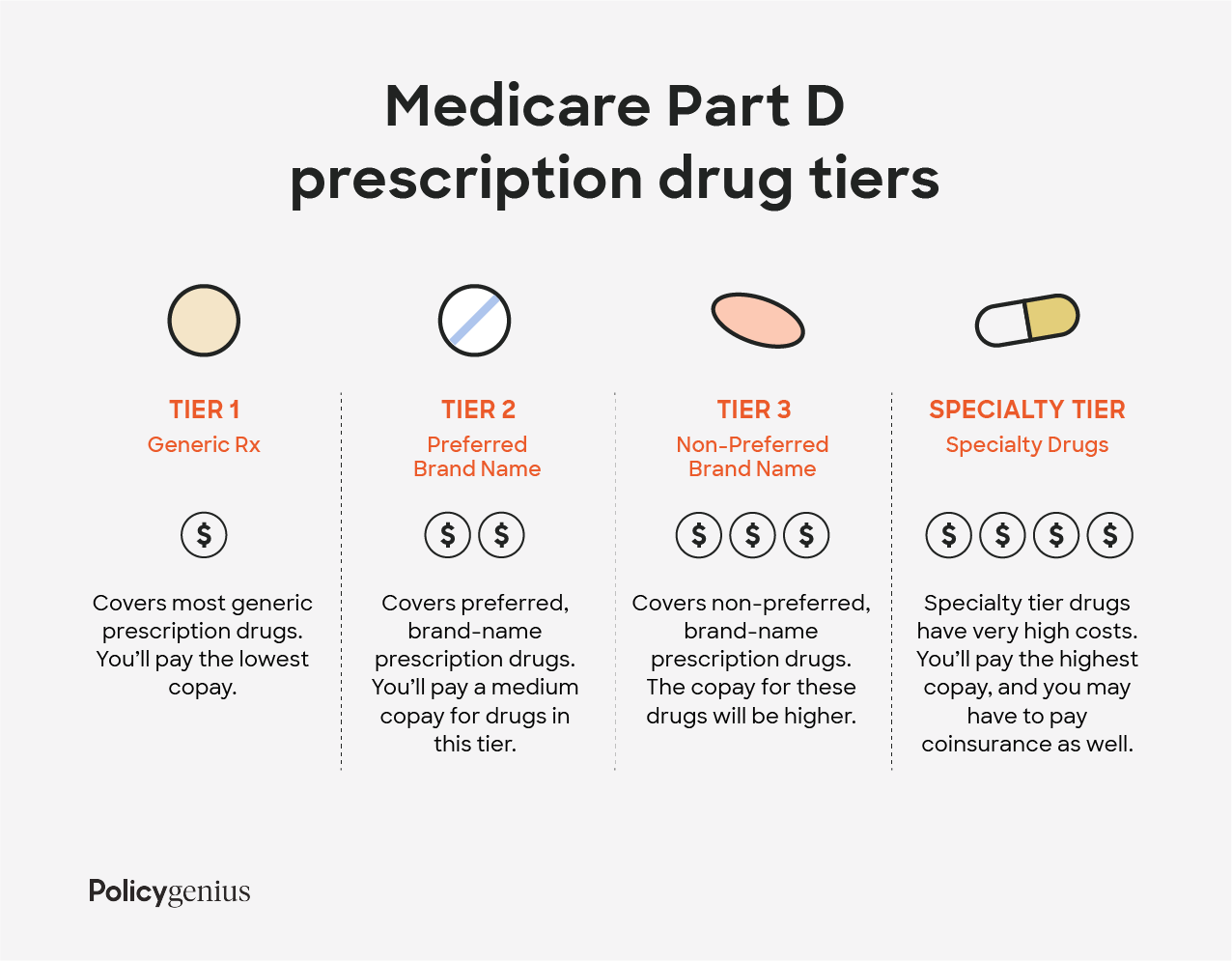

What Is Medicare Part D Senior Market Solutions

What Is Medicare Part D Senior Market Solutions

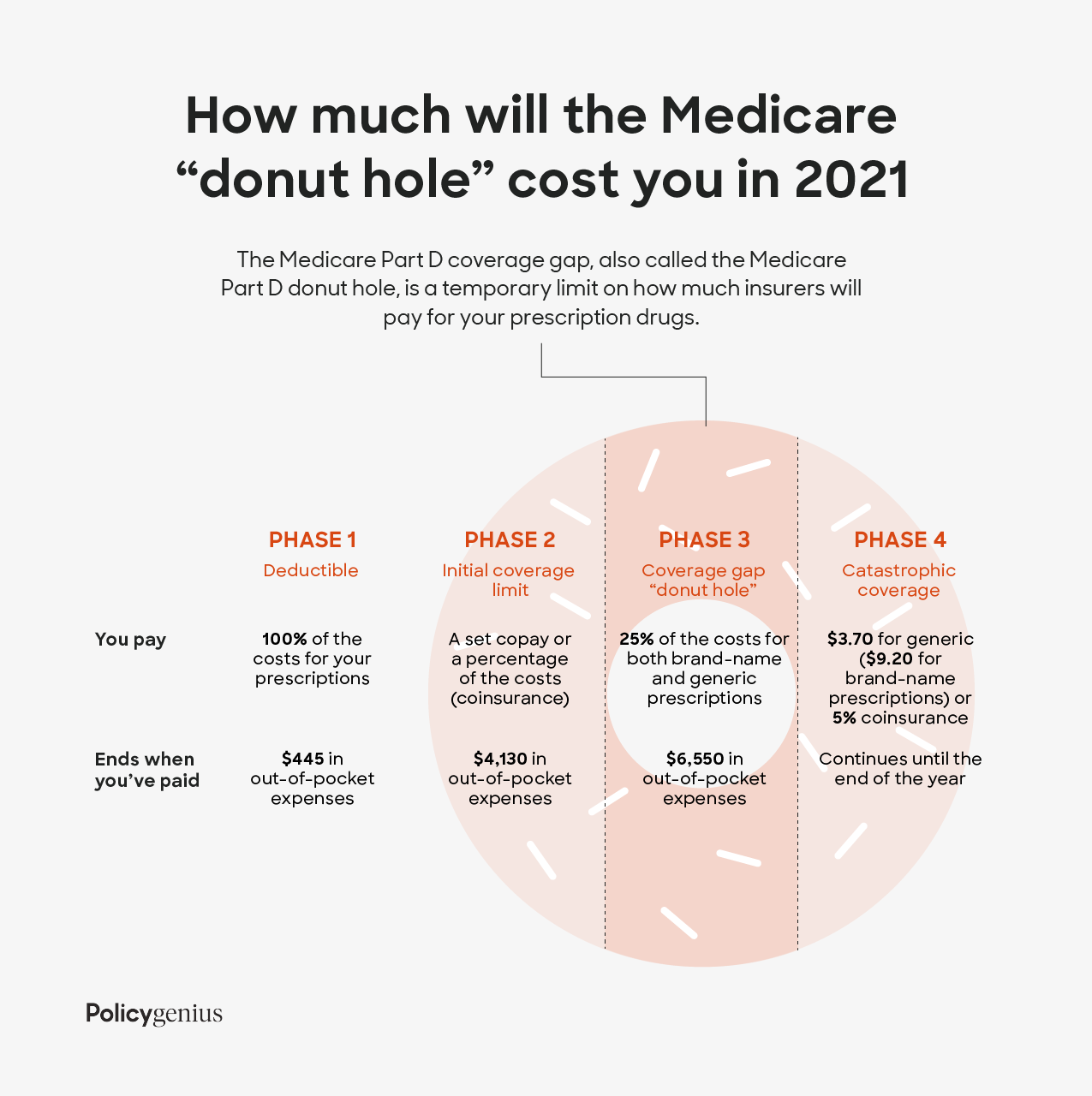

Your Guide To Medicare Part D For 2021 Policygenius

Your Guide To Medicare Part D For 2021 Policygenius

How Much Will I Pay In Medicare Part D Costs

How Much Will I Pay In Medicare Part D Costs

Medicare Drug Coverage Penalty How The Part D Penalty For Not Enrolling Works

Medicare Drug Coverage Penalty How The Part D Penalty For Not Enrolling Works

Your Guide To Medicare Part D For 2021 Policygenius

Your Guide To Medicare Part D For 2021 Policygenius

Medicare Cost What To Know Medicare Usa

Medicare Cost What To Know Medicare Usa

Part D Late Enrollment Penalty Maine Medicare Options

Part D Late Enrollment Penalty Maine Medicare Options

Medicare Late Enrollment Penalty Avoid Penalty Fees

Medicare Late Enrollment Penalty Avoid Penalty Fees

:max_bytes(150000):strip_icc()/medicare-part-d-costs-4589863_FINAL-a334073127ad461fbd5457a7d74d1e6c.png) How Much Does Medicare Part D Cost

How Much Does Medicare Part D Cost

Do I Have To Sign Up For A Medicare Part D Plan 65medicare Org

Do I Have To Sign Up For A Medicare Part D Plan 65medicare Org

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.