An HSA will allow you to use tax-deductible dollars to pay for your out-of-pocket and other qualified medical expenses. An HSA would save you 952 in taxes or 1890 for a family.

Https Www Bcbsm Com Content Dam Microsites Som State Health Plan Hdhp Booklet Pdf

Anthem Blue Cross and Blue Shield.

Blue cross hsa. Think of it like a retirement account for medical expenses. You can then use HSA funds to pay coinsurance or copays until you. Blue Cross and Blue Shield of Illinois offers HSA services through Blue Healthcare Bank an independent licensee of the Blue Cross and Blue Shield Association created by 33 investing Blue Cross and Blue Shield Plans.

The fee is dictated by your HSA plan type. The HSA allows you to set aside tax-free dollars that you can save for eligible healthcare expenses today tomorrow and even for retirement. This account applies to eligible medical expenses paid for you your spouse and dependents.

Blue Cross and Blue Shield of Illinois does not provide legal or tax advice and nothing herein should be construed as legal or tax advice. Yes there is a monthly fee associated with the HSA plans offered by Blue Cross and Blue Shield of Vermont. Anthem Blue Access PPO HSA The Heritage Employee Benefit Trust Base Plan.

Because the accompanying medical plan has a deductible the HSA is a great way to set aside funds to minimize your out-of-pocket costs when you get care. Health Care Services Corporation the parent company of Blue Cross Blue Shield of Illinois is one of the Blue Cross Blue Shield Plans with an ownership stake in Blue. Or you can keep saving and investing your money and use it.

Learn the difference between an HSA and an FSA Flexible Spending Account. An HSA is a bank account you and your employer can put tax-free money into each benefit year. These materials and any tax-related statements in them are not intended or written to be used and cannot be used or.

I authorize Manitoba Blue Cross to collect use and disclose my personal information as described above. There is no cost to members for preventive exams. With a CareFirst BlueCross BlueShield HSA plan such as BlueChoice HMO HSAHRA Gold 1500 90 or BlueChoice Advantage HSAHRA Gold 1500 90 you are responsible for the full cost of your medical coverage until you meet your annual deductible.

To enroll in an HSA a member must be covered under a qualified high-deductible health plan and cannot be covered by any other health plan that is not a qualified high-deductible health plan with some exceptions. You also wont pay taxes when you take money out of your HSA to pay for eligible health-related expenses. Blue Care Network members 1-800-662-6667.

2018 HSA contribution limits. GETTING STARTED WITH BLUE OPTIONS HSA IMPORTANT INFORMATION REGARDING THIS HEALTH BENEFIT PLAN. In-network preventive services are not subject to the deductible.

Taking Action to Address Racial Health Disparities Learn how Blue Cross and Blue Shield companies are addressing our nations crisis in racial health disparities at our new Health Equity website. The money deposited into your account also grows tax-free and you pay no taxes on distributions for qualified healthcare expenses. You keep it even if you.

Health Savings Accounts HSA have tax and legal ramifications. Accounts paid by individual account holders are billed annually and payment is automatically debited directly from the HSA. This includes health care expenses your health plan doesnt cover.

Funds placed in an HSA account as well as interest and other investment earnings. These materials and any tax-related statements in them are not intended or written to be used and cannot be used or. Blue Cross Blue Shield of Michigan members 313-225-9000.

Learn the difference between an HSA and an FSA Flexible Spending Account. Self-employed on parent duty or without workplace benefits. In accordance with applicable federal law Blue Cross and Blue Shield of North Carolina BCBSNC will not discriminate against any health care.

Think of your HSA as not just part of your benefits but as an investment. Deductible minimum that qualifies for an HSA. A Health Spending Account HSA is a unique benefit that lets you choose where your benefit dollars are spent.

How an HSA plan works. Make health coverage part of your plan with one of our Blue Choice plans. To be eligible to establish an HSA you must be enrolled in a qualified High Deductible Health Plan HDHP.

Covered Medical Benefits Cost if you use an In-Network Provider Cost if you use a Non-Network Provider Overall Deductible 4000 person 8000 family 8000 person 16000 family Out-of-Pocket Limit 4000. Health Savings Accounts HSA have tax and legal ramifications. For example you can use HSA dollars to cover health care costs until you reach your plans deductible.

You can contribute money to your account and spend it now on qualified medical expenses. With an HSA plan preventive services are 100 covered. If your HSA is through your employer your employer will choose the plan type option and may pay the fee for that plan type or pass it on to you.

The Blue Cross Blue Shield Association is an association of 35 independent locally operated Blue Cross andor Blue Shield companies. Blue Cross and Blue Shield of Texas does not provide legal or tax advice and nothing herein should be construed as legal or tax advice. You can use the money in your HSA to help pay for your share of costs for your care or for certain health-related expenses that traditional health plans dont cover.

Once a member has enrolled in a Blue Saver PPO health plan they must choose a bank. Eligible expenses are reasonable medical expenses not reimbursed by any government-sponsored or private health care plan. Your HSA belongs to you and is completely portable.

If you have a BlueSolutions plan you can start a health savings account HSA. These include routine physicals well-child care and certain cancer screenings as well as. Policies I can contact Manitoba Blue Cross at 2047750151 or 18008732583 or wwwmbbluecrossca should I have questions as to the collection use or disclosure of my personal information.

Eligible expenses can also include expenses incurred outside your province of residence deductibles co-payments and amounts above plan maximums.

Anthem Blue Cross Blue Shield Health Rewards Debit Mastercard Picshealth

Anthem Blue Cross Blue Shield Health Rewards Debit Mastercard Picshealth

Active Hsa 5000 Deductible Premera Blue Cross

Active Hsa 5000 Deductible Premera Blue Cross

What You Need To Know About Hsas Hras And Fsas

What You Need To Know About Hsas Hras And Fsas

Https Www Anthem Com Provider Noapplication F1 S0 T0 Pw E232282 Pdf Refer Ahpprovider State Wi

How Do I Know What S Covered Under My Hsa Medavie Blue Cross

How Do I Know What S Covered Under My Hsa Medavie Blue Cross

High Deductible Plan With Hsa Nrao Information

High Deductible Plan With Hsa Nrao Information

Health Savings Accounts Michigan Health Plans Bcbsm Com

Health Savings Accounts Michigan Health Plans Bcbsm Com

Hsa Blue Cross And Blue Shield Of Texas

Https Www Anthem Com Bydesign Noapplication F3 S0 T0 Pw A033790 Pdf Refer Ahpbydesign

Https Www Anthem Com Provider Noapplication F1 S0 T0 Pw E232282 Pdf Refer Ahpprovider State Wi

Https Www Bluecrossmn Com Sites Default Files Dam 2020 06 P11ga 17045146 2019 T19038 High Value Hsa 2000 Nonembedded Deductible Plan Sbc Pdf

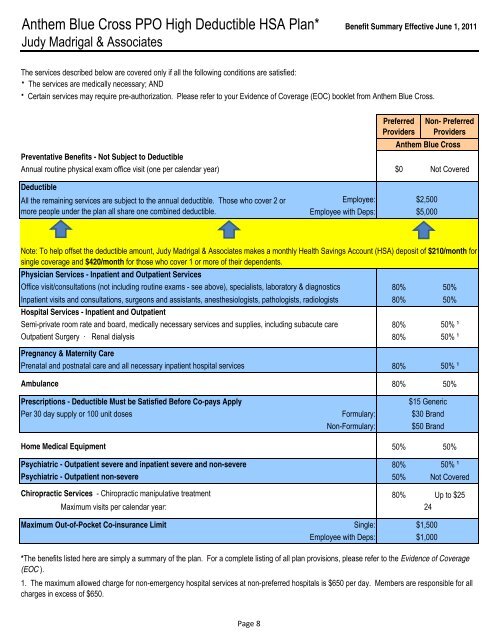

Anthem Blue Cross Ppo High Deductible Hsa Plan Judy Madrigal

Anthem Blue Cross Ppo High Deductible Hsa Plan Judy Madrigal

Https Www Bcbsm Com Content Dam Public Shared Documents Plan Pages 2019 Bronze Health Plans Premier Ppo Hsa Pdf

Health Savings Account Plan Welcome To Blue Cross Blue Shield Of Massachusetts

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.