May 15 2019 admen Interesting Login to your Covered California online account. If you have insurance from an employer sponsored plan you will get a 1095C.

The amount paid was based on the most recent household size and income information you provided to Covered California.

How to get form 1095 a from covered california. If that information changed during the year and you did not report the change to Covered California you may have. You may find the form in your Secure Mailbox iffy or more reliably on your Documents and Correspondence page. Complete the form avove to get your 1095 today.

Read About IRS Form 1095-A. Beneficiaries should keep Form 1095-B for their records as proof they received health. I would like to know what website I can go to to print out my Tax Form 1095A.

How to Download Tax Form 1095-A from your Covered California Account. During tax season Covered California sends two forms to members. Enter the number of people in the tax household.

Can I print it online. Enter the age of the head of household and select Needs Coverage. Each form will show the months of coverage that met the requirement for MEC for any months of coverage you got from either MediCal or Covered California.

These forms are used when you file your federal and state tax returns to. Your 1095-A may be available in your HealthCaregov account as early as mid-January or as late as February 1. They also send a copy to the IRS.

How do I get form 1095. You will need your Form 1095-A when you prepare your federal income tax return. The Form 1095-A has the information you or your tax preparer will need to file your tax returns.

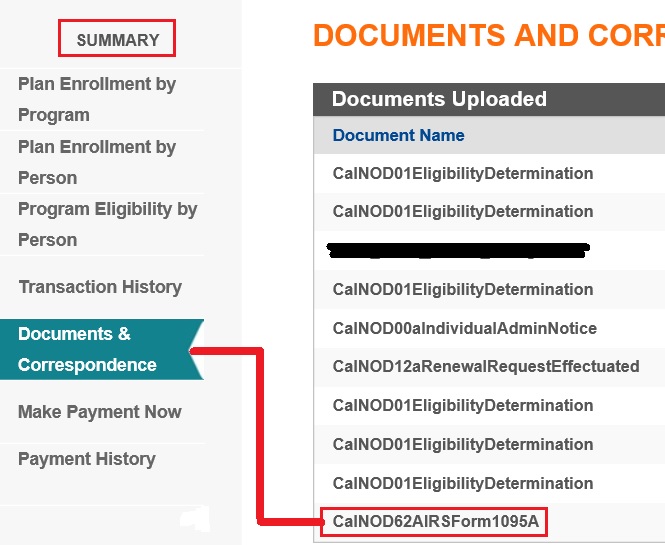

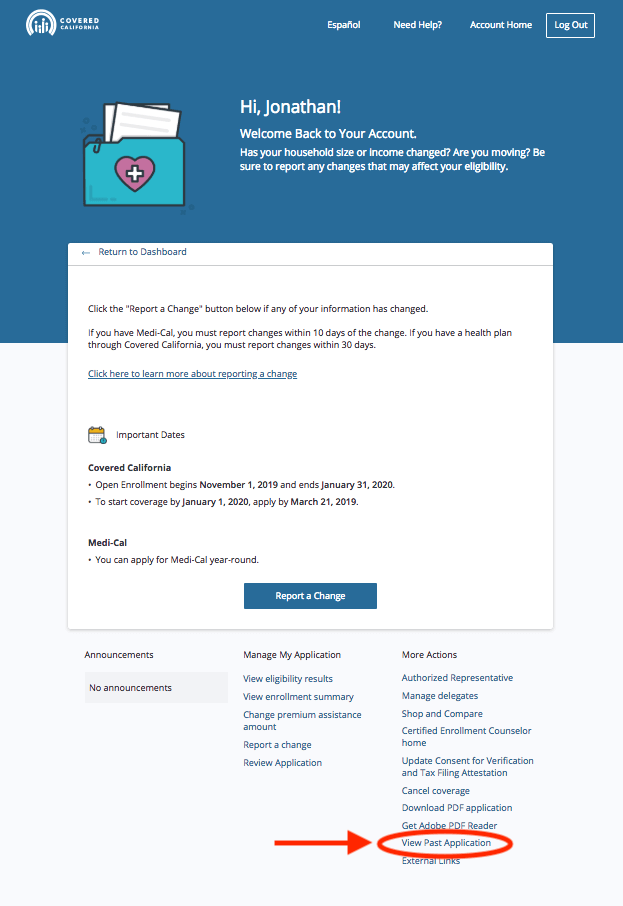

You will have to login to your Covered California online account. To get there click on the Summary checkbox on the home screen and next click the Documents and Correspondence link select and download CalNOD62A_IRSForm1095A_2016. Tax Forms and Filing.

The Form 1095-B will report the months of MEC a Medi-Cal beneficiary received during the calendar year. Participants enrolled in Covered California receive a 1095 A. Federal COBRA Election Form for Group Health Coverage.

If the individual is a recipient of Medi-Cal and other Government Sponsored Health Coverage in 2015. How to find your 1095-A on Covered California Step 1. You were enrolled in employer health coverage through Covered California for Small Business CCSB.

You will find the 1095-A form in your Documents and Correspondence folder. Find the link called View Past Application in the bottom right-hand column and click on it. The web address for the Covered California Account Login is.

No Covered California is not your insurance company. Log in to your HealthCaregov account. You dont need to do anything.

Your Form 1095-A shows the amount the Internal Revenue Service IRS paid to your insurance company to lower the cost of your health coverage. The Government Agency will issue a 1095-B to the plan member. To get there click on the Summary checkbox on the home screen and next click the Documents and Correspondence link select and download CalNOD62A_IRSForm1095A_2016.

If you have MediCal or Health insurance directly from an insurance company you will get a 1095B. Is Covered Ca my insurance company. Medicare and Covered California Fact Sheet.

To get there click on the Summary checkbox on the home screen and next click the Documents and Correspondence link select and download the 1095-A document as PDF. CCSBSHOP plan members of the Small Employer less than 50 full-time employees group plans will receive a 1095-B from the Healthcare Plan Provider. You will find the 1095-A form in your Documents and Correspondence folder.

Use the California Franchise Tax Board forms finder to view this form. The federal IRS Form 1095-A Health Insurance Marketplace Statement. You were enrolled in a minimum coverage plan also known as catastrophic plan.

Click Case Summary in the upper left. Enter ZIP code and county if prompted Enter total household income for the tax filing year. Under Your Existing Applications select your 2020 application not your 2021 application.

The Form 1095-As have already been posted online. You were enrolled in the Medi-Cal program. Medicare and Covered California Fact Sheet Spanish Rights and Protection Brochure.

The California Form FTB 3895 California Health Insurance Marketplace Statement. FPL Federal Poverty Level Chart. DHCS will send your MEC information to the IRS and beneficiaries are not required to provide Form 1095-B to the IRS if they chose to file their taxes.

Login to your Covered California online account. Do not select the boxes for pregnant or blind. You will get a Form 1095-B for your Medi-Cal coverage from DHCS and you will also get a Form 1095A from Covered California.

Some reasons why you may not receive an IRS Form 1095-A or Form FTB 3895. Covered CA members will receive their 1095-A Forms either by postal mail or by a secure message on their Covered CA online account depending on how they indicated on their application how they would like to be contacted by Covered CA. IRS Form 1095-A Covered California will send IRS Form 1095-A Health Insurance Marketplace Statement to all enrolled members.

It is used to fill out IRS Form 8962 Premium Tax Credit as part of your federal tax return. How to find your 1095-A online Note. Covered California will mail the IRS Form 1095-A to all consumers who got insurance through Covered California in 2014.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.