Volunteer accident insurance pays for minor injuries to volunteers who are donating their time and expertise to your cause. Additionally the ACA changes how individuals who are served by charitable nonprofits can access health insurance.

Health Insurance Purchasing Cooperatives State And Federal Roles

June 12 2018 Laura Pierce.

Nonprofit health insurance options. Health insurance benefits are a consideration for prospective employees and offering health insurance can make the difference in a nonprofits ability to retain talented staff members. There are no lenient rules or generous breaks for nonprofits especially small nonprofits to provide decent affordable health insurance for their employees. SHOP plans are similar to employer-sponsored group health insurance.

We provide thousands of conveniently located in-network primary care physicians and. Another difference is that many nonprofit health insurance networks are more focused on primary care and preventative care than other types of insurance providers. How does the ACA affect nonprofits offering health insurance.

Various federal state and local laws require that certain minimum benefits be provided to employees. As a result many nonprofits turn to the qualified small employer health reimbursement arrangement QSEHRA which allows them to reimburse employees tax. With this in mind Washington.

Below are the types of insurance coverages you should look for. Consequently understanding the ACAs basic elements is important for any nonprofit whose mission intersects with the delivery of health care in our communities whether or not your nonprofit. You as an employer should research your states laws to determine what is required.

So how do not-for-profit organizations afford to offer it to their employees. There are many types of insurance options available to nonprofit organizations to help protect the nonprofit from claims and lawsuits that destroy the good work offered to your community. If your nonprofit provides additional benefits like retirement and health plans fiduciary insurance is a viable option for your organization.

Nonprofit Health Insurance Options Health insurance costs money. Home Blog New Insurance Option for Nonprofits New Insurance Option for Nonprofits. How Does Non Profit Health Insurance Work.

Often times general insurance agents dont take the time to educate nonprofit directors on the exposures and risks you face on a daily basis. Therefore if your priority is cheap health insurance for basic coverage non profit insurance may be a good option for you. The costs are high and rising fast.

A New Benefits HR Management Option for Nonprofits We hear from our members all the time that healthcare benefits for employees is a huge challenge. Workers compensation pays medical expenses disability and death benefits for injured workers. The individual and small group marketplace in Maine was dominated by for-profit Anthem Blue Cross a subsidiary of WellPoint until the state selected nonprofit Harvard Pilgrim Health Care to provide coverage options for small businesses individuals and self-employed residents through a public-private partnership called DirigoChoice a precursor to the state exchanges a few years ago.

The legally required benefits you need to offer largely depends on your company size and location. Your organization can still be held liable even if you use a third party to manage your financial plans so having. Small nonprofits have few options and little buying power.

Nonprofit companies are no more exempt from ACA rules than for-profit companies. In January 2019 the US. This insurance covers claims relating to improper administration of employee benefit plans or inappropriate use of donor and grant funds.

SHOP Marketplace Group Plan If you qualify your nonprofit can purchase a plan on the state- or federally-run SHOP ACAs Small Business Health Options Program Marketplaces. We make it easy by offering customizable healthcare plan designs personalized service and assistance and an incredible integrated network of alliance partners including UCSF Health John Muir Health and Hill Physicians Medical Group among others. The difference is that SHOPs offer access to small business tax credits and may have more flexible participation or contribution requirements.

Besides the obvious choices like general liability and health insurance a nonprofit may need insurance coverage for events volunteer activities malpractice and products. Offering healthcare at your nonprofit is a unique challenge. Department of Labors final rule regulating association health plans AHPs went into effect.

So were often faced with high premiums or poor benefit options. Depending on your nonprofits location states municipalities and even foundations require different types of insurance.

Nonprofit Health Insurance Business Benefits Group

Nonprofit Health Insurance Business Benefits Group

What Are Non Profit Health Insurance Companies Safe Policies Insurance

What Are Non Profit Health Insurance Companies Safe Policies Insurance

Health Benefits For Non Profit Organizations

Health Benefits For Non Profit Organizations

What Are Non Profit Health Insurance Companies

What Are Non Profit Health Insurance Companies

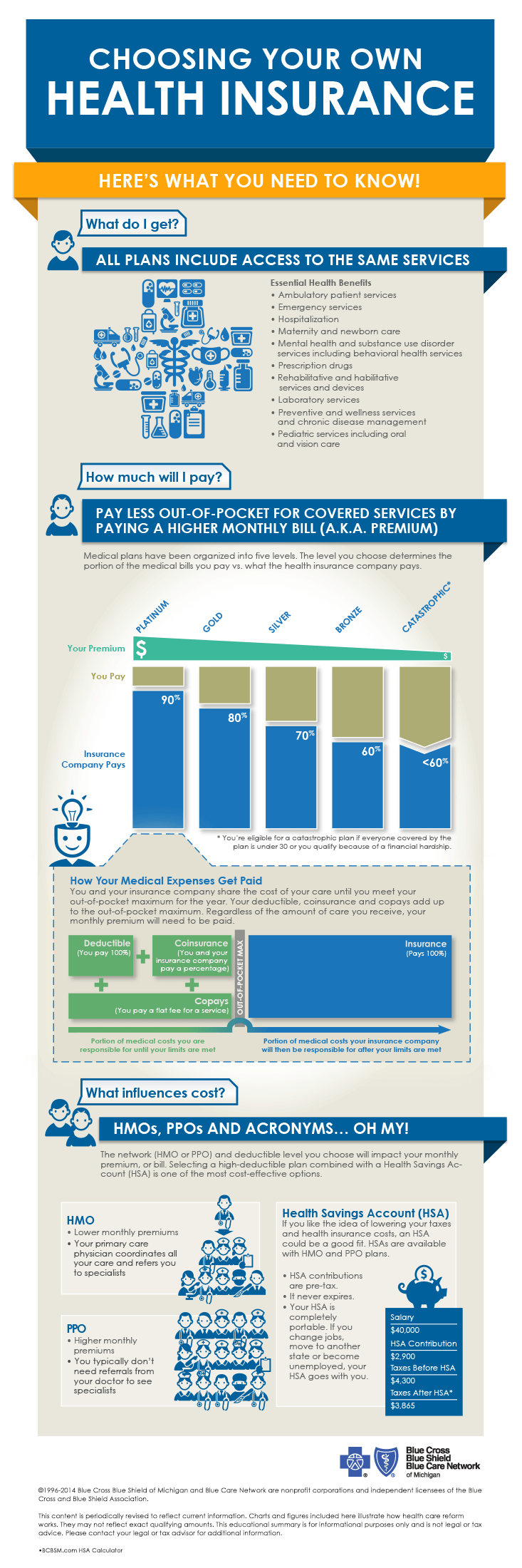

Choosing Your Own Health Insurance Health Insurance 101 Blue Cross Blue Shield Of Michigan

Choosing Your Own Health Insurance Health Insurance 101 Blue Cross Blue Shield Of Michigan

Nonprofit Health Insurance Business Benefits Group

Nonprofit Health Insurance Business Benefits Group

For Companies With Less Than 3 Expatriate Employees Or Individual Expatriates We Can Also Source Individual Internati Health Insurance Plans Expat Insurance

For Companies With Less Than 3 Expatriate Employees Or Individual Expatriates We Can Also Source Individual Internati Health Insurance Plans Expat Insurance

Health Benefits For Non Profit Organizations

Health Benefits For Non Profit Organizations

Nonprofit Health Insurance Options Ultimate Guide Einsurance

Nonprofit Health Insurance Options Ultimate Guide Einsurance

For 2019 Employers Adjust Health Benefits As Costs Near 15 000 Per Employee

For 2019 Employers Adjust Health Benefits As Costs Near 15 000 Per Employee

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.