Employer contributions under an HRA are pre-tax to the employee so wouldnt increase their reportable income. Health for California Insurance Center is licensed with the Department of Insurance and Covered California.

Affordable Employer Sponsored Health Insurance Ca

Affordable Employer Sponsored Health Insurance Ca

Covered California stated that your income is too low to qualify for Covered California coverage.

Covered california employer sponsored insurance. My mom is under his employer sponsored insurance. Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients. He will get Medicare and my mom would lose her insurance.

Medi-Cal Eligibility and Covered California - Frequently Asked Questions. In order to be enrolled into a Covered California Exchange Plan with a subsidy you must not have any of the following scenarios apply to you. It would be from his social security and pension.

During this period you can enroll for health coverage starting January 1 of the following year. A Health Reimbursement Arrangement HRA would allow the employer to reimburse premium andor out-of-pocket medical dental andor vision expenses up to 4950 for employee-only coverage and 10000 for family coverage. There has been no employer exodus from insurance and they want care to be affordable for the employee.

If you fail to meet the contribution or participation requirements Covered California offers an Annual Special Enrollment Period from November 15 to December 15. You do not have other health coverage such as free Medi-Cal or employer-sponsored insurance that prevents you from qualifying for insurance through Covered California. One of which you are not offered group health insurance through an employer that is considered affordable with minimum value standard.

Would she qualify for covered California. Lessons on Affordability from the Employer Sponsored Market Ensuring employee access to comprehensive affordable health care is important to the California employer communitys bottom line. Their income annually is 90k but now that he is going to retire their annual income will be about 36k.

Group insurance Health Reimbursement Accounts HRAs supplemental plans flex spending accounts to use with a health plan or COBRA. However there are a few exceptions. Yet as you have said that in California the spouse is required to be offered coverage under the employer-sponsored group plan further suggests if as my initial above understanding is correct that the spouse too in California with access to affordable coverage will likewise not have eligibility for tax subsidized coverage through the Marketplace.

Health care reform places no requirement on small business employers less than 50 employees to provide employer-sponsored health insurance in 2014 and beyond. Here in California those who are not covered by employer-provided health insurance can opt to purchase insurance via Covered California. The Consolidated Omnibus Budget Reconciliation Act of 1985 COBRA requires most employers with group health insurance plans to offer their employees the opportunity to continue their health coverage under their employers plan even after they have been terminated or laid off or had another change in their employment status.

Employers offer many of types of health coverage options such as. Covered California stated that you are not a California resident. Californias employers are less likely to offer high deductible plans than their.

If you do not find an answer to your question please contact your local county office from our County Listings page or email us at. This year I started with Covered California and then received employer sponsored insurance If you had more than one Marketplace plan enter each 1095-A separately. Depending upon your income and family size you might even be eligible for help with the cost of your premiumsr.

Review of key takeaways on California employer-sponsored insurance. As you probably already know the Affordable Care Act established open state-run health insurance exchanges. If your employer offers you affordable and minimum value coverage but you turn it down sign up for an individual plan through Covered California.

You can buy a Covered California health plan but you will have to pay the full cost without tax credits. Be currently enrolled in a group health insurance plan through your employer be currently offered affordable group health insurance through your employer. 1 Half of Californians have coverage through an employer 2 Coverage rates vary by income raceethnicity citizenship status 3 Rising costs affect coverage rates benefit levels wages 4 Small business employees less likely to be offered coverage and have higher deductibles.

Covered California eligibility for a health plan with a subsidy or tax credit is dependent upon several factors. Most employer sponsored health plans meet the criteria. Affordable Employer Sponsored Health Insurance.

The is currently no requirement for California employers to provide health insurance for their employees. Back to Medi-Cal Eligibility. Covered California stated that you did not pay your premiums by your due date.

However you must have at least 70 of your employees enroll in a. You can still sign up for a health plan through Covered California but you will have to pay full price if your employer-sponsored health insurance is not considered affordable under Obamacare. You can enroll in Covered California at any time throughout the year.

My mom would still be 60 years old and taking care of my baby her grandson. With all of this variety you might wonder if you should enroll in your employer plan or shop with Covered California. If you had employer-sponsored coverage and a Marketplace plan enter the information from 1095-A for the months you were enrolled in the plan.

Exceptions to the Employer Sponsored Coverage Affordability Rule Most individuals and families that are offered insurance at work or through a family members job do not qualify for a tax credit through the California state exchange. Employees who are offered health coverage by their employer that is affordable and that meets minimum value standards are not eligible for financial help to help pay premiums for an individual Covered California health plan.

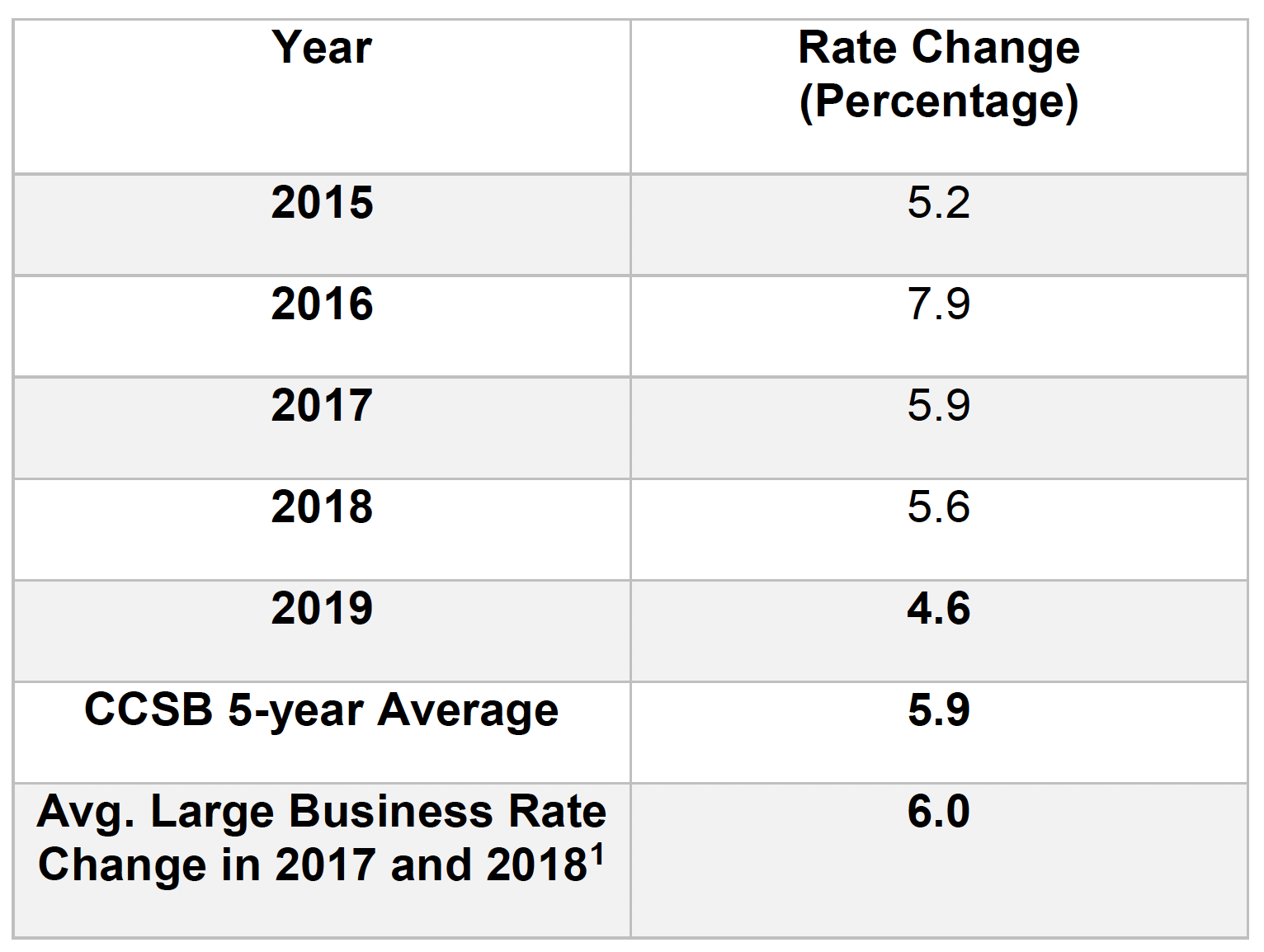

Covered California For Small Business Announces Rates And Plans For 2019 With An Average Premium Increase Of 4 6 Percent

Covered California For Small Business Announces Rates And Plans For 2019 With An Average Premium Increase Of 4 6 Percent

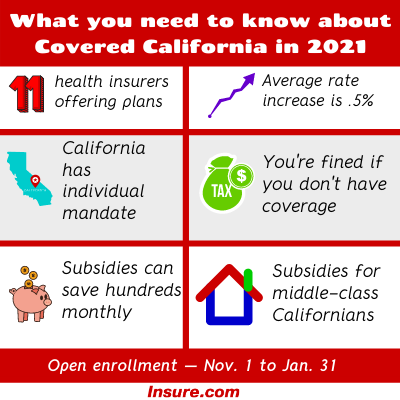

Covered California Open Enrollment 2021 A Complete Guide Insure Com

Covered California Open Enrollment 2021 A Complete Guide Insure Com

Https Www Cpp Edu Benefits Docs Employer Covered Calif Notice Pdf

Https Www Coveredca Com Pdfs Ccsb Employer Guide 2021 Final Pdf

Covered California Enrollment Nears 1 6 Million Amid Covid 19 Los Angeles Times

Covered California Enrollment Nears 1 6 Million Amid Covid 19 Los Angeles Times

Covered California The Official Site Of California S Health Insurance Marketplace

Covered California The Official Site Of California S Health Insurance Marketplace

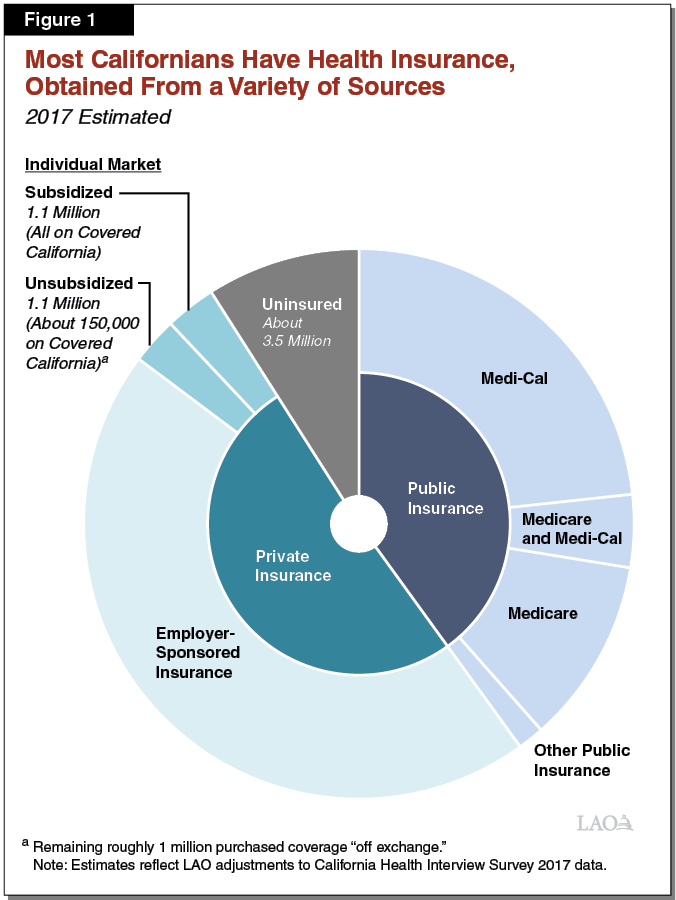

The 2019 20 Budget The Governor S Individual Health Insurance Market Affordability Proposals

The 2019 20 Budget The Governor S Individual Health Insurance Market Affordability Proposals

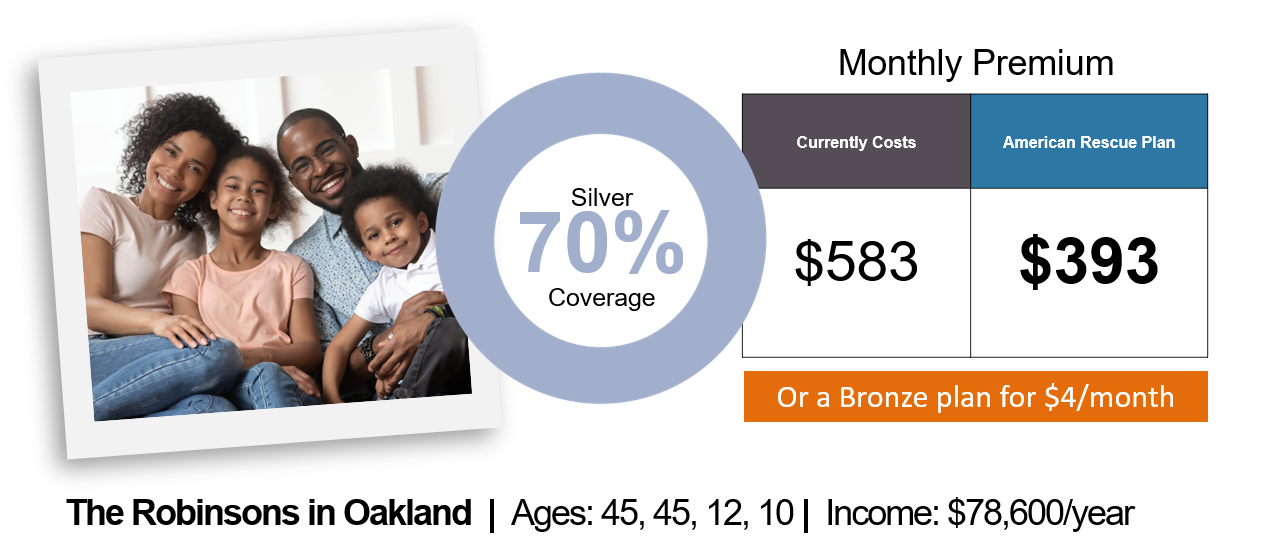

Covered California Opens The Doors For Millions Of Californians To Benefit From Lower Health Care Premiums Save Money And Stimulate The Economy Through The American Rescue Plan

Covered California Opens The Doors For Millions Of Californians To Benefit From Lower Health Care Premiums Save Money And Stimulate The Economy Through The American Rescue Plan

Coveredca Or Employer Sponsored Plan What Is Afforda

Coveredca Or Employer Sponsored Plan What Is Afforda

Covered California Opens The Doors For Millions Of Californians To Benefit From Lower Health Care Premiums Save Money And Stimulate The Economy Through The American Rescue Plan

Covered California Opens The Doors For Millions Of Californians To Benefit From Lower Health Care Premiums Save Money And Stimulate The Economy Through The American Rescue Plan

Short Term Health Plans In California Health For California

Short Term Health Plans In California Health For California

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.