NBBP x months without coverage x 1 Part D penalty. It doesnt seem like a lot of moneyjust an extra 24 for a year.

_360_255_100.jpg) Where Do You Sign Up For Medicare September 2017

Where Do You Sign Up For Medicare September 2017

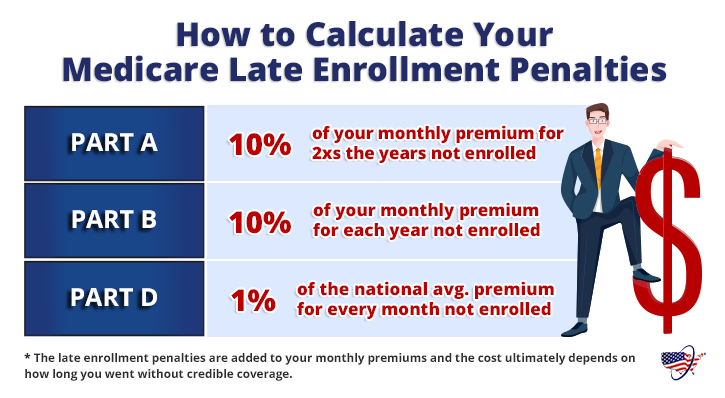

For each month without coverage you will pay an additional premium of 1 percent of the current national base beneficiary premium.

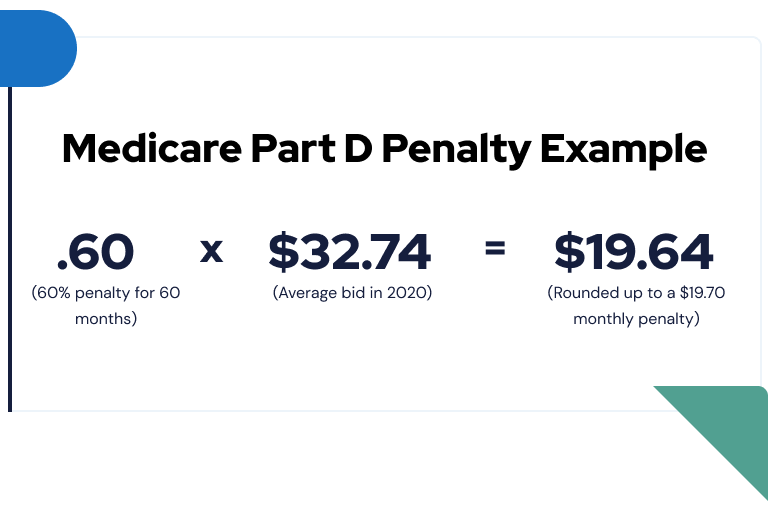

When did medicare part d penalty start. 3274 x 6 x 001 196. The best time to sign up for Part D is during your initial enrollment period which is the 60 day period after you enroll in part B. Your coverage would then begin on Jan.

Medicare calculates the penalty by multiplying 1 of the national base beneficiary premium 3306 in 2021 times the number of full uncovered months you didnt have Part D or creditable coverage. As you could have enrolled then but didnt you can sign up only during the annual open enrollment period which runs from October 15 to December 7 each year with coverage beginning January 1just like anybody who misses their enrollment deadline. You decide to join a plan this year during the open enrollment which runs until Dec.

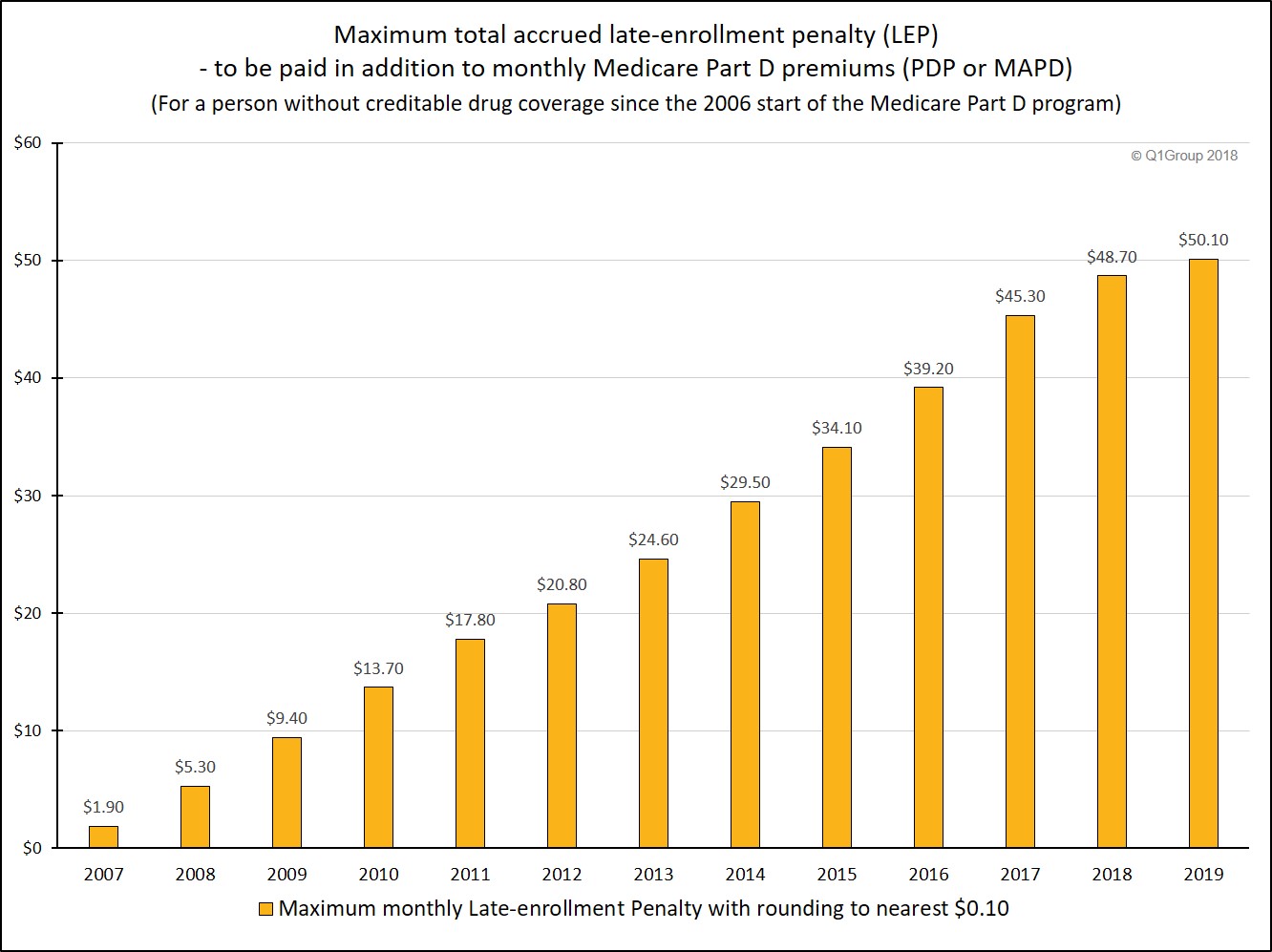

This is not a one-time penalty. For 50 years these programs have been protecting the health and well-being of millions of American families saving lives. In 2019 this premium is 3319.

In short the Medicare Modernization Act and the Medicare. For 2021 the average beneficiary premium is 3306. 033 x 9 297.

But if you do not enroll in Part B or Part D just before or after you turn 65 called the Initial Enrollment Period you must pay a premium penalty that increases. The CMS rounds the total to the nearest 10 cents so your penalty would be 2 per month. When calculated this penalty is rounded to the nearest 010 and added to the base monthly premium youre required to pay.

Where did the Medicare Part D prescription drug program come from. On July 30 1965 President Lyndon B. The figure is rounded to the nearest 010.

So instead of paying the base rate of 3319 per month for Medicare Part D in 2019 your monthly costs with the late enrollment penalty would be. Your monthly premium penalty would therefore be 231 3306 x 1 03306 x 7 231 per month which you would pay in addition to your plans premium. This law established a voluntary drug benefit for Medicare beneficiaries and created the new Medicare Part D program.

Generally the late enrollment penalty is added to the persons monthly. Under the 2003 law that created Medicare Part D the Social Security Administration offers an Extra Help program to lower-income seniors such that they have almost no drug costs. When did medicare part d penalty start Medicare has many different parts and can be difficult to navigate.

The national base beneficiary premium in 2021 is 3306 a month. In a Medicare drug plan may owe a late enrollment penalty if he or she goes without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more in a row after the end of his or her Initial Enrollment Period for Part D coverage. The monthly premium is rounded to the nearest 10 and added to your monthly Part D.

If it sounds like a foreign language to you then you probably arent alone. When the Part D program began in 2006 people already in Medicare could sign up until May 15 of that year without incurring a late penalty. The Part D penalty is always.

There is no premium for Part A. Lets suppose you started shopping and purchased your Medicare Part D Prescription Drug Plan in 2021 nine months after your Initial Enrollment Period IEP ended. For beneficiaries who are dual-eligible Medicare and Medicaid eligible Medicaid may pay for drugs not covered by Part D of.

The Medicare Part D penalty is based on the number of months you went without PDP coverage. The Medicare Part D penalty is calculated by multiplying 1 of the national base beneficiary premium 3306 in 2021 by the number of full months that you were eligible for but didnt enroll in a Medicare Prescription Drug Plan and went without other creditable prescription drug coverage. If you enroll after your initial enrollment period you may pay a higher premium every month due to a late enrollment penalty Medicare Part D Cost Assistance.

Here is an example of a common Part D penalty. Medicare Part D Late Enrollment Penalty. Johnson signed into law legislation that established the Medicare and Medicaid programs.

Your penalty in 2014 is 30 percent 1 percent for each of the 30. The income-related monthly adjustment amount or IRMAA is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. One percent of the national base beneficiary premium of 3306 is 033 which will be multiplied by 9 months.

Medicare Part D plans have their origin in the Medicare Prescription Drug Improvement and Modernization Act which was passed on December 8 2003. So if you went six months without coverage your formula would look like this. The Medicare IRMAA for Part B went into effect in 2007 while the IRMAA for Part D was implemented as.

In addition approximately 25 states offer additional assistance on top of Part D. Part D premium for as long as he or she has Medicare prescription drug coverage even if the person changes his or her Medicare.

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Don T Wait Until It S Too Late

Medicare Don T Wait Until It S Too Late

What Is Medicare Part D Senior Market Solutions

What Is Medicare Part D Senior Market Solutions

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2021 Medicare Part D Late Enrollment Penalties Will Increase Slightly Maximum Penalties Can Reach Up To 695 For The Year

2021 Medicare Part D Late Enrollment Penalties Will Increase Slightly Maximum Penalties Can Reach Up To 695 For The Year

Understanding The Part D Late Enrollment Penalty

Understanding The Part D Late Enrollment Penalty

Medicare Part D Late Enrollment Penalty Calculator Reconsideration

Medicare Part D Late Enrollment Penalty Calculator Reconsideration

Medicare Part D What Are My Options Medicare University Powered By Local Medicare Agents

Medicare Late Enrollment Penalty Avoid Penalty Fees

Medicare Late Enrollment Penalty Avoid Penalty Fees

Medicare Mistakes How To Avoid 10 Costly Medicare Mistakes Medicare Usa

Medicare Mistakes How To Avoid 10 Costly Medicare Mistakes Medicare Usa

Unintended Part D Late Penalty Could Get You If Enrolling After Age 65 Aarp Medicare Plans

Unintended Part D Late Penalty Could Get You If Enrolling After Age 65 Aarp Medicare Plans

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

Medicare Part D Open Enrollment When Does It Start

Medicare Part D Open Enrollment When Does It Start

How To Avoid Paying The Medicare Part D Penalty Money

How To Avoid Paying The Medicare Part D Penalty Money

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.