The attached briefing materials detail Californias 2020 Income Limits and were updated based on. If you make 601 of the FPL you will be ineligible for any subsidies.

Covered California Income Limits Explained

Covered California Income Limits Explained

All plans cover treatment and vaccines for COVID-19.

Covered california income guidelines. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. The Covered California exchange will permit individuals to enroll in health plan coverage or Medi-Cal during the initial enrollment period from October 1 2013 to March 31 2014 and thereafter during an open enrollment period that will begin on October 15 and last through December 7 annually. If you do not find an answer to your question please contact your local county office from our County Listings page or email us.

The Covered CA website allows you to view Covered California income limits get quotes shop plans and submit an application online all from the convenience of your own home. The tax subsidy program serves to help lower the cost of health insurance for low and middle-income Californians. Medi-Cal Eligibility and Covered California - Frequently Asked Questions.

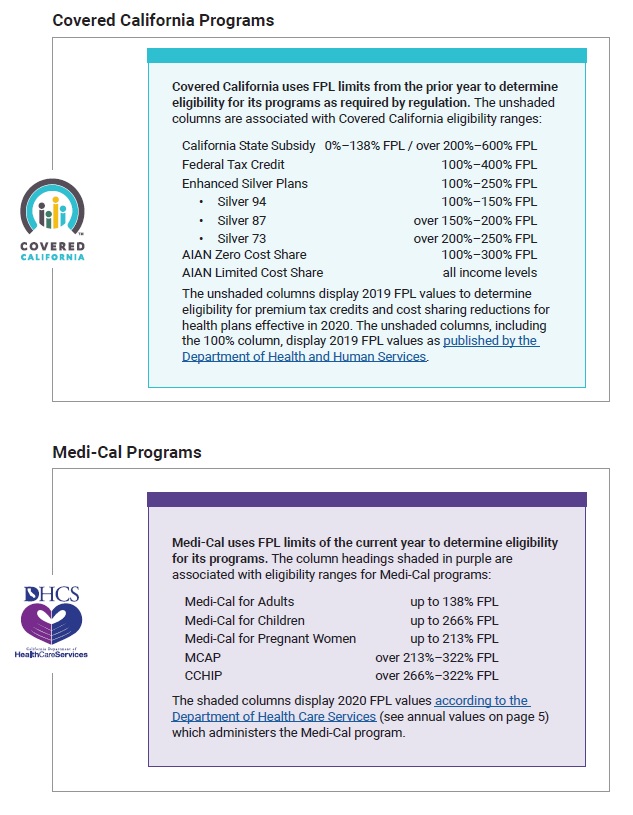

So lets say youre a family of six. Covered California uses FPL limits from the prior year to determine eligibility for its programs as required by regulation. In order to be eligible for assistance through Covered California you must meet an income requirement.

This web site is owned and operated by health for california which is solely responsible for its content. That means you can earn no more than 134960. Covered California Outreach and Sales Division Updated.

On refugee status for a limited time depending how long you have been in the United States. Both Covered California and Medi-Cal have plans from well-known companies. To be eligible for assistance through Covered California you must meet an income requirement.

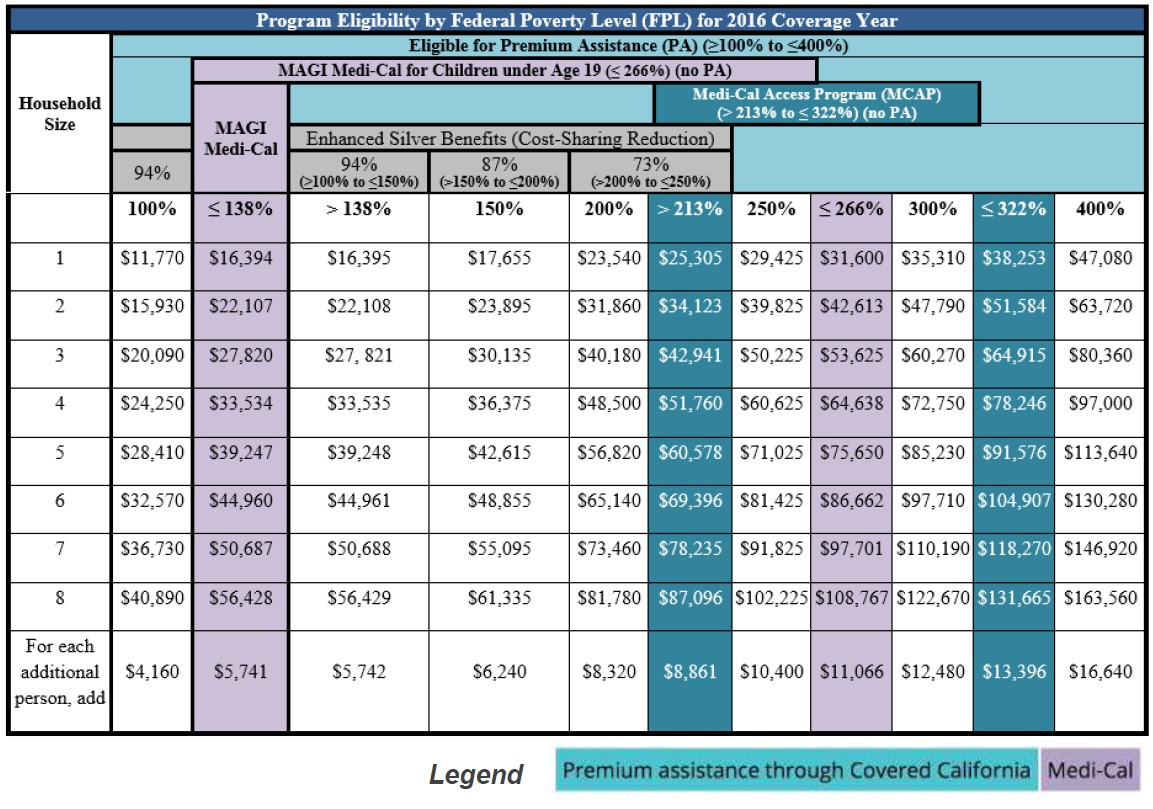

Medi-Cal has free or low-cost coverage if you qualify. April 15 2016 OutreachandSalescoveredcagov or Low to help determine if you qualify Income Guidelines use through October 2016 You may be eligible for Medi-Cal -Income Health Plan. Department of Housing and Urban Development HUD released on April 1 2020 for its Public Housing Section 8 Section 202 and Section 811 programs and 2 adjustments HCD made based on state statutory.

This site is not maintained by or affiliated with covered california and covered california bears no. Previously those who made above 400 of the federal poverty line FPL were not eligible for premium tax credits. Compare brand-name Health Insurance plans side-by-side and find out if you qualify.

Covered California Programs Medi-Cal Programs Percentage of income paid for premiums based on household FPL Based on second-lowest-cost Silver plan Household FPL Percentage Percent of Income 0-150 FPL 0 household income 150-200 FPL 0-2 household income 200-250 FPL 2-4 household income 250-300 FPL 4-6 household income 300-400 FPL 6-85 household income. If you do you are not eligible for a subsidy. Its the only place to get financial help to pay for your health insurance.

In a skilled nursing or intermediate care home. A parent or caretaker relative of an age eligible child. If you make 601 of the FPL you will be ineligible for any subsidy.

To qualify for federal tax credits or a subsidy in California you must make 0-600 of the FPL. Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients. Alimony only if divorce or separation finalized before Jan.

Covered california california health benefit exchange and the covered california logo are registered trademarks or service marks of covered california in the united states. Pandemic Unemploment Compensation 300week Social Security. Whether you qualify for financial assistance depends on your household income and.

Can anyone get Covered California. Excluded untaxed foreign Income. When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes.

The unshaded columns are associated with Covered California eligibility ranges. Any financial help you get is based on what you expect your household income will be for the coverage year not last years income. You can also get Medi-Cal if you are.

Use the Shop Compare tool to find the best Health Insurance Plan for you. 1 changes to income limits the US. Back to Medi-Cal Eligibility.

Social Security Disability Income SSDI Retirement or pension. If you need additional assistance regarding affordable health insurance for California contact a certified agent by calling this toll free phone number. California State Subsidy 0138 FPL over 200600 FPL Federal Tax Credit 100400 FPL Enhanced Silver Plans 100250 FPL.

In 2020 those who make between 400 to 600 of the FPL are eligible for subsidies. To qualify for government subsidies you must purchase your coverage through Covered California and your annual gross income cannot be more than 400 percent of the FPL.

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Https Hbex Coveredca Com Toolkit Renewal Toolkit Downloads 2016 Income Guidelines Pdf

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Fpl Chart 2016 Covered Ca Shop Small Business Health Insurance Benefit Agents

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

Covered California Versus Medi Cal Pfeifer Insurance Brokers

Covered California Versus Medi Cal Pfeifer Insurance Brokers

Covered California Updates Income Reporting Former Foster Youth

Covered California Updates Income Reporting Former Foster Youth

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Covered California Health Insurance Income Guidelines

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.