Typically it is sent to individuals who had Marketplace coverage to allow them to. Claim Premium Tax Credits Reconcile the Credit on their returns with Advanced Premium Tax Credit Payments.

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

If anything about your coverage or household is wrong contact the Marketplace Call Center.

Marketplace insurance 1095 a form. If any person on the tax return Taxpayer Spouse or any dependent was covered by a Marketplace plan they will receive a Form 1095-A Health Insurance Marketplace Statement. The 2016 subsidy is also known as the Premium Tax Credit PTC. Having a Form 1095-A is a prerequisite for filing.

Take the premium tax credit reconcile the credit on their returns with advance payments. The healthcare 1095 A Form is designed to gather your tax information related to the federal subsidy that you could get in 2016 and the actual costs of your health insurance plan. Find out if its obtainable in your HealthCaregov account as from mid-January.

If you bought health insurance through one of the Health Care Exchanges also known as Marketplaces you should receive a Form 1095-A which provides information about your insurance policy your premiums the cost you pay for insurance any advance payment of premium tax credit and the people in your household covered by the policy. Individuals to allow them to. Make sure its accurate.

But the IRS is still sorting out the details on this so were not yet sure how theyll handle it. Form 1095 provides proof of health coverage for you and any covered dependents for the applicable monthsyear. The IRS suggests.

If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A If your form is accurate youll use it to reconcile your premium tax credit. If you or members of your family enrolled in a private health plan through MNsure you will receive IRS Form 1095-A Health Insurance Marketplace Statement. Health Insurance Marketplaces furnish Form 1095-A to.

But the IRS might change that for 2020 in the. If you did not receive the form it may be because you asked for only electronic communications in your Marketplace application. Members on an Individual Health plan through the Health Insurance Marketplace HIM receive Form 1095-A from CMS.

Whatever marketplace plans you may have had in 2016 ensure every member of your household gets Form 1095-A Health Insurance Marketplace Statement via mail by mid-February at the latest. Members on an Individual Health plan that is not part of the Federal Marketplace Exchange receives Form 1095-B from Humana. If she got a Form 1095-A that shows a premium tax credit was paid on her behalf the normal rules say that she has to file Form 8962 to reconcile that tax credit.

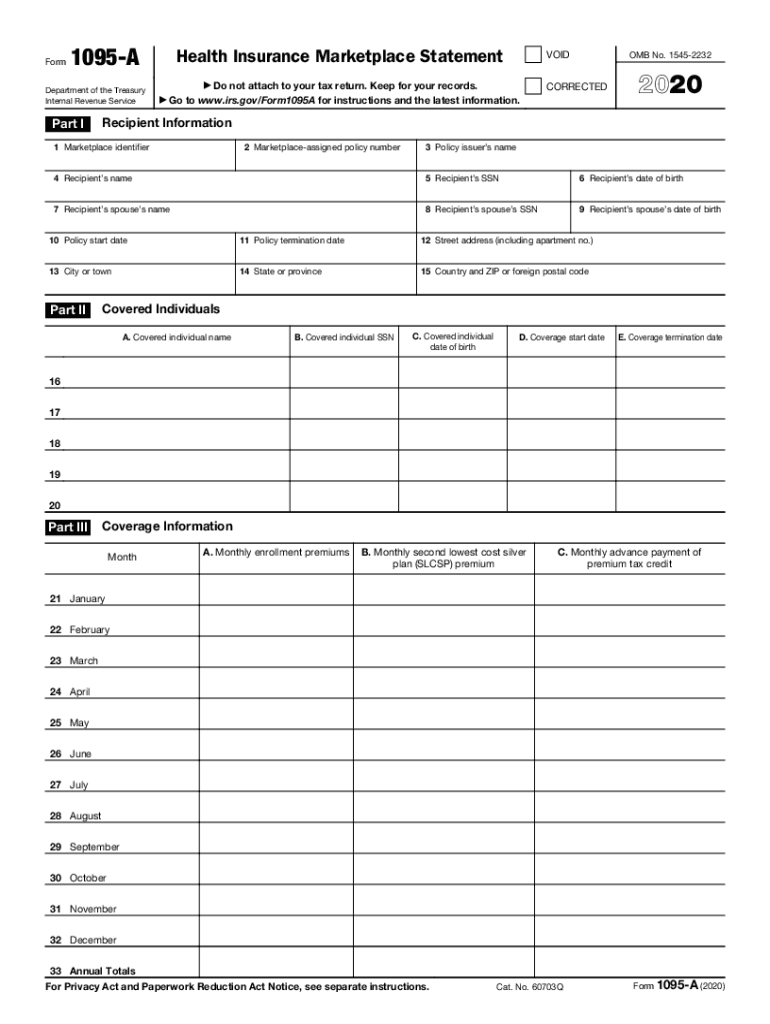

This Form 1095-A provides information you need to complete Form 8962 Premium Tax Credit PTC. It was established to provide people who bought health insurance plans via the health insurance marketplace with cheaper coverage. If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement.

How to check Form 1095-A for accuracy what to do if its wrong Carefully read the instructions on the back. IRS to report certain information about individuals who enroll in a qualified health plan through the Health Insurance. A 1095-A Health Insurance Marketplace Statement is a form you receive from the Health Insurance Marketplace or Health Insurance Exchange at healthcaregov if you and your family member s purchased health insurance through the Marketplace for some or all of the year.

Form 1095-A 2020 Page 2 Instructions for Recipient You received this Form 1095-A because you or a family member enrolled in health insurance coverage through the Health Insurance Marketplace. This Form 1095-A comes directly from the federal Marketplace or a state exchange and should be issued to the Policyholder by January 31. Health Insurance Marketplace Statement.

Taxpayers who do not receive their Form 1095. Form 1095-A is an IRS form for individuals who enroll in a Qualified Health Plan QHP through the Health Insurance Marketplace. Form 1095-A is a form that is sent to Americans who obtain health insurance coverage.

Health Insurance Marketplace Statement. Forms 1095-B and 1095-C are not required to file a taxpayers Individual Income Tax Return even though they are required to be distributed to the taxpayer and IRS. You should have received Form 1095-A also called a Health Insurance Marketplace Statement by mail from the Marketplace.

Similar to a W-2 you will receive the form completed by the Marketplace. Employer-Provided Health Insurance Offer and Coverage Insurance. For 2020 however nobody has to repay excess premium subsidies.

What Is Form 1095-A. You will not receive Form 1095-A if you were enrolled in a catastrophic health plan or a dental plan only. If taxpayers experience difficulty obtaining the Form 1095-A Health Insurance Marketplace Statement from their Marketplace they should review the monthly billing statements provided by their health coverage provider or contact the provider directly to obtain the coverage information monthly premium amount and amount of monthly advance.

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

/1095b-741f9631132347ab8f1d83647278c783.jpg) Form 1095 B Health Coverage Definition

Form 1095 B Health Coverage Definition

Corrected Tax Form 1095 A Katz Insurance Group

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

Understanding Your Form 1095 A Youtube

Understanding Your Form 1095 A Youtube

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2020 Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

Breakdown Form 1095 A Liberty Tax Service

Breakdown Form 1095 A Liberty Tax Service

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.