If you choose the high-deductible option it means you must pay for Medicare-covered costs coinsurance copayments deductibles up to the deductible amount of 2370 in 2021 before your policy. Lump-sum cash benefits for accidents and serious illnesses that can help pay a medical plans high deductible.

Medicare Supplement High Deductible Plan G For 2021 Medicarefaq

Medicare Supplement High Deductible Plan G For 2021 Medicarefaq

It is not meant to replace your health insurance policy or serve as a secondary backup.

High deductible supplemental health insurance. The idea behind high-deductible plans or HDHPs is that if consumers face the consequences of their health spending they will spend their dollars more wisely. Plans offering cash benefits can help pay out-of-pocket costs such as co-pays and deductibles. Most high deductible health plans come with lower monthly premiums.

Shop Plans GAP insurance can. Each year Medicare might adjust the deductible amount. 9 hours agoHigh-Deductible Health Plans.

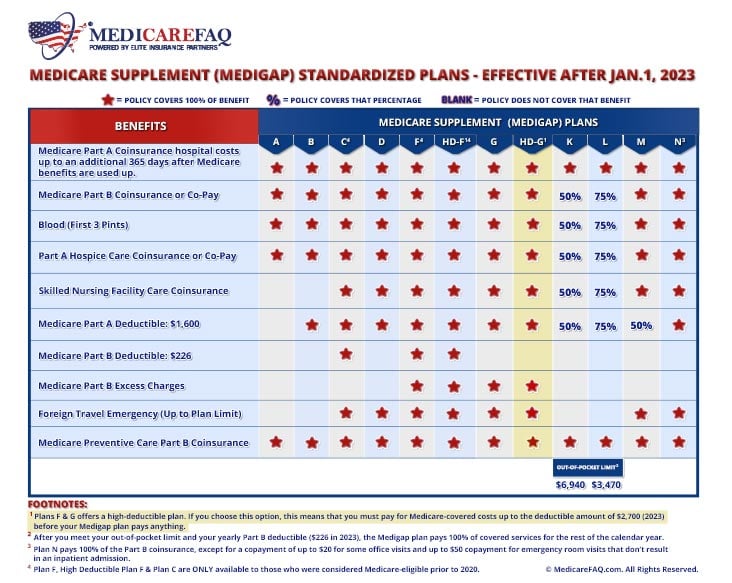

As noted above annual deductible for high-deductible plans is 2370 in 2021. Medicare Supplement Plans Comparison Chart 2021 Medigap Plan F is also offered as a high-deductible plan some insurance companies in some states. A low deductible health plan may be referred to as an LDHP.

Both scenarios could be accurate but it all depends on how the group health plan is set up. The new high-deductible Plan G option offers the coverage benefits of Plan G with lower monthly premiums in exchange for the higher deductible. Supplemental insurance products can cover nonmedical expenses such as childcare lost income or travel that might arise during a serious illness or accident.

High-Deductible Supplemental Health Insurance Plans. A health savings account or health reimbursement arrangement can help you cover the costs of health care. Dont Let the Name Scare You Off.

With HDHP plans your deductible will be at least 1350 for individuals and 2700 for a family. Use the money for whatever you need like mortgage payments credit card payments car payments day care or business costs. The term high deductible means different things to different people but usually it does one of two things.

A high deductible health plan has lower monthly premiums and a higher deductible than other plans. Accident supplement policies are popular with healthy people who have high-deductible insurance plans defraying upfront premium costs while providing a backup plan in the unlikely event of a calamity. 1 it sends chills down your spine and makes you think it has terrible coverage or 2 you associate the term with lower premiums.

Cover your deductible costs. In 2020 that rises to 1400 for individuals and 2800 for a family. It helps provide financial protection for costs not covered by your health insurance policy.

But with a high-deductible plan you have to meet the Medicare Supplement deductible for the year before the plan helps pay your Medicare out-of-pocket costs. Medicare Supplement Insurance high-deductible Plan G is a new Medigap plan being offered in most states in 2020. Disability and supplemental health insurance solutions as well as health savings and spending accounts offered to US.

Benefits from the high-deductible Plan F will not begin until out-of-pocket expenses are 2370. Out-of-pocket expenses for this deductible are expenses that would ordinarily be paid by the policy. Moneybag Protect your income.

Some High Deductible options. Its possible to use secondary insurance to pay your deductibles. The money can then be.

Depending on the type of plan you have there could be separate deductibles for prescriptions andor separate deductibles per family member. Blue Cross Blue Shield. A B F High Deductible F G N.

There are some pros and cons to a high deductible health plan. If you choose a plan with a higher deductible you may be required to pay more out-of-pocket in order to reach your deductible. 5 This high-deductible plan pays the same benefits as Plan F after one has paid a calendar year 2370 deductible.

Additionally they can help cover other non-medical expenses which could include rent utilities and transportation costs. There is already a standard Medigap Plan G. For 2020 the IRS defines an HDHP as one with a deductible of 1400 or more for an individual or 2800 or more for a family.

Its the amount you pay out-of-pocket before your insurance covers any cost. Payments go right to you. High-deductible health plan pros and cons.

A high deductible health plan is also referred to as HDHP. A premium on the other hand is what you pay every month for your plan.

Health Insurance Deductibles 101 Infographic Health Edeals Blog

High Deductible Plan G Medicare Review Reviews Ratings

High Deductible Plan G Medicare Review Reviews Ratings

Compare Medicare Supplement Plans Cigna

Compare Medicare Supplement Plans Cigna

Cost Of Supplemental Health Insurance For Seniors

Cost Of Supplemental Health Insurance For Seniors

High Deductible Plan F High Deductible Medicare Supplement

High Deductible Plan F High Deductible Medicare Supplement

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

High Deductible Plan F High Deductible Medicare Supplement How To Plan Medicare Supplement Medicare Supplement Plans

High Deductible Plan F High Deductible Medicare Supplement How To Plan Medicare Supplement Medicare Supplement Plans

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

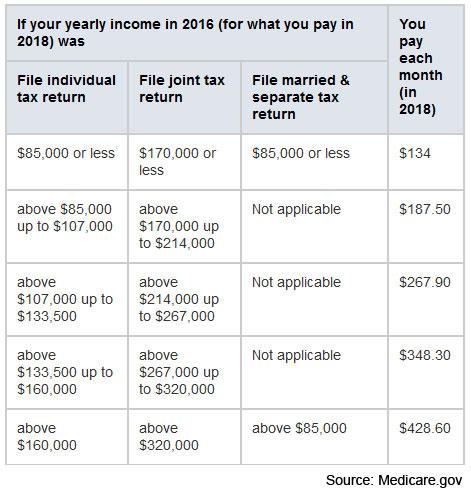

Nearing 65 Don T Get Caught By Medicare S Money Traps Seeking Alpha

Nearing 65 Don T Get Caught By Medicare S Money Traps Seeking Alpha

Major Medical Insurance Or A High Deductible Health Plan

Supplemental Health Insurance For High Deductible Health Plans Premium Saver

Supplemental Health Insurance For High Deductible Health Plans Premium Saver

High Deductible Medigap Plan Makes Sense For Some

High Deductible Medigap Plan Makes Sense For Some

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.