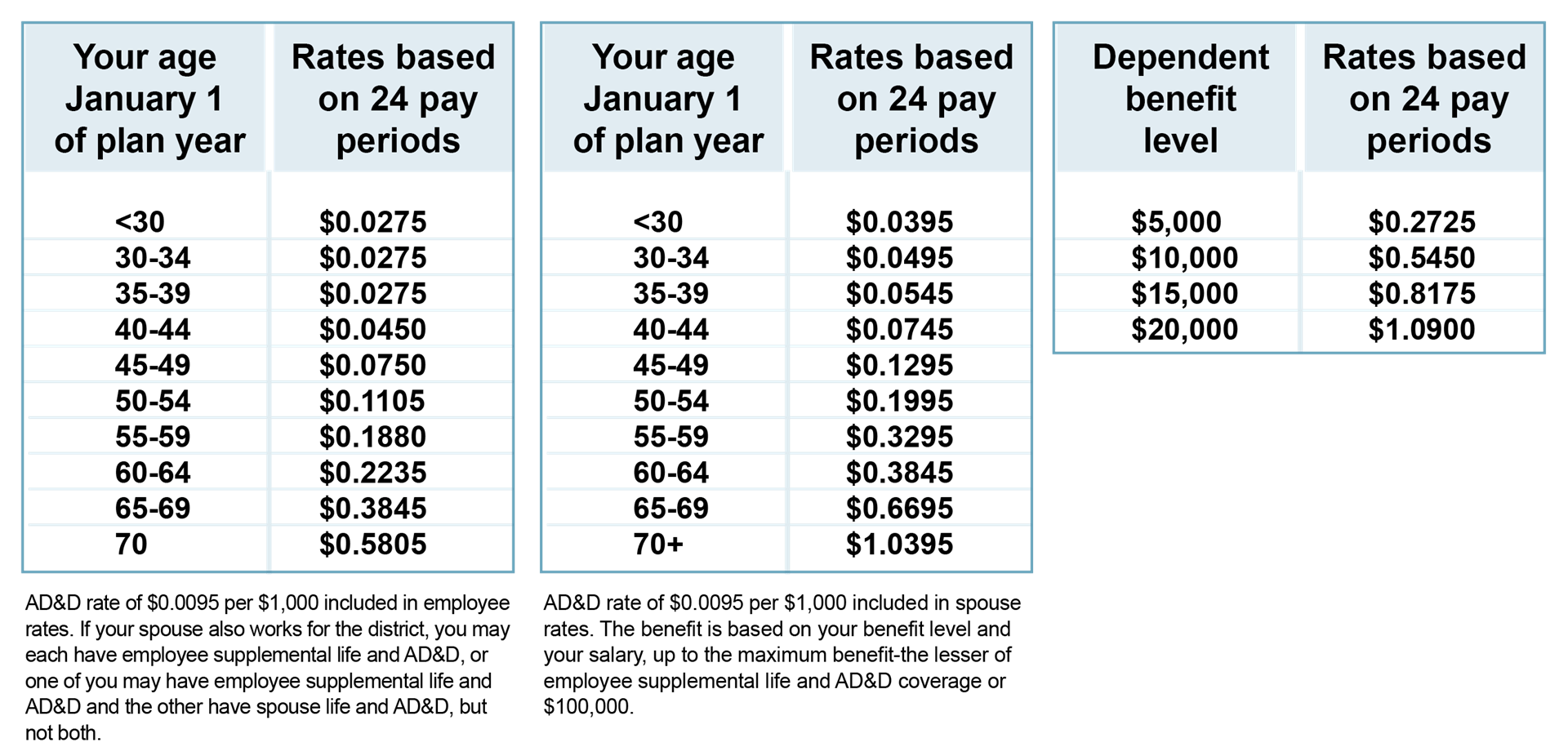

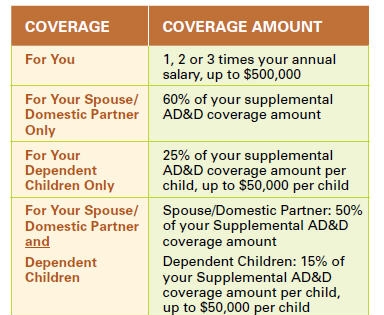

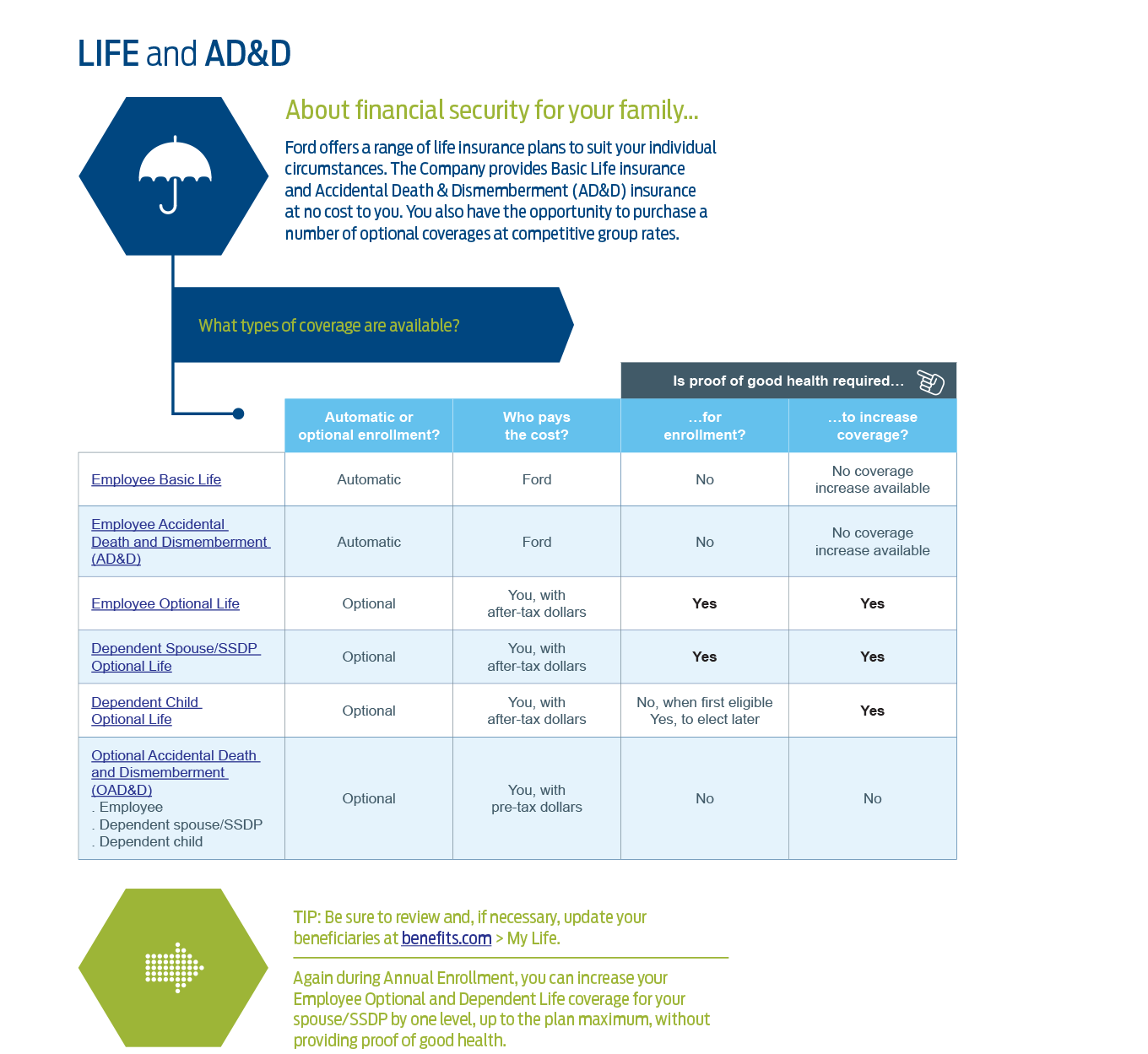

Employee Supplemental Life Insurance and Accidental Death Dismemberment ADD insurance allows you to purchase additional financial protection beyond company-paid basic coverage for you and your family. How much can I purchase.

ADD is Insurance that pays an additional benefit if you are seriously injured or die due to a covered accident.

Supplemental life and ad&d insurance. Some employers provide employees with the option to purchase supplemental life insurance that increases coverage and does not have stipulations such as ADD or burial insurance. For example monthly premiums might start at 450 for every 100000 in accidental death coverage from Farmers. Supplemental life insurance adds an extra layer of coverage to an existing policy.

Will ADD insurance really help. While an ADD policy provides benefits to your beneficiaries when you die the caveat is that your death must be caused by an accident. For people with health issues supplemental life insurance may be more affordable than individual life insurance.

Supplemental Life and ADD Insurance You can purchase Supplemental Life and ADD Insurance in increments of 10000. If you elect an amount that exceeds the guaranteed issue amount of 80000 you will need to. The maximum amount you can purchase cannot be more than 5 times your annual Salary or 300000.

An ADD policy also differs from a standard life insurance policy because its generally offered as a life insurance policy benefit rider or supplemental insurance. This coverage can be purchased in addition to or in place of ADD insurance and other life insurance you already have. You can purchase Supplemental Life and ADD Insurance each in increments of 5000 up to.

And it is deducted from payroll. You should still have life insurance. ADD vs Term Life Insurance.

This option may be. Supplemental insurance can include. The limits will depend on your particular policy.

One available option in many group or life insurance plans is supplemental ADD insurance which protects against accidental death and dismemberment. Didnt Read Supplemental ADD insurance sometimes offered alone or as a supplement to other life insurance programs provides additional money to your beneficiaries in the event. Some policies offer riders for ADD.

In many instances the supplemental life insurance that your employer offers you is in reality an ADD insurance policy and shouldnt be confused with a standard life insurance policy. In general ADD insurance premiums are tied to the amount of coverage you purchase. Here are some common terms to look for.

Supplemental life insurance offered by an employer is additional term life insurance that you can purchase that is above and beyond the employer-provided basic coverage. Supplemental Life Dependent Life and Expanded Dependent Life insurance are available for a monthly premium to employees eligible for full or mid-level benefits. An ADD rider pays out an extra amount if death is due to an accident but if the death is from natural causes the policy simply pays out the base amount.

Basic and Supplemental Life Insurance pays a benefit if you die for any reason except those excluded in the certificate of insurance. Supplemental life insurance is similar to a group term life insurance policy but is typically more limited. A life insurance rider is an addendum to a policy that provides additional coverage.

Senior Management Life is also offered at no cost to members of the Senior Management Group. UnitedHealthcare Insurance Company provides the coverage. So while you can buy an ADD policy by itself it is more commonly added to another life insurance product.

Life insurance for. As with basic coverage it usually can be bought in the form of a multiple of your annual salary. Accidental death and dismemberment ADD insurance is insuranceusually added as a rider to a health insurance or life insurance policythat covers the unintentional death or dismemberment of the.

People with riskier jobs pay higher premiums than people with low-risk employment. An ADD policy may be a good idea especially if you work in a high-risk job. Supplemental ADD coverage could be a wise investment regardless but understand that ADD doesnt cover you for any type of death or dismemberment.

Coverage you purchase in addition to your basic policy. Ask an expert if the life insurance company youve chosen offers an ADD rider. What the Plans Cover.

What S Covered By Ad D Insurance The Florida Bar Member Benefits Insurance Retirement Programs

What S Covered By Ad D Insurance The Florida Bar Member Benefits Insurance Retirement Programs

What Is Supplemental Life Insurance And Is It Worth The Cost

What Is Supplemental Life Insurance And Is It Worth The Cost

Micsc Accidental Death And Dismemberment Ad D

Micsc Accidental Death And Dismemberment Ad D

Voluntary Benefits Life And Ad D

Voluntary Benefits Life And Ad D

Is Group Accidental Death Dismemberment Ad D Worth It Glg America

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Accidental Death Dismemberment Ad D Insurance

Accidental Death Dismemberment Ad D Insurance

Sebb Supplemental Life Insurance Youtube

Sebb Supplemental Life Insurance Youtube

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Life And Accidental Death And Dismemberment Ad D Insurance Pittsburghpa Gov

Life And Accidental Death And Dismemberment Ad D Insurance Pittsburghpa Gov

What To Know About Ad D Insurance Forbes Advisor

What To Know About Ad D Insurance Forbes Advisor

What Is Supplemental Life Insurance And Do You Need It Thestreet

What Is Supplemental Life Insurance And Do You Need It Thestreet

Basic Life And Ad D Desoto School District

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.