Qualifying health care coverage is also called minimum essential coverage. Health insurance is all about being prepared for what might happen and how you can protect your family from potential financial risk.

How Can You Tell If Your Health Insurance Is Obamacare

An employer-sponsored plan including COBRA Any health insurance plan sold on the Health Insurance Marketplace Medicare Part A coverage and Medicare Advantage plans Most Medicaid coverage Childrens Health Insurance Program CHIP.

Minimum essential health coverage. How much of these benefits they cover depends on your plans actuarial value. But merely having coverage isnt enough to save you from paying the healthcare penalty. Minimum Essential Coverage MEC Minimum Essential Coverage is defined as the type of health insurance coverage that you must have in order to comply with the individual mandate set forth by the Affordable Care Act ACA.

This generally means coverage offers 10 essential benefits and meets actuarial value standards. From January 1 2014 and onward individuals must have MEC insurance or they will be subject to a tax penalty. What is Minimum Essential Coverage.

See all insurance types that qualify. Since its passage in 2010 the Affordable Care Act ACA has created standards and requirements around health insurance coverage for individuals and for employers. These federally-mandated standards have given rise to whats known as minimum essential coverage MEC.

MECs can be purchased as a standalone product or they can be combined with various types of healthcare coverage. Most coverage offered in the employer private and public markets are Minimum Essential Coverage. In fact if you dont have minimum essential coverage you could owe the government some extra money when you file your federal income taxes.

If youre an employer who offersor plans to offerhealth benefits to your. Minimum Essential Coverage is health insurance that meets the requirements of the ObamaCare the Affordable Care Act. HealthCareGov Types of health insurance that count as coverage.

Minimum Essential Coverage. The fee for 2018 plans and earlier You may owe the fee for any month you your spouse or your tax dependents dont have qualifying health coverage sometimes called minimum essential coverage. To avoid the penalty for not having insurance for plans 2018 and earlier you must be enrolled in a plan that qualifies as minimum essential coverage sometimes called qualifying health coverage.

Minimum Essential Coverage MEC Any insurance plan that meets the Affordable Care Act requirement for having health coverage. You are considered to have minimum essential coverage if you have. With this insight you can be informed of the Minimum Essential Coverage plans available and the ten health benefits offered through ACA.

Minimum Essential Health Coverage is typically reported to the taxpayer on Forms 1095-A Health Insurance Marketplace 1095-B small employer and SHOP plans and 1095-C large employer. Minimum essential coverage is available from a variety of sources. If you do not have minimum essential coverage and wish to obtain it through the Health Insurance Marketplace the Marketplace has an open enrollment period each year as well as special enrollment periods for eligible taxpayers.

Have an Actuarial Value of 60 or more. Major medical insurance purchased through the healthcare marketplace Individual or family plans purchased outside the healthcare marketplace as long as they meet the standards of the ACA. Health insurance is now mandatory for just about everyone.

Minimum Essential Coverage 10 Essential Benefits Updated on August 27 2020 Under the Affordable Care Act major medical health insurance plans and qualified health plans QHPs must meet Minimum Essential Coverage Standards which generally means they must. In order to be considered minimum essential coverage all health plans regardless of price insurance company or metal tier cover ten essential health benefits well get into those later. Starting January 1 2014 the individual shared responsibility provision called for each individual to have minimum essential health coverage known as minimum essential coverage for each month qualify for an exemption or make a payment when filing his or her federal income tax return.

Minimum Essential Coverage MEC for short is a health insurance product that generally covers preventative medical services such as vaccinations checkups and screenings. You pay the fee when you file. Some of the most common types of minimum essential coverage are.

Understanding The Difference Between Minimum Essential Coverage Essential Health Benefits Minimum Value And Actuarial Value Leavitt Group News Publications

Understanding The Difference Between Minimum Essential Coverage Essential Health Benefits Minimum Value And Actuarial Value Leavitt Group News Publications

Aca 10 Essential Health Benefits Design Health

What Is Mec And What Does It Cover Sbma Benefits

What Is Mec And What Does It Cover Sbma Benefits

Minimum Essential Coverage Plans What Do They Really Cover Sbma Benefits

Minimum Essential Coverage Plans What Do They Really Cover Sbma Benefits

Obamacare Minimum Essential Coverage 10 Essential Benefits

Obamacare Minimum Essential Coverage 10 Essential Benefits

Obamacare Minimum Essential Coverage 10 Essential Benefits

Obamacare Minimum Essential Coverage 10 Essential Benefits

Mec With Limited Benefits V2 3

Mec With Limited Benefits V2 3

Obamacare Minimum Essential Coverage 10 Essential Benefits

Obamacare Minimum Essential Coverage 10 Essential Benefits

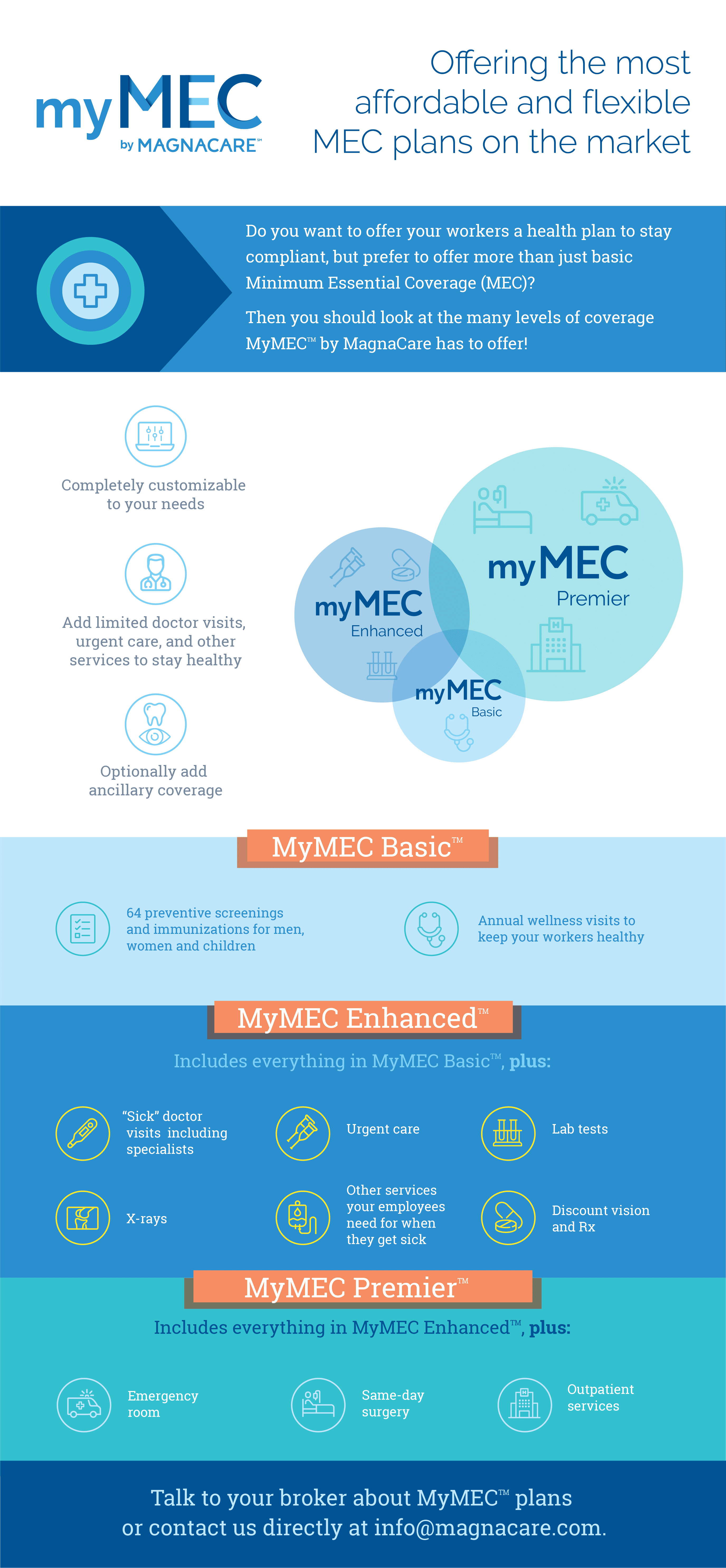

Minimum Essential Coverage Mec Infographic Magnacare

Minimum Essential Coverage Mec Infographic Magnacare

Minimum Essential Coverage Mec Health For California

Minimum Essential Coverage Mec Health For California

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.