Whats a Medicare PPO plan. Out-of-network care is allowed in emergency cases only.

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

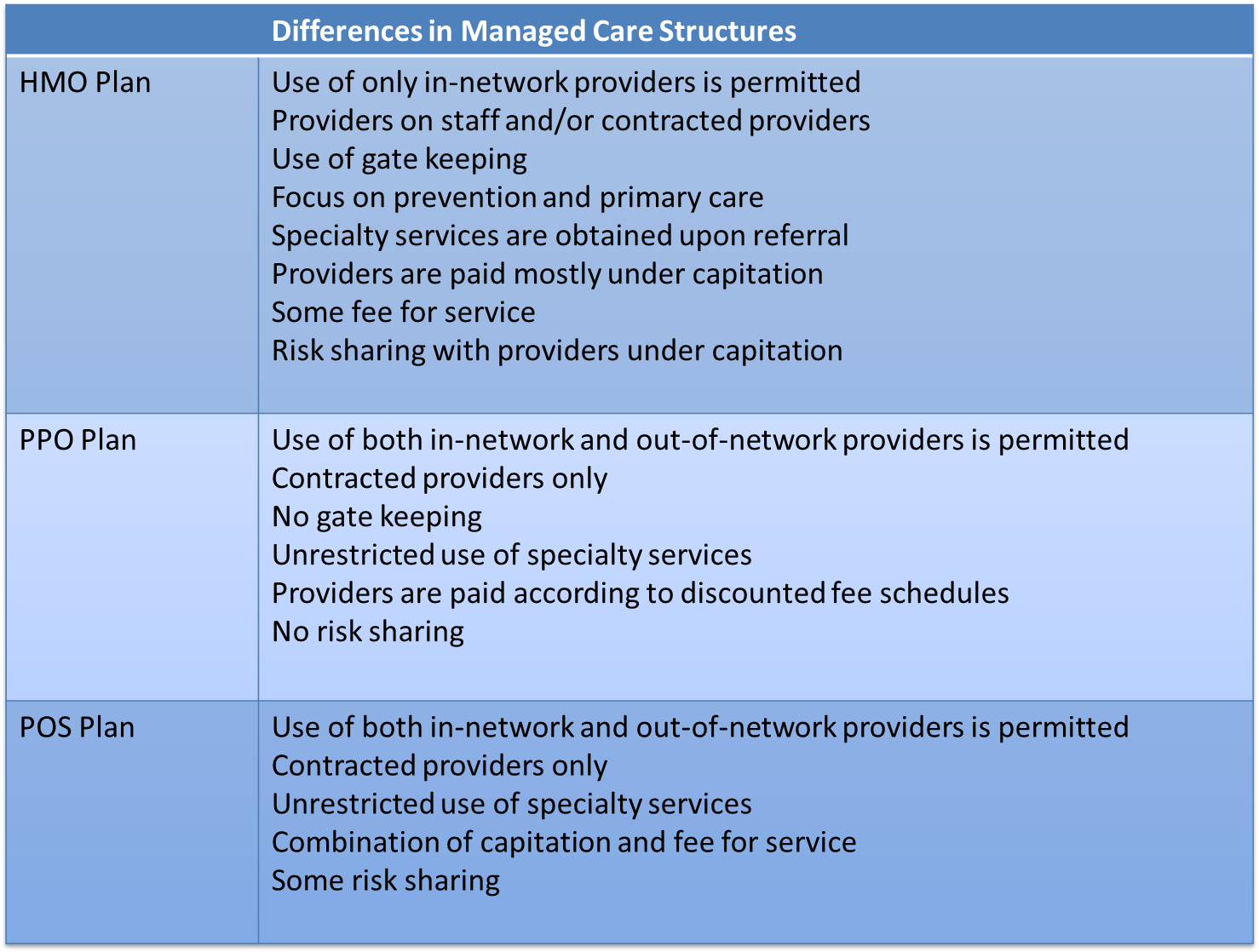

The table below compares these three types of Medicare plans.

Difference between hmo and ppo medicare plans. HMO plans may require that beneficiaries choose a primary care physician. Group Medicare Advantage plans may provide more value and service than Original Medicare. Compared to PPOs HMOs cost less.

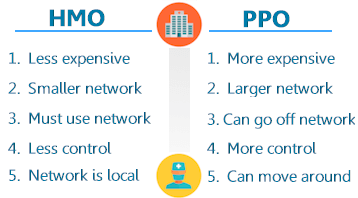

Cost On average HMO members can generally expect to pay lower premiums than members of PPO plans. What are the differences between HMO and PPO plans. But there are a few HMO vs.

The difference between them is the way you interact with those networks. Plan Medicare-Medicaid comuníquese con nuestro Departamento de Servicio al Cliente para obtener información adicional sin costo para usted al 1-844-445-8328. Primary care physicians HMO plans generally require members to utilize a primary care physician PCP while PPO plans.

HMO stands for health maintenance organization. Your out-of-pocket costs with a PPO plan will typically be lower if you use the PPO plans network of preferred providers. Care you receive in-network through the HMO has a different deductible than care you receive out-of-network through the POS.

An exclusive provider organization EPO plan is situated between an HMO and PPO in terms of flexibility and costs. You dont have to choose a primary care provider with a Medicare PPO but you do with an HMO. In general Medicare PPOs give plan members more leeway to see providers outside the network than Medicare HMOs.

The value of Group Medicare Advantage plans for employers plan sponsors and retirees. Medicare HMO Health Maintenance Organization plans and Medicare PPO Preferred Provider Organization plans are two types of Medicare Advantage plans. In-Network vs Out-of-Network.

Medigap plans dont have networks but Medicare Advantage PPO plans do. However in HMO plans a primary care physician must provide a referral to a certain specialist. If you want to see a specialist an HMO.

The HMO and POS portions of the plan have separate deductibles. PPO stands for preferred provider organization. Medicare HMO PPO Medicare also has both PPO and HMO options.

The two deductibles cannot be combined - they must be reached separately. There are few differences between the two. While HMO and PPO plans are the 2 most common plans especially when it comes to employer-provided health insurance there are other plan types you should know about including EPO and POS plans.

In most cases if you belong to an HMO you must use in-network care meaning care from those health care facilities or doctors that are in the HMOs network. If you are interested in joining a PPO make sure to speak to a plan representative for more information. There are several differences in costs and coverage among Original Medicare Preferred Provider Organizations PPOs and Health Maintenance Organizations HMOs.

Both HMO and PPO plans generally include prescription drug coverage through a Medicare Advantage Prescription Drug. A PPO may be better if you already have a doctor or medical team that you want to keep but who dont belong to your plan network. Generally speaking an HMO might make sense if lower costs are most important and if you dont mind using a PCP to manage your care.

With a Medigap plan Medicare will pay its portion and the Medigap plan will pay its portion. Although they generally have provider networks Medicare Advantage PPOs let you see doctors outside the plan network. Referrals HMO members.

Referrals and Primary Care Physicians PCPs In HMOs you will likely have to choose a PCP. PPO plans do not require that beneficiaries choose a primary care physician. Group Medicare Advantage HMO and PPO plans can provide retirees with coverage at an affordable cost.

Besides HMO plans usually dont have. 2 rows Medicare Advantage PPO and HMO plans are a great insurance option for people who want to. Learn the difference between an HMO and a PPO plan why your choice of doctors is important and see if your doctor is in our network.

All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care. One major difference between HMO and PPO plans is that you can typically get your care from any provider you choose with a PPO. Medicare HMO and PPO plans differ mainly in the rules each has about using the plans provider network.

PPO plans have higher premiums in exchange for the flexibility and broader choices of doctors and hospitals. As mentioned above Differences between HMO Health Maintenance Organization and PPO Preferred Provider Organization plans include network size ability to see specialists costs and out-of-network coverage. One of the most common questions I get asked when consulting with Medicare beneficiaries is - what is the difference between HMOs PPOs and Medigap Policies.

You can offer your Medicare-eligible retirees group medical and prescription drug coverage all in one plan. Using the Plans Provider Network. With a Medigap plan you wont have to worry about higher costs if the doctor is out-of-network.

The Kaiser Versus Health Net Comparison And Review

The Kaiser Versus Health Net Comparison And Review

Medicare Advantage Ppo Vs Hmo What S The Difference

Medicare Advantage Ppo Vs Hmo What S The Difference

Medicare Hmo Plans The Secret To A Healthy And Prosperous Life

Medicare Hmo Plans The Secret To A Healthy And Prosperous Life

Hmo Vs Ppo Which Plan Is Best For You

Hmo Vs Ppo Which Plan Is Best For You

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Difference Between Hmo And Ppo Difference Between

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Vs Medicare Senior Healthcare Direct

Medicare Advantage Vs Medicare Senior Healthcare Direct

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

The Difference Between Medicare Hmo And Ppo Plans Aarp Medicare Plans

The Difference Between Medicare Hmo And Ppo Plans Aarp Medicare Plans

Difference Ma Medigap Medicare Planning Difference Medicare Advantage Vs Medicare Supplement Plans

Difference Ma Medigap Medicare Planning Difference Medicare Advantage Vs Medicare Supplement Plans

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.