To learn more visit medicaregov or talk to a Medicare expert you trust. First lets start by understanding how this Late Enrollment Penalty is calculated.

Penalties For Not Signing Up For Medicare Part D What Is The Part D Penalty

Penalties For Not Signing Up For Medicare Part D What Is The Part D Penalty

Avoid being without a drug plan for 63 days Make sure that you do not go 63 days without a drug plan be it a.

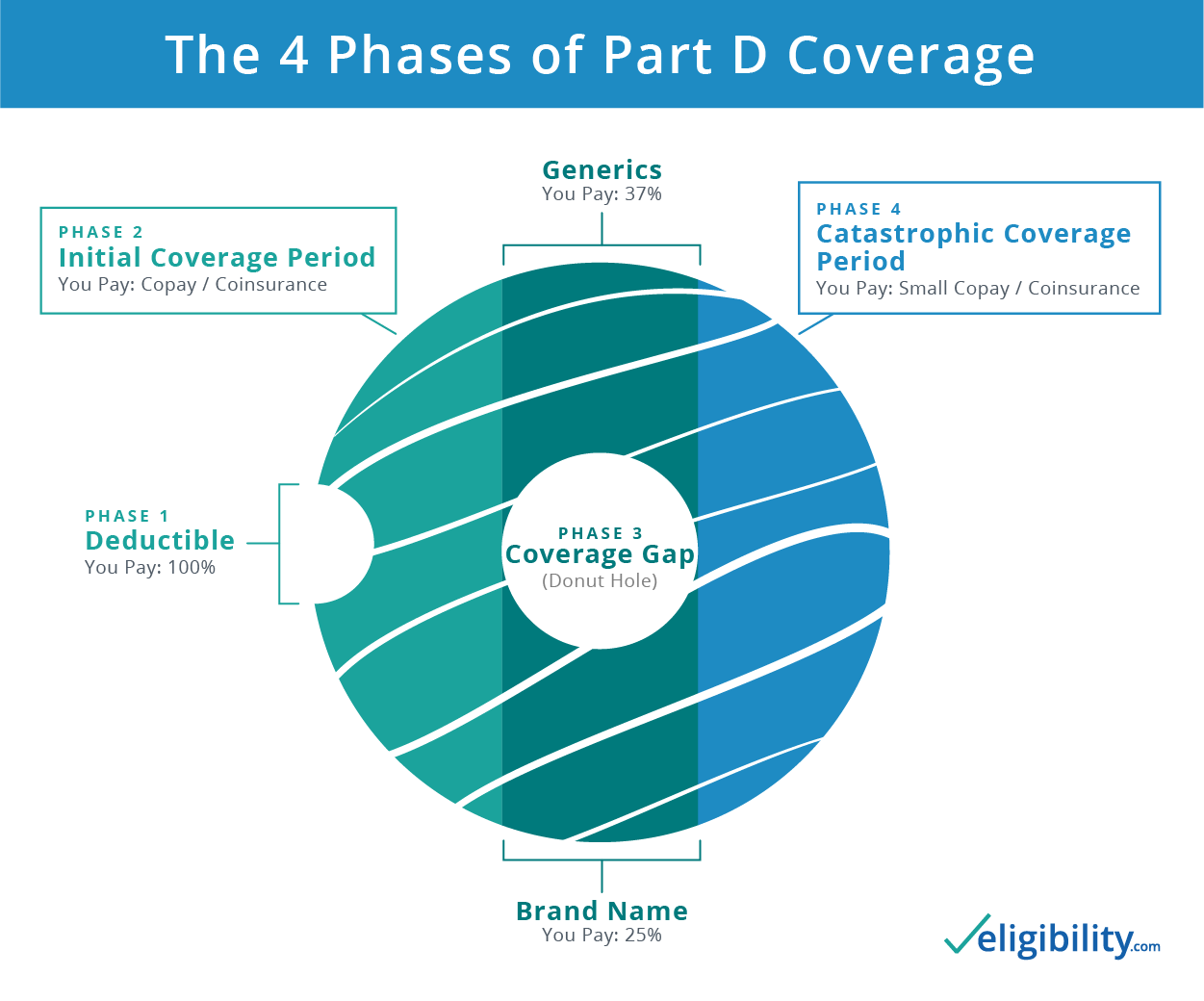

How to avoid medicare part d penalty. For more information and an example of the calculation see Medicaregovs Part D Penalty. As is the case with Part B you can delay enrollment if you have qualifying employer healthcare coverage. This number would be multiplied by the national base 3274 in 2020 and rounded to the nearest 10 cents.

The monthly premium is rounded to the nearest 10 and added to your monthly Part D premium. You can avoid Part D penalties by signing up when you first become eligible. The easiest way to avoid this penalty.

If you have creditable prescription drug coverage when you first become eligible for Medicare generally you can keep it without paying the late enrollment penalty if you sign up for Part D later. You can avoid this penalty by enrolling in prescription drug coverage when it first becomes available to you. Part D covers prescription medications and costs about 33 per month.

Medicare calculates the penalty by multiplying 1 of the national base beneficiary premium 3306 in 2021 times the number of full uncovered months you didnt have Part D or creditable coverage. Unfortunately if these patients did miss the Medicare Open Enrollment sign up window which runs from October 15th to December 7th they will have to wait until next year to change plans or enroll in a Part D plan in most cases. Enroll in creditable prescription drug coverage.

How to Avoid the Medicare Part D Penalty Enroll when you are eligible. Your Initial Enrollment Period consists of the three months before the month you turn 65 the month of your 65th birthday and the three months following your 65th birthday. Enroll in Medicare drug coverage when youre first eligible.

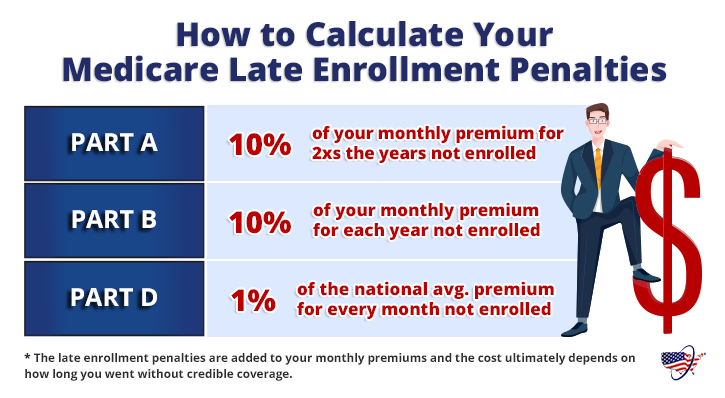

Medicare will calculate your late enrollment penalty by taking the 1 penalty rate of the national base beneficiary premium and multiplying it by the number of full uncovered months that you werent enrolled in a Part D plan or creditable drug coverage. Creditable prescription drug coverage could. The penalty for Part D is a one percent premium increase for each month that you should have been enrolled.

Youll pay this penalty in addition to your Part D Premium. How To Avoid The Part D Penalty 1. Moreover a penalty will be added onto their monthly premium for years to come.

Inform Medicare about. Say you dont enroll in Part D for 20 months. For most people that is their Initial Enrollment Period.

The three months leading up to your 65 th birthday the month of your birthday and the following three months. Like Part B the premium may be higher if you are a high earner. Keep records of the creditable coverage in case you need to appeal a penalty later.

Medicare imposes premium penalties on people who dont follow the programs health insurance coverage rules. 3274 x 6 x 001 196 NBBP x months without coverage x 1 Part D penalty. The Part D penalty is rounded to the nearest 10 cents.

Even if you dont take drugs now you should consider. The other way you can skip the penalty says Fassieux is if you qualify for Medicare Part Ds Extra Help program which helps low-income individuals afford their prescriptions. This totals to 660.

Keep this letter recommends Fassieux because you could need it if you join a Medicare drug plan later. The first of course is to join a Medicare drug plan as soon as you are eligible. 3 ways to avoid the Part D late enrollment penalty 1.

If this were the case your multiplier would be20 or a 20 penalty. Part D late enrollment penalty NBBP x Months without drug coverage x 1 So if you went six months without coverage your formula would look like this. Keep this information because you may need it if you join a Medicare drug plan later and want to avoid the Part D late enrollment penalty.

You can simply sign up for a Part D plan or find a private plan that offers prescription drug coverage when you sign up for Medicare. This penalty is added to your monthly Part D premium and youll have to pay it for as long as you have a Medicare drug plan. There are three ways to avoid the Part D late penalty.

Enroll in Medicare drug coverage if you lose other creditable coverage. Enroll in Part D as soon as you are eligible If you are enrolled in Original Medicare Part A and Part B you should. The best way to avoid paying the Part D late enrollment penalty is to enroll in a.

Enroll if you lose your creditable plan.

How To Avoid Paying The Medicare Part D Penalty Money

How To Avoid Paying The Medicare Part D Penalty Money

Medicare You How The Part D Penalty Is Calculated Youtube

Medicare You How The Part D Penalty Is Calculated Youtube

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

2020 Medicare Part D Late Enrollment Penalties Will Decrease For A Third Year In A Row Although Maximum Penalties Can Reach Up To 641 Per Year

2020 Medicare Part D Late Enrollment Penalties Will Decrease For A Third Year In A Row Although Maximum Penalties Can Reach Up To 641 Per Year

How To Avoid Medicare Penalties Part B And Part D Penalties Explained

How To Avoid Medicare Penalties Part B And Part D Penalties Explained

What Is Medicare Part D Senior Market Solutions

What Is Medicare Part D Senior Market Solutions

How To Avoid Medicare Part D Penalty Medicare Nationwide

How To Avoid Medicare Part D Penalty Medicare Nationwide

Penalties For Not Signing Up For Medicare Boomer Benefits

Penalties For Not Signing Up For Medicare Boomer Benefits

Managing Medicare Part D Prescription Drug Coverage

Managing Medicare Part D Prescription Drug Coverage

Medicare Part D Premium And Deductible Costs For 2020 Eligibility

Medicare Part D Premium And Deductible Costs For 2020 Eligibility

Medicare Part D What Are My Options Medicare University Powered By Local Medicare Agents

Medicare Mistakes How To Avoid 10 Costly Medicare Mistakes Medicare Usa

Medicare Mistakes How To Avoid 10 Costly Medicare Mistakes Medicare Usa

Medicare Drug Coverage Penalty How The Part D Penalty For Not Enrolling Works

Medicare Drug Coverage Penalty How The Part D Penalty For Not Enrolling Works

How To Avoid The Part D Penalty

How To Avoid The Part D Penalty

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.