Health Insurance Marketplace Statement The role of the Marketplace. Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace.

Breakdown Form 1095 A Liberty Tax Service

Breakdown Form 1095 A Liberty Tax Service

Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Health Insurance Marketplace.

What is the 1095 a form. The purpose of this form is to provide information about how long you have been covered by the plan and how much advance premium tax credit APTC subsidy you received to assist you in paying the premiums. If you receive the Premium Tax Credit you will receive a Form 1095-A. What Is a Tax Form 1095-A.

The healthcare 1095 A Form is designed to gather your tax information related to the federal subsidy that you could get in 2016 and the actual costs of your health insurance plan. Here are 5 important things to know about this form. Generally speaking you may need a 1095 form to fill out your Form 1040 US.

Health Insurance Marketplace Statement. If you qualify for marketplace tax credits based on income at tax time or if you took tax credits in advance youll. What is Form 1095-A.

Form 1095-A is a form that is sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier. Taxpayers who are eligible for the Premium Tax Credit have a choice in how they. This tax break is offered in the form of the Premium Tax Credit.

5 things to know about tax Form 1095-A If anyone in your household had Marketplace health insurance in 2019 you should have already received Form 1095-A Health Insurance Marketplace Statement in the mail. Helpful tips about tax Form 1095-A. The amount of coverage you have.

The Marketplace is the governments term for the online insurance markets or exchanges. It comes from the Marketplace not the IRS. The 1095-A form is for people who have health insurance through the Health Insurance Marketplace often called an exchange.

The 2016 subsidy is also known as the Premium Tax Credit PTC. Insurance companies participating in health care exchanges should provide you with the 1095-A form a health insurance marketplace statement. Dont file your taxes until you have an accurate 1095-A.

Keep your 1095-As with your important tax information like W-2 forms and other records. A 1095 shows information about your health plan for the year. You claim it by filing Form 8962 with your tax return.

Youll need your Form 1095-A to fill out this form. Any tax credits you were entitled to. Form 1095-A is also furnished to individuals to allow them to take the premium tax credit to reconcile the credit on their returns with advance payments of the premium tax credit advance credit payments and to file an accurate tax.

If anybody in your household needed a Marketplace program in 2019 then you need to have Form 1095-A Health Insurance Marketplace Statement by email no later than mid-February. This is usually mailed by the insurer to individuals who have enrolled in their employers fully insured plan to report their minimum essential coverage. What Is Form 1095-A.

This is for individuals who have purchased health insurance coverage through the health insurance marketplace often called a local exchange. The Affordable Care Act offers a tax break to qualifying people purchasing health insurance through the Marketplace aka healthcaregov or your local state exchange to help offset the costs associated with health insurance. Your 1095-A includes information about Marketplace plans anyone in your household had in 2020.

The Form 1095-A only reports medical coverage not catastrophic coverage or stand-alone dental and vision plans. This form is to reconcile your Premium Tax Credit. Two ways to take the tax credit.

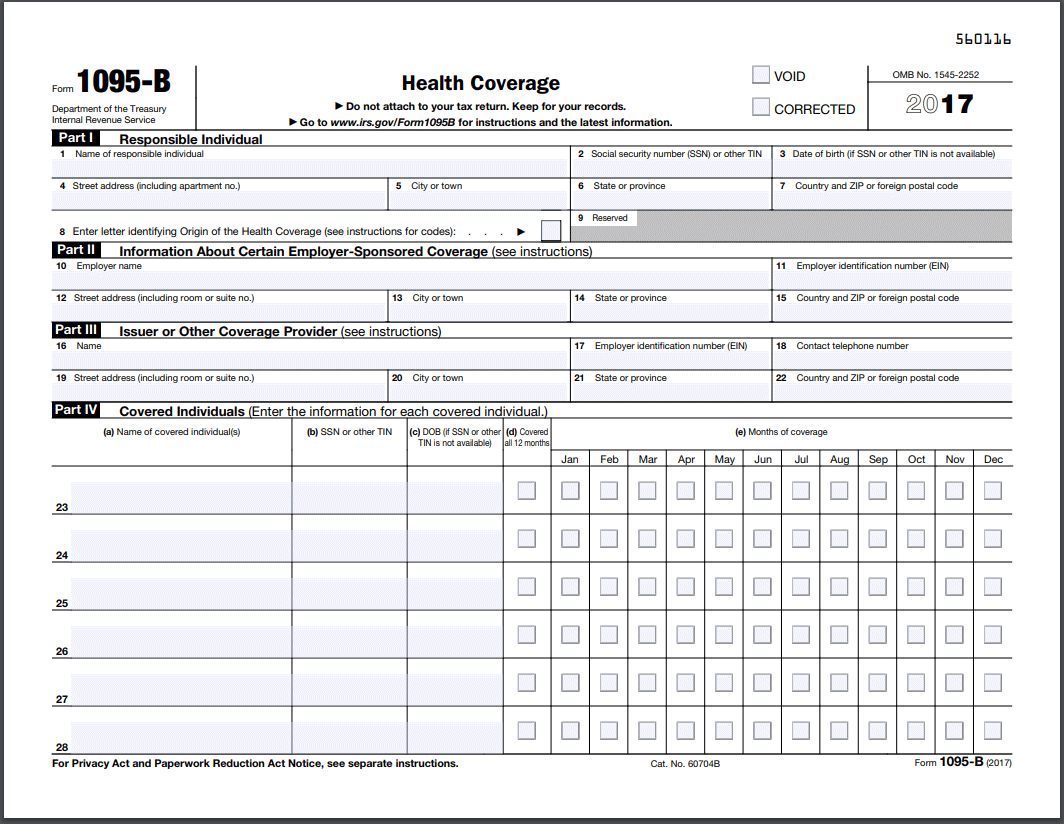

It can be available on your HealthCaregov accounts the moment mid-January. Form 1095-A Form 1095-B Form 1095-C. You should have your 1095-A before submitting your taxes.

If you used them to pay for your health insurance and the amount you paid for coverage. What is a 1095 Form Used For. About Form 1095-A Health Insurance Marketplace Statement Internal Revenue Service.

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

What Is Irs Form 1095 Katz Insurance Group

What Is Irs Form 1095 Katz Insurance Group

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

What Is Form 1095 A Health Insurance Marketplace Statement Turbotax Tax Tips Videos

What Is Form 1095 A Health Insurance Marketplace Statement Turbotax Tax Tips Videos

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Understanding Your Form 1095 A Youtube

Understanding Your Form 1095 A Youtube

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.