So if youre experiencing one of the ailments above you could visit an urgent care clinic for a 50 access fee. Coverage for all ages through age 69.

Emergency Room Visit Coverage In Visitors Insurance For Fixed Coverage Plans

Emergency Room Visit Coverage In Visitors Insurance For Fixed Coverage Plans

Patients who have health insurance usually get startled by the high bills charged by emergency rooms.

Insurance for emergency room only. And thats not including extra charges such. In addition if the ambulance company that transports you to the emergency room doesnt take your insurance your out-of-network costs could be over 2000 depending on. Medical insurance often covers some of those costs but it may not cover all the costs associated with an emergency room visit.

Often some of them think that the facility has. Benefits up to 100000 per Hospital Emergency Room visit up to 2 times per year - per family. Health insurance is not designed to address current emergency health care needs.

Emergency health insurance California Quote with Tax Credits to view rates and plans side by side from the major carriersFree. For example if you get into a medical emergency and your medical costs total thousands of dollars. Your insurance company cant charge you more for getting emergency room services at an out-of-network hospital.

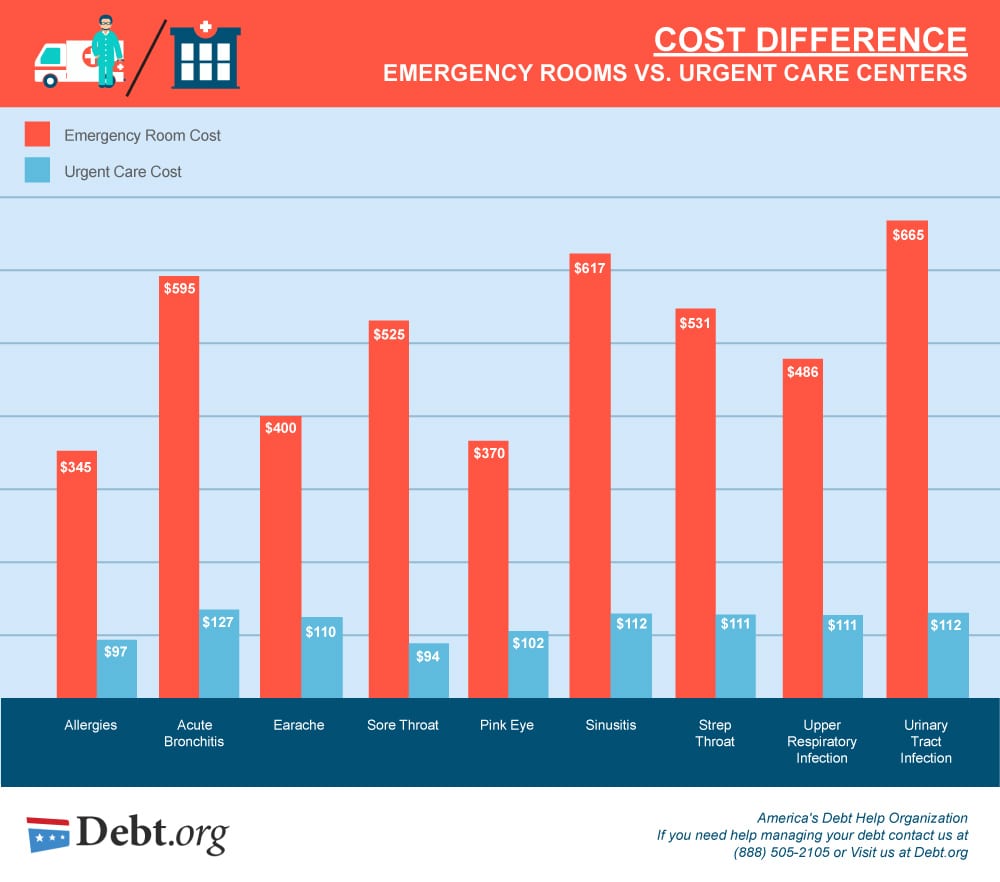

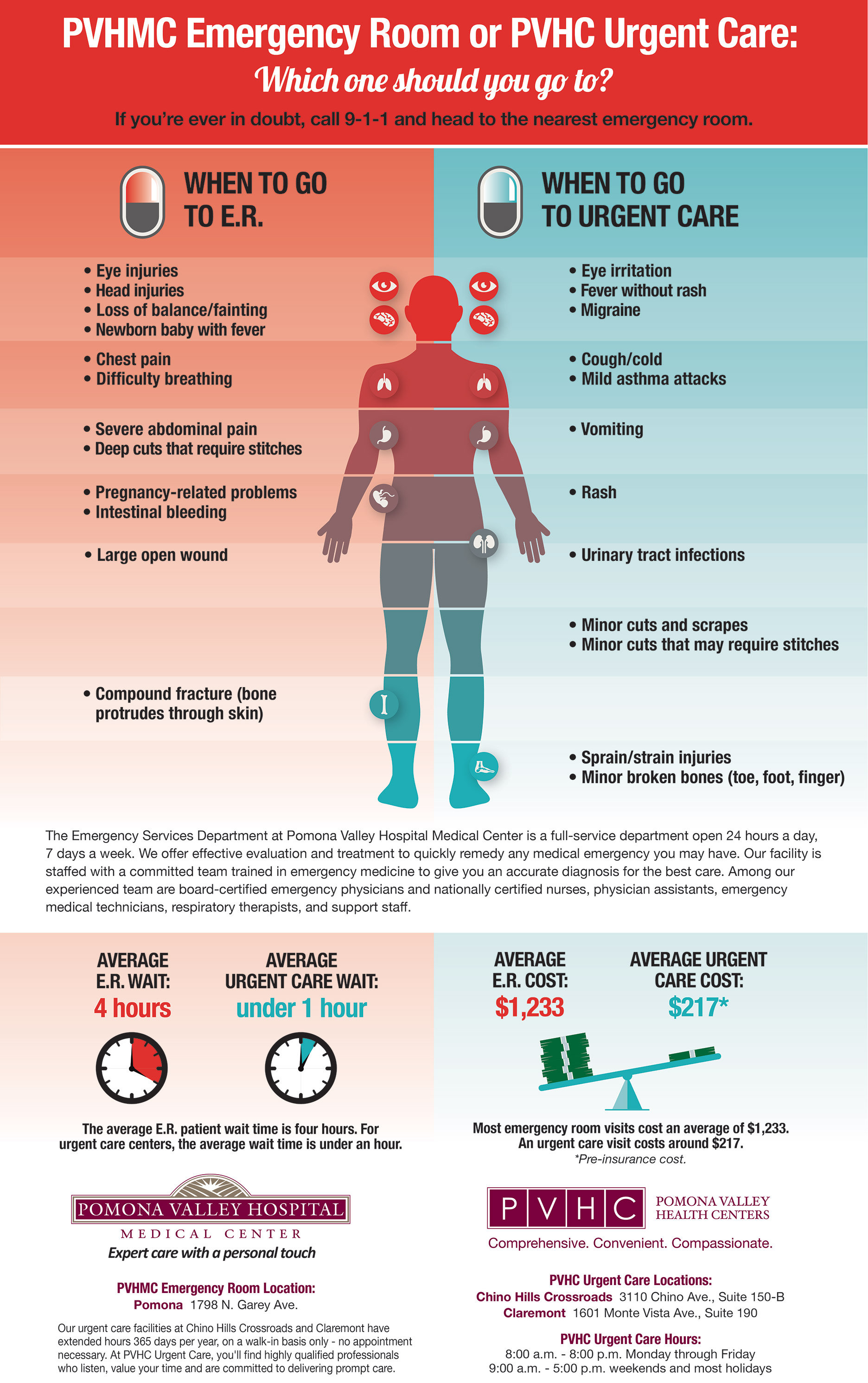

As a general rule urgent care will cost less than emergency room visits. In other words if it is not a life-threatening scenario then urgent care is the best option. The fact is if emergency rooms were to provide their services for free to all the people without insurance they would be in a financial crisis.

Emergency room insurance coverage comes with a lot of caveats. The emergency room will administer treatment immediately since they cannot delay screening or treatment in order to ask about the payment procedure or insurance status. If they cannot afford to offset the outstanding amounts in one go they can negotiate terms of payment with the emergency room.

In fact the federal Emergency Medical Treatment and Labor Act EMTALA is designed to guarantee a persons right to receive emergency treatment regardless of if they can pay or not source. For example the VisitorSecure plan with a 5000000 policy maximum will only pay up to 37500 per injuryillness for the use of a hospital Emergency Room and ALL EXPENSES INCURRED THEREIN. In an emergency you should get care from the closest hospital that can help you.

On the other hand if you are not admitted you will likely be on the hook for the entire deductible or co-pay. Well see what we can do for you. This is vital since there are some scenarios where insurers will shift the medical bill to you after reviewing your case only to find that it wasnt an ER worthy emergency.

Obamacare requires all plans to cover emergency services. Then the remainder of your bill would apply to your coinsurance the amount that youre responsible to pay for a covered health care. The fixed coverage plans will ONLY pay the fixed amount listed in the schedule of benefits for ALL charges incurred in the Emergency Room.

Affordable monthly cost of 20 for single or family coverage. Its also designed to. Catastrophic plans are designed to protect you in a worst-case scenario.

Embrace Pet Insurance covers emergency and specialty pet care no matter where you go so you can rest easy knowing your pet is covered for every unexpected accident and illness. When they visit an emergency room for any medical service they are required to pay all the charges in cash. The hospital administration will inquire about the insurance status and payment details once.

This means that regardless of how much everything totals up. There are people in America with good jobs and stable sources of incomes but have no medical insurances. If they can afford to offset the bill all at once then well and good most emergency rooms accept cash payment.

In some cases an emergency room is the only option if you need medical attention but the office of your primary care physician is closed. Emergency and Specialty Veterinary Care Coverage Just like human medicine veterinary care is constantly advancing including emergency rooms urgent care and veterinary specialists. The Health Care Cost Institute found that the average emergency room visit cost 1389 in 2017¹.

If you need emergency care you should go to the nearest emergency room and feel confident that your insurance will cover it. Emergency Room expense protection is just a click away. Typical health insurance companies must be notified of an emergency room stay within 48 hours and its likely you will be responsible for a high deductible or copay before your provider pays out for any emergency room insurance coverage.

Health insurance already covers emergency room care so you dont need extra insurance. Also regardless of whether you have health insurance emergency departments must treat you if its an emergency. Also keep in mind that a short-term health insurance plan through Vera provides benefits for urgent care visits as well as emergency room care.

By charging the already insured. Therefore many emergency rooms recover their money in three ways. Monthly plan premiums tend to be lower but youll generally need to pay for all health-care costs out of pocket until you reach the plans annual deductible which is usually at least a couple thousand dollars.

However you must check out the insurance plan if its from Cigna. You may wind up with a hefty hospital bill if you visit an emergency room without insurance but they must care for you in an emergency. If you were admitted to the hospital after the ER visit your insurer might reduce or waive co-pay or out-of-pocket deductible costs.

That hospital will treat you regardless of whether you have insurance. Does insurance cover an emergency room visit. The patient is probably unconscious and they cannot wait for the condition to deteriorate because they dont have the insurance details.

It basically says that if you need emergency medicine you must be treated at any emergency room to the best of the staffs ability until youre in stable condition for transfer. Call us at 800-320-6269 or run your instant quote for both ACA and Short term plans here. Many insurance companies will use hospital admission as a litmus test to determine if you were truly sick enough to need emergency care.

Emergency Room Vs Urgent Care Differences Costs Options

Emergency Room Vs Urgent Care Differences Costs Options

/cdn.vox-cdn.com/uploads/chorus_asset/file/10098111/mo_er_member_letter_2017__1_.jpg) An Er Visit A 12 000 Bill And A Health Insurer That Wouldn T Pay Vox

An Er Visit A 12 000 Bill And A Health Insurer That Wouldn T Pay Vox

/iStock-695645846-5a84704dc064710036fb5f61.jpg) When Insurers Deny Emergency Department Claims

When Insurers Deny Emergency Department Claims

Emergency Room Or Pvhc Urgent Care Which One Should You Go To Pomona Valley Health Centers

Emergency Room Or Pvhc Urgent Care Which One Should You Go To Pomona Valley Health Centers

Insurer S Limits On Er Coverage Slammed By Doctors Group Courthouse News Service

Insurer S Limits On Er Coverage Slammed By Doctors Group Courthouse News Service

How Much Does An Urgent Care Visit Cost Ehealth

How Much Does An Urgent Care Visit Cost Ehealth

Usa Visitors Difference Between Urgent Care Vs The Emergency Room

Usa Visitors Difference Between Urgent Care Vs The Emergency Room

Northern Utah Emergency Room Er Vs Urgent Care Ogden Clinic

Northern Utah Emergency Room Er Vs Urgent Care Ogden Clinic

Your Insurance May Not Cover That Emergency Room Visit

Your Insurance May Not Cover That Emergency Room Visit

Emergency Room Insurance Payment Options

Emergency Room Health Insurance Coverage Keep Yourself Protected

Emergency Room Health Insurance Coverage Keep Yourself Protected

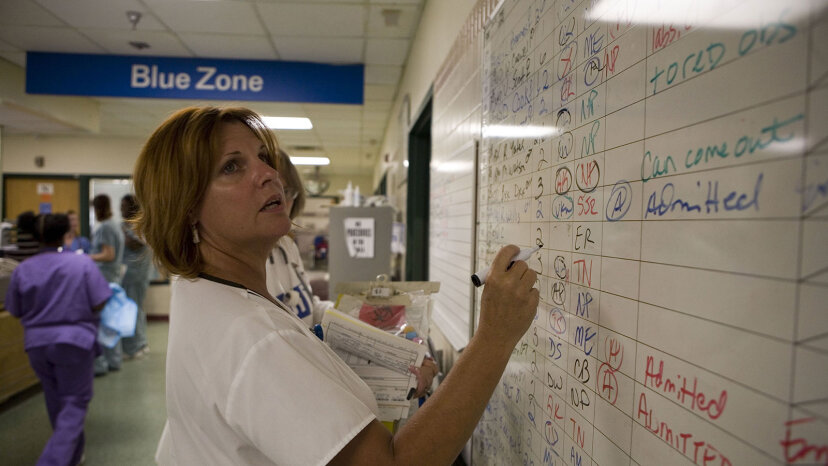

What Happens When Your Insurance Says Your Er Visit Was Avoidable Howstuffworks

What Happens When Your Insurance Says Your Er Visit Was Avoidable Howstuffworks

/average-cost-of-an-er-visit-059cd1b1df38413f94f3ba420c8c24b5.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.