For many people especially for those who are self-employed or who are paid by commissions annual income fluctuates greatly. Will Covered California share my personal and financial information.

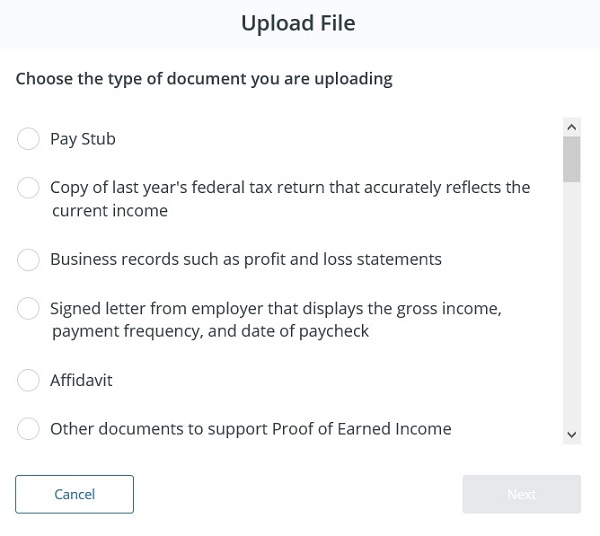

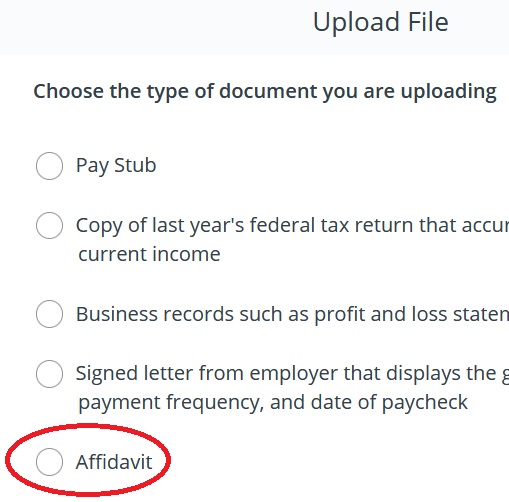

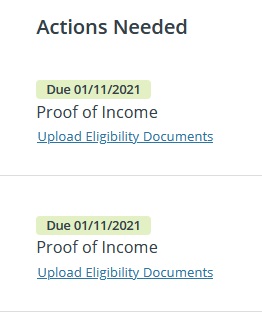

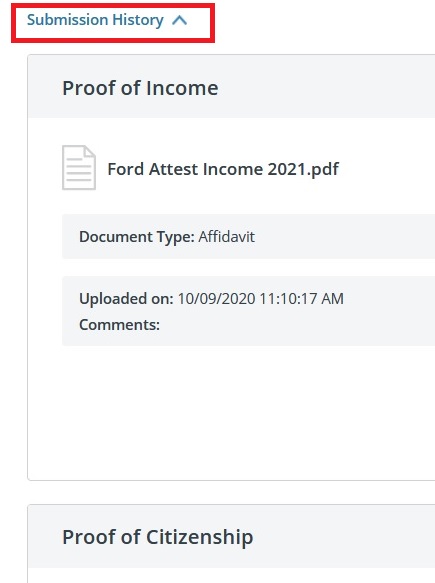

New Covered California Eligibility Document Upload Section

New Covered California Eligibility Document Upload Section

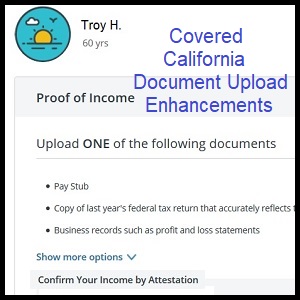

Documents to Confirm Eligibility.

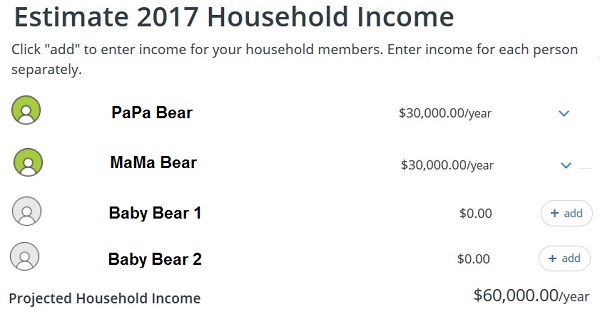

Proof of income for covered california. Percentage of household income calculation 25 of gross income that exceeds filing threshold. This application asks for a lot of personal information. A family of 3 with a gross household income of 150000 that includes.

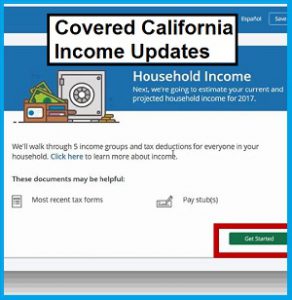

How will Covered California check my income. Distributions resulting from federally protected rights specific to American Indians. So how do you report your income to Covered California.

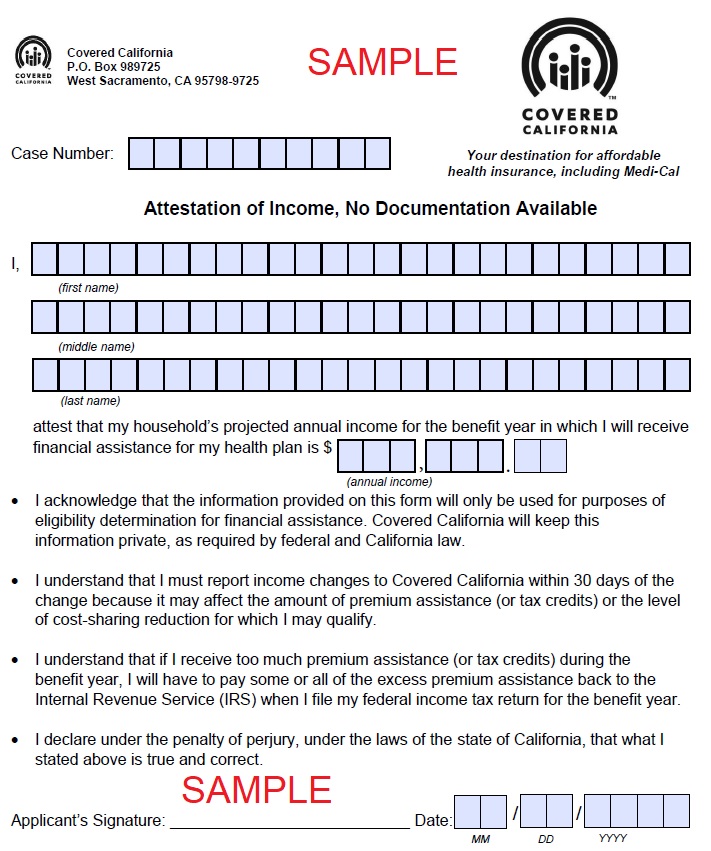

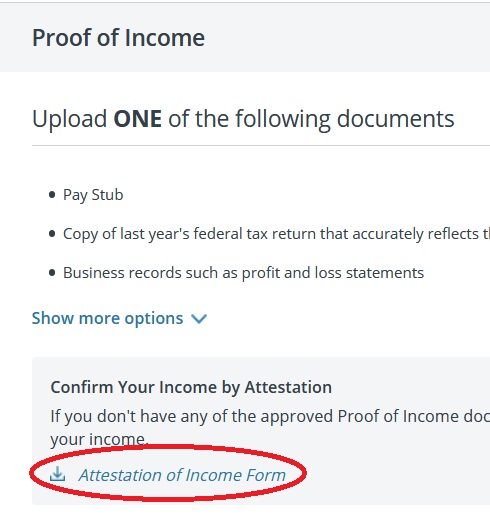

Box 989725 West Sacramento CA 95798-9725 Case Number. MAGI is used to determine eligibility for Covered California subsidies and Medi-Cal expansion. Attestation of Income No Documentation Available I last name attest that my households projected annual income for the benefit year in which I will receive financial assistance for my health plan is annual income.

Our goal is to make it simple and affordable for Californians to get health insurance. The employer statement must. Be signed by the employer.

Covered California is a partnership of the California Health Benefit Exchange and the California. It should be kept with your other tax information in the event the Internal Revenue Service IRS or Franchise Tax Board FTB require you to provide it as proof of your health care coverage. It must contain the persons first and last name income amount year and employer name if applicable.

If the data is inconsistent we ask you to submit documents to confirm the new information. The Form 1095-B is used as proof of Minimum Essential Coverage MEC when filing your state andor federal taxes. In order to be eligible for assistance through Covered California you must meet an income.

What is Covered California. Some examples of taxable American Indian Income which are excluded from MAGI are. Otherwise Covered California may not accept it.

You can start by using your adjusted gross income AGI from your most. 150000 - 49085 x 025 252288. Flat amount calculation 750 per adult 375 per child.

Covered California compares the information you enter on your application with government data sources or information youve provided before. If you submit a pay stub make sure that it is current and within the last 45 days. Include the following information.

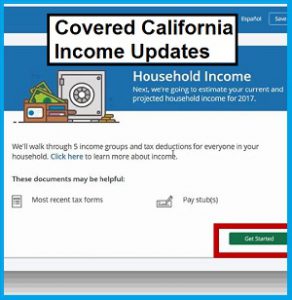

If you have been asked to provide proof please click on these categories for a more detailed list of acceptable documents. When you apply through Covered California for your health insurance you must indicate what your income will be for the benefit year since the premium assistance that you may receive is based on your annual income. Covered California will accept a clear legible copy from the allowable document proof list from the following categories which you can click on for more details.

Be no older than 45 days from the date received by Covered California. Distributions or payment for tribal land. If Covered California is unable to verify through external sources they may ask for document proofs in one or more of the categories below.

Covered California will let you know which categories they need documentation. One of the most common proofs is a pay stub. Can anyone get Covered California.

Any financial help you get is based on what you expect your household income will be for the coverage year not last years income. When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes. Proof of Income Proof of Citizenship or Lawful Presence Proof of California Residency and Proof of Minimum Essential Coverage.

Income can be verified by providing various types of documents such as the acceptable list below. Covered California is the new marketplace that makes it possible for individuals and families to get free or low- cost health insurance through Medi-Cal or to get help paying for private health insurance. Proof of Income Proof of Citizenship or Lawful Presence Proof of California Residency.

750 x 2 375 1875. Be on company letterhead or state the name of the company.

Proof Of Income Covered Ca Accepted Documents

Proof Of Income Covered Ca Accepted Documents

Covered California Small Business Quotes California Health Insurance Premiums Under Obamacare Revealed Dogtrainingobedienceschool Com

Covered California Small Business Quotes California Health Insurance Premiums Under Obamacare Revealed Dogtrainingobedienceschool Com

Covered California Income Limits Explained

Covered California Income Limits Explained

Proof Of Income For Covered California Attestation Form

Proof Of Income For Covered California Attestation Form

New Covered California Eligibility Document Upload Section

New Covered California Eligibility Document Upload Section

Proof Of Income Covered California Attestation Youtube

Proof Of Income Covered California Attestation Youtube

Proof Of Income For Covered California Attestation Form

Proof Of Income For Covered California Attestation Form

Proof Of Income For Covered California Attestation Form

Proof Of Income For Covered California Attestation Form

Proof Of Income For Covered California Attestation Form

Proof Of Income For Covered California Attestation Form

Covered California Income Verification Attestation Affidavits

Covered California Income Verification Attestation Affidavits

Proof Of Income For Covered California Attestation Form

Proof Of Income For Covered California Attestation Form

Proof Of Income For Covered California Attestation Form

Proof Of Income For Covered California Attestation Form

Covered California Income Verification Attestation Affidavits

Covered California Income Verification Attestation Affidavits

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.