4 rijen The California state subsidy is called the State Premium Assistance. Publication 3849A Premium Assistance Subsidy PAS Publication 3895B California Instructions for Filing Federal Forms 1094-B and 1095-B Publication 3895C California Instructions for Filing Federal Forms 1094-C and 1095-C.

Do You Qualify For The New California Health Insurance Premium Subsidy

Do You Qualify For The New California Health Insurance Premium Subsidy

The State Premium.

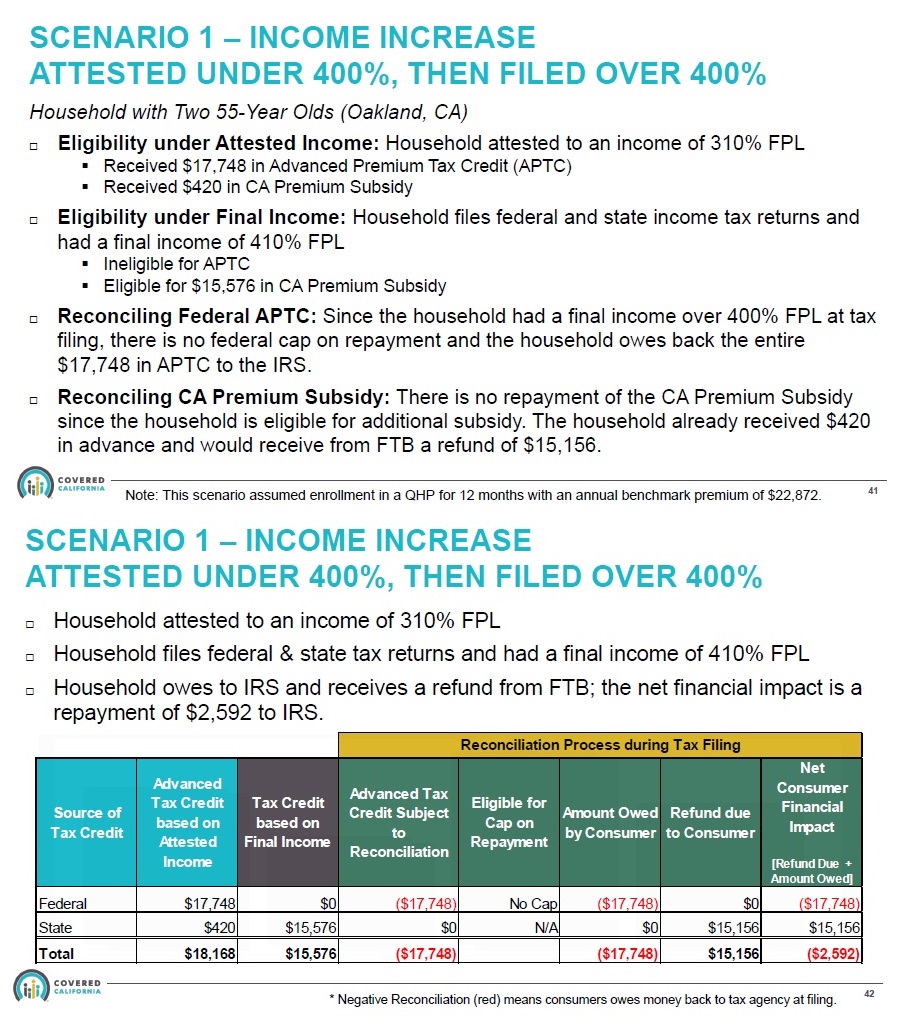

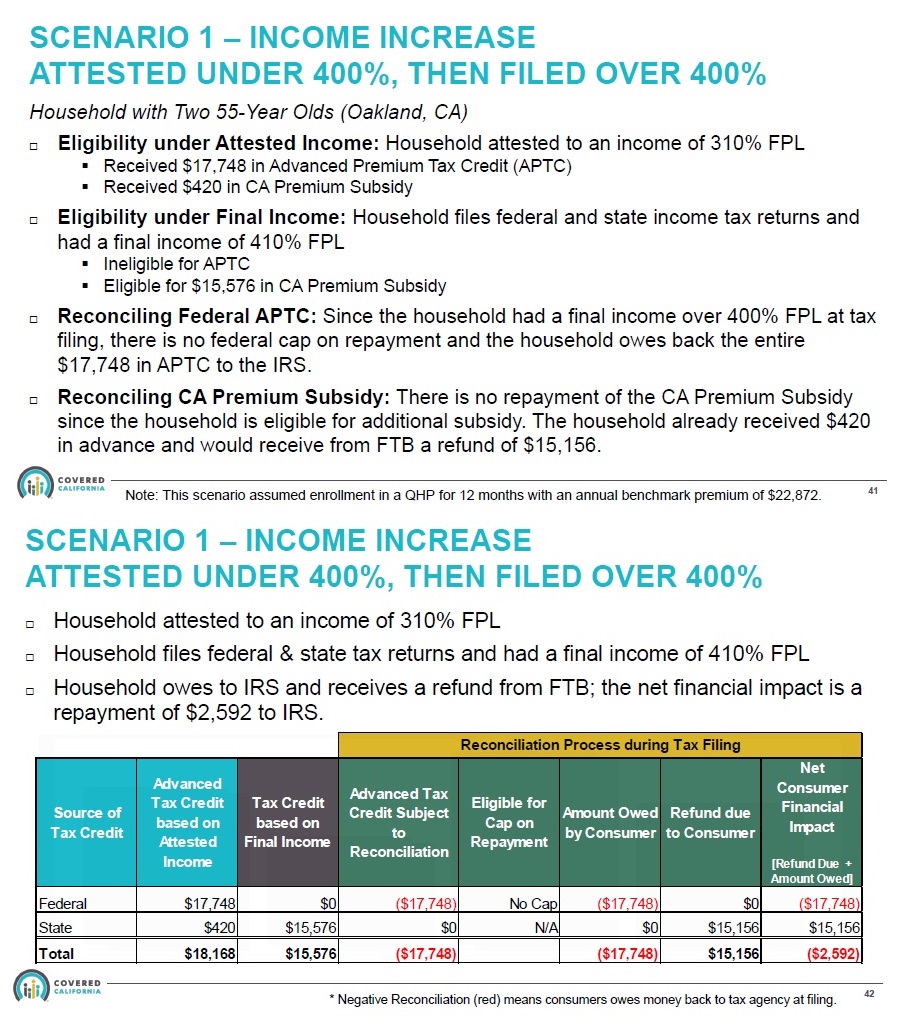

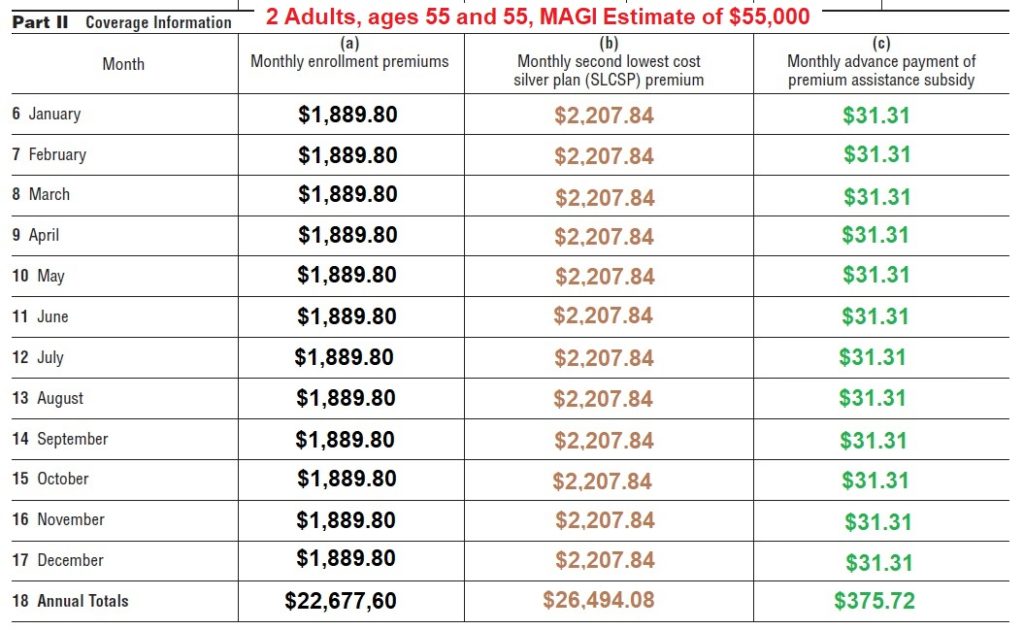

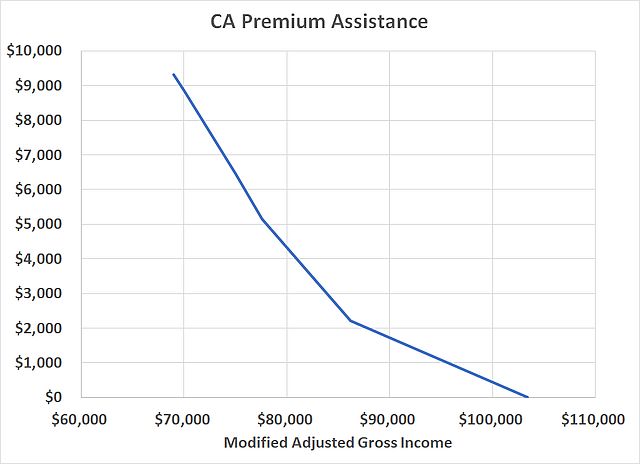

What is ca premium subsidy. The net premium subsidy is 2508. Before the American Rescue Plan California helped people who made too much money qualify for the premium tax credit with a state subsidy. Advance Premium Assistance Subsidy APAS paid throughout the year will need to be reconciled at the end of the year with the actual PAS allowed based on the actual household income for the year less federal Premium Tax Credit PTC amounts.

The subsidies are in the form of tax credits. Learn more about who qualifies for a subsidy. The subsidy is technically an advance premium tax credit.

March 31 2021 at 530 am. What is CA premium subsidy. Payment of the premium assistance.

Advance Premium Assistance Subsidy APAS paid throughout the year will need to be reconciled at the end of the year with the actual PAS allowed based on the actual household income for the year less federal Premium Tax Credit PTC amounts. You may qualify for 100 coverage of COBRA premiums. The majority of the states have expanded Medicaid.

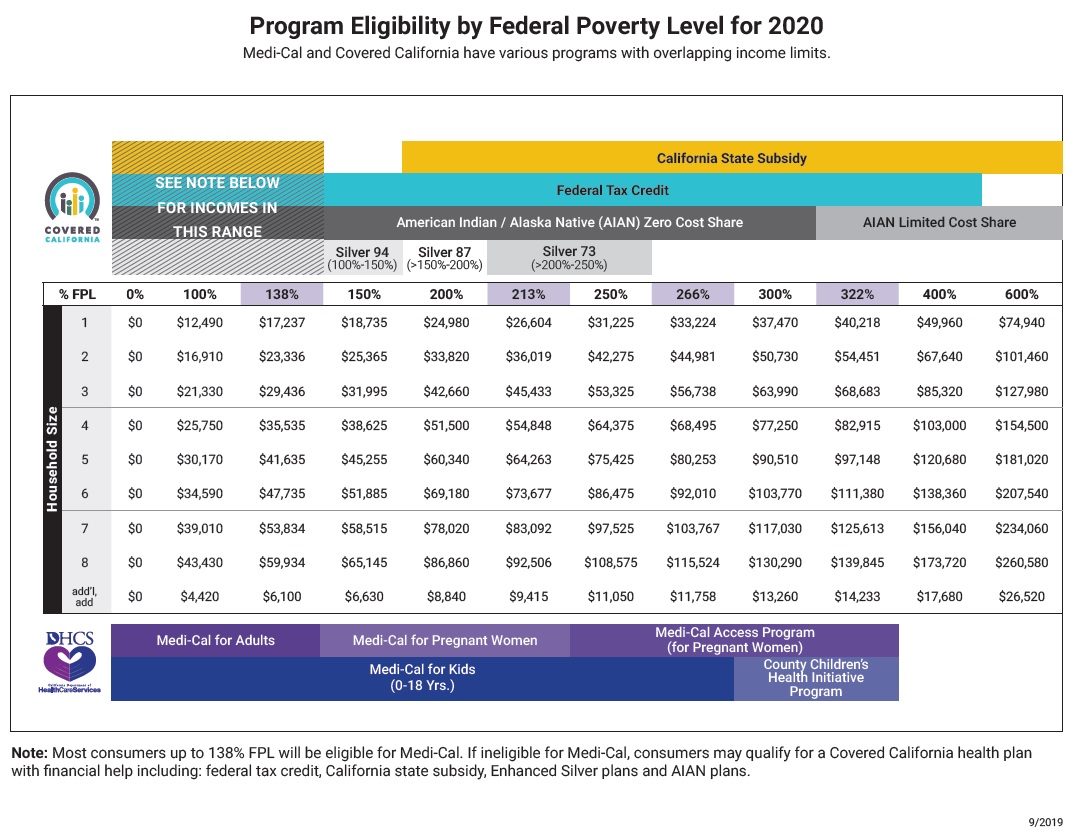

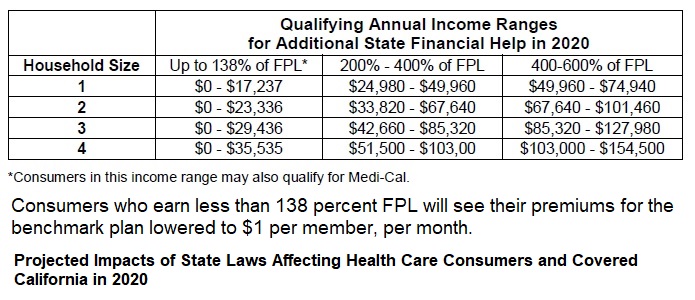

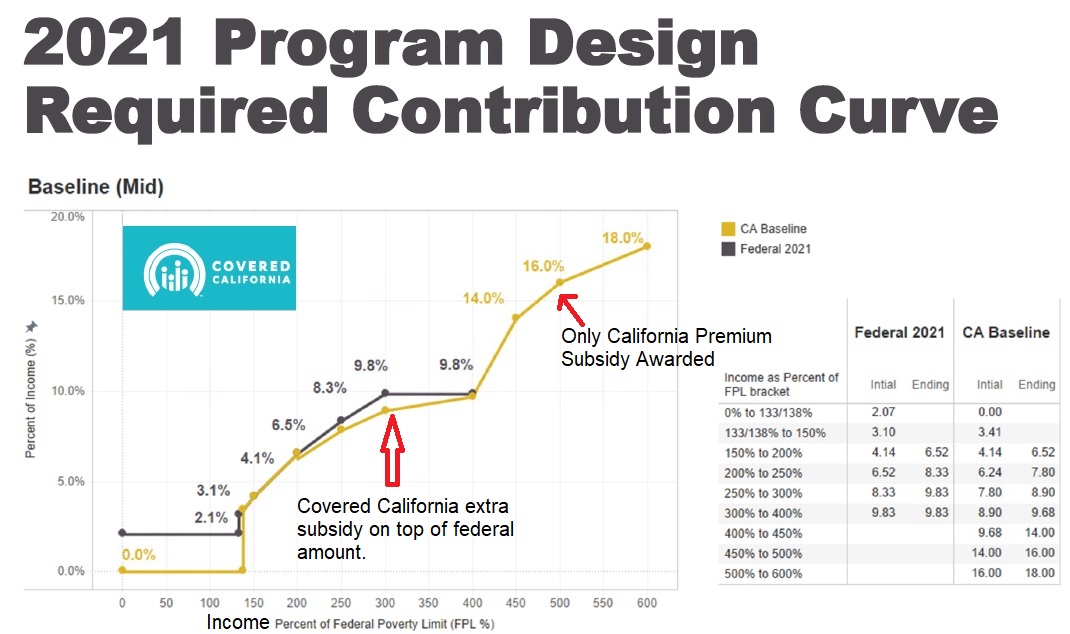

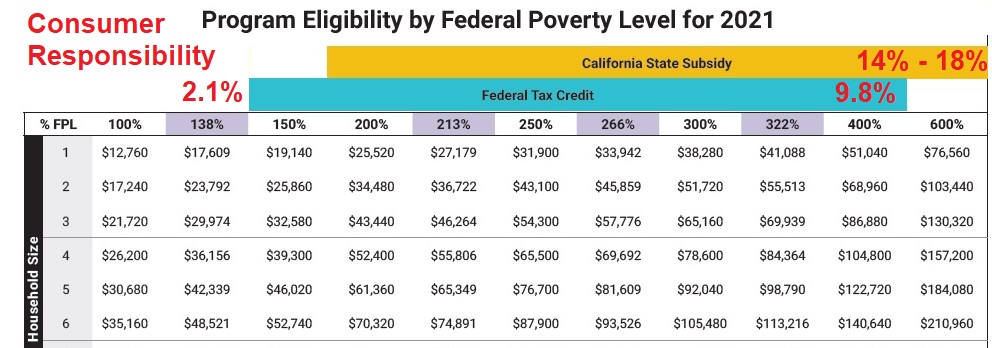

The federal ACA Premium Tax Credit subsidies stop at 400 of the federal poverty level. Premium Subsidies Cost-Sharing Reductions Medicaid and CHIP ACA-specific MAGI is used to determine eligibility for premium subsidies the subsidy is actually a tax credit thats available upfront or on your tax return and cost-sharing reductions when people shop for coverage in their states health insurance exchange. Low-income and moderate-income families earning up to 400 percent of the federal poverty level FPL are.

The Affordable Care Acts premium subsidies were designed to help Americans purchase their own health insurance. Qualifying for Premium Subsidy. An additional tax credit on the federal return of 2820 and an additional tax liability -312 on the state return.

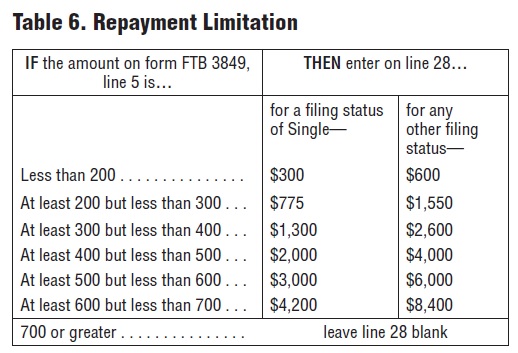

PAS and APAS are reconciled on Form 3849 Premium Assistance Subsidy. How is the California Premium Subsidy program different from the federal Affordable Care Act ACA Premium Tax Credit Subsidy through Covered California. California doesnt conform to federal and you must repay the overpayment of the subsidy to CA but not to fed.

Premium assistance applies to all medical plans. Its also currently unclear whether premium assistance applies to states plans like Colorado Continuation Coverage. The cost of coverage and conditions of enrollment will vary depending on several factors which are covered below in detail.

Based on federal guidelines subsidies will be available starting in January to individuals earning up to almost 75000 a. The premium subsidy benefit is where the retirement system pays a percentage of your monthly insurance premiums or a percentage of the maximum subsidy for some deferred members. April 7 2021 at 300 pm.

The majority of our customers get financial help. Income decrease estimated MAGI under 400 and filed even lower MAGI below original estimate. Prior to 2021 the rule was that households earning between 100 and 400 of the federal poverty level could qualify for the premium tax credit health insurance subsidy the lower threshold is 139 of the poverty level if youre in a state that has expanded Medicaid as Medicaid coverage is available below that level.

Reporting changes in circumstances. Health Flexible Spending Accounts FSA are not covered. If you are a low- or moderate-income Californian you may get help buying insurance from Covered California through monthly subsidies that lower your premium costs so that you pay less for top-quality brand-name insurance.

Had your hours reduced. Thanks to the American Rescue Plan Californians will get more help paying for their plan from the federal government and even more Californians qualify for the new savings. It likely also applies to stand-alone dental vision and EAP plans although further clarification would be welcome.

The amount of PAS available to a household is based on the projected household income for the year. The California Premium Subsidy will be available to households who earn between 401 and 600 of the FPL. Subsidy Cost Sharing Assistance or Cost Sharing Reduction Lower-income taxpayers who qualify for the premium assistance tax credit may also be eligible for cost sharing assistance if they enroll in a silver plan.

You can choose to have the federal government pay the insurance company the credit on your behalf to lower your monthly premium or claim.

State And Federal Subsidies For California In 2020 Health For California Insurance Center

State And Federal Subsidies For California In 2020 Health For California Insurance Center

Premium Subsidy California To 600 Fpl Federal Poverty Level And New Mandate Penalty

Premium Subsidy California To 600 Fpl Federal Poverty Level And New Mandate Penalty

How Is The California Premium Assistance Subsidy Calculated With Ftb 3895 And 3849

How Is The California Premium Assistance Subsidy Calculated With Ftb 3895 And 3849

Do You Qualify For The New California Health Insurance Premium Subsidy

Do You Qualify For The New California Health Insurance Premium Subsidy

Faq California Premium Subsidy For Health Insurance

Faq California Premium Subsidy For Health Insurance

How Is The California Premium Assistance Subsidy Calculated With Ftb 3895 And 3849

How Is The California Premium Assistance Subsidy Calculated With Ftb 3895 And 3849

Two Covered California Subsidies Which Do You Qualify For

Two Covered California Subsidies Which Do You Qualify For

Health Care Reform Subsidies Explained In Layman S Terms

Health Care Reform Subsidies Explained In Layman S Terms

How Is The California Premium Assistance Subsidy Calculated With Ftb 3895 And 3849

Covered California 2020 Open Enrollment Official Website Assemblymember Richard Bloom Representing The 50th California Assembly District

2021 California Aca Health Insurance Premium Subsidy

2021 California Aca Health Insurance Premium Subsidy

Two Covered California Subsidies Which Do You Qualify For

Two Covered California Subsidies Which Do You Qualify For

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

Faq California Premium Subsidy For Health Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.