If not use gross income and subtract the amounts your employer takes out of your pay for child care health insurance and retirement plans. Current enrollees and those seeking Obamacare coverage can access the additional help for two years as part of the 19 trillion relief package that President Joe Biden signed in early March.

Optimizing Your Agi To Maximize Obamacare Credits Hull Financial Planning

Optimizing Your Agi To Maximize Obamacare Credits Hull Financial Planning

For premium subsidies the exchange will keep track of the amount that is paid to your health insurance carrier.

Is the subsidy for obamacare taxable. You are generally not eligible to deduct the cost of your Obamacare health insurance premiums from your federal taxable income. In 2021 Obamacare subsidies begin if your health plan cost is greater than 85 of your household income towards the cost of the benchmark plan or a less expensive plan the benchmark plan is the second-lowest silver plan. Unlike other tax credits which you can take advantage of only after you file your annual return Obamacare subsidies can be claimed upfront via the ACAs marketplaces.

Under the new law Obamacare subsidies are out of the IRSs reach. After-tax contributions lower MAGI on withdrawal like the Roth IRA. For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four.

This tax exemption is just for the 2020 tax year though. The subsidies are a tax creditalbeit a tax credit that you can take in advance paid directly to your health insurance company rather than having to wait to claim on your tax return like other tax credits. To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level.

HSAs are tax free in and tax free out which make them especially cool. A health care subsidy cost assistance lowers the amount you spend on your monthly premium via advanced premium tax credits or reduces your out-of-pocket costs for things like copays coinsurance deductibles and out-of-pocket maximums cost-sharing reduction. Generally the subsidy is added to your income tax refund as a premium tax credit.

If your pay stub lists federal taxable wages use that. The government determines subsidies based on your adjusted gross income AGI family size and directly. In order for that to happen.

First of all it is not a subsidy in the technical sense of the term it is a federal tax credit that may have to be repaid under certain circumstances. Fortunately the American Rescue Plan Act lets you off the hook for this year. The subsidies both premium assistance tax credits and cost-sharing are not considered income and are not taxed.

Last year some 60 of Obamacare consumers who received advance premium subsidies and filed their taxes with HR Block were forced to repay an average 716 of their subsidy according to the firm. The IRS announced last week that taxpayers who received excess advance payments in 2020 on the tax credit for health care under the Affordable Care Act arent required to file Form 8962 Premium Tax Credit or report an excess advance Premium Tax Credit repayment on their Form 1040 or Form 1040-SR Schedule 2 Line 2 when they file their 2020 taxes this. Many of them didnt actually cut a check to the government.

It will be reported to you and to the IRS at the end of the year. The Obamacare health insurance subsidy is known as the health insurance Premium Tax Credit. The types of assistance offered under the Affordable Care Act are.

Rather their average refund was reduced by 38. Some medical expenses may be tax deductible if you meet the minimum threshold. Advanced Premium Tax Credits for those making between 100 and 400 FPL Cost Sharing Reduction subsidies for those making between 100-250 FPL and Medicaid for those are making less than 138 FPL.

The discount on your monthly health insurance payment is also known as a premium tax credit. Federal Taxable Wages from your job Yes. Before-tax and tax deductible contributions like to a traditional IRA lower MAGI and increase subsidies.

If your income increases during the year then your subsidy will be reduced making your tax bill larger as a result. This is going to help Americans who received additional federal unemployment or who grappled with erratic employment through the pandemic. ObamaCare Cost Assistance.

Cost assistance includes. Subsidies are subsidized by the federal government and are paid for through taxes. This is generally true for ObamaCares tax credits and other assistance programs.

However you can choose to use the credit in advance by applying it toward your monthly premium cost. 8 Your AGI is your gross income minus specific deductions such as the student loan interest tax deduction and deductions for.

/obamacare-taxes-penalties-and-credits-3306061_FINAL2-acbc62123f0a4d59860dd165ecc6aa8d.png) Will You Have To Pay Obamacare Taxes This Year

Will You Have To Pay Obamacare Taxes This Year

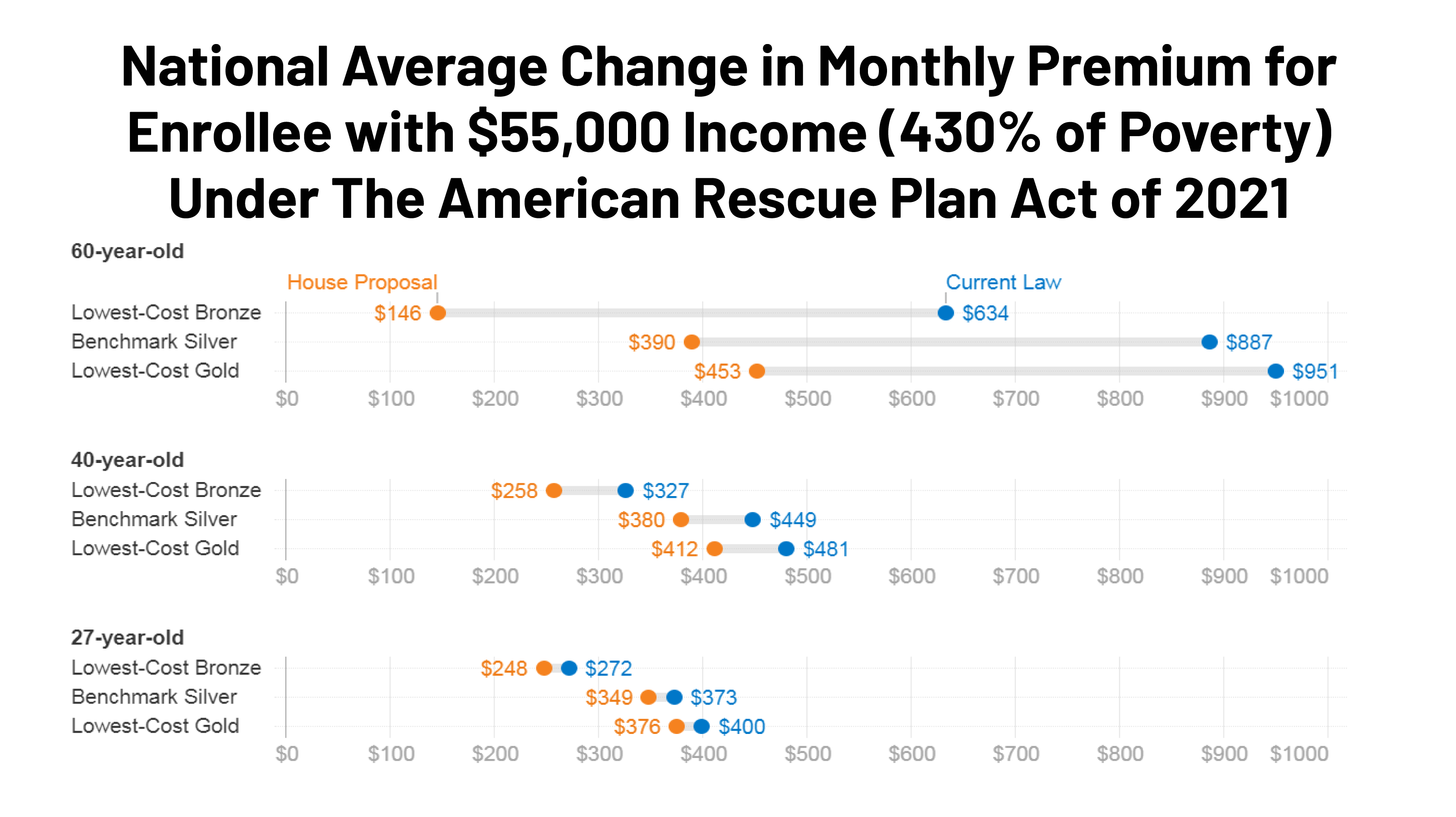

Impact Of Key Provisions Of The American Rescue Plan Act Of 2021 Covid 19 Relief On Marketplace Premiums Kff

Impact Of Key Provisions Of The American Rescue Plan Act Of 2021 Covid 19 Relief On Marketplace Premiums Kff

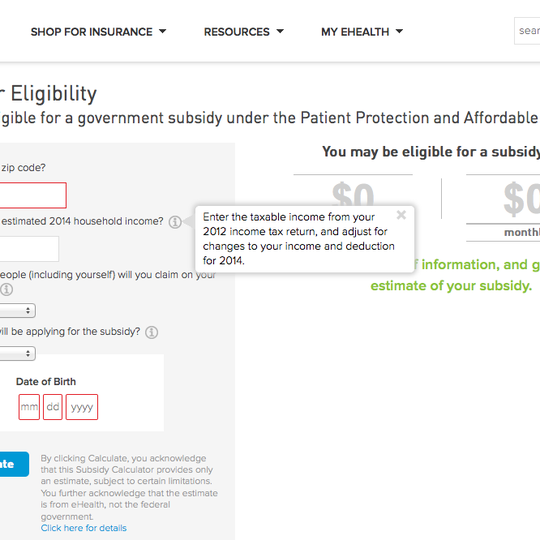

/media/img/posts/2013/11/Screen_Shot_2013_11_04_at_1.50.18_PM/original.png) The Infinite Bewilderment Of Signing Up For Obamacare Subsidies The Atlantic

The Infinite Bewilderment Of Signing Up For Obamacare Subsidies The Atlantic

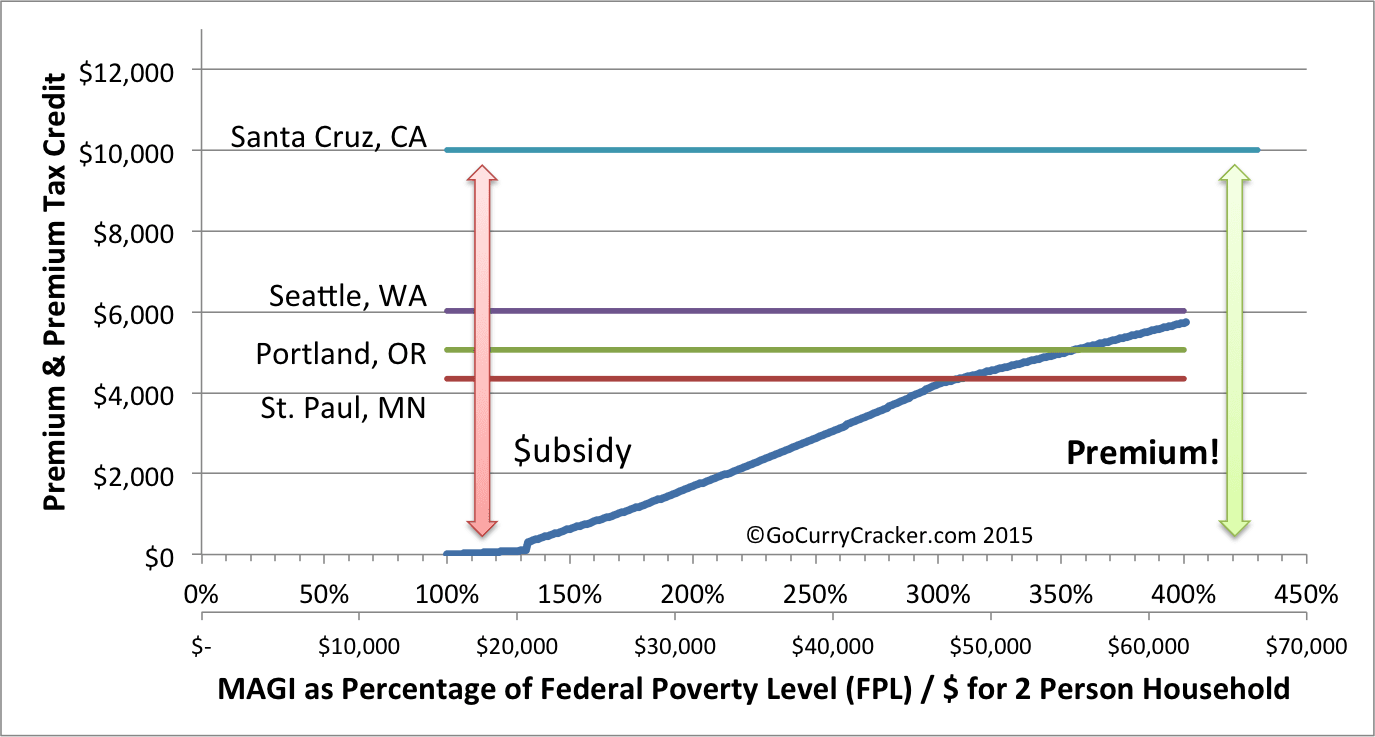

Obamacare Optimization In Early Retirement Go Curry Cracker

Obamacare Optimization In Early Retirement Go Curry Cracker

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

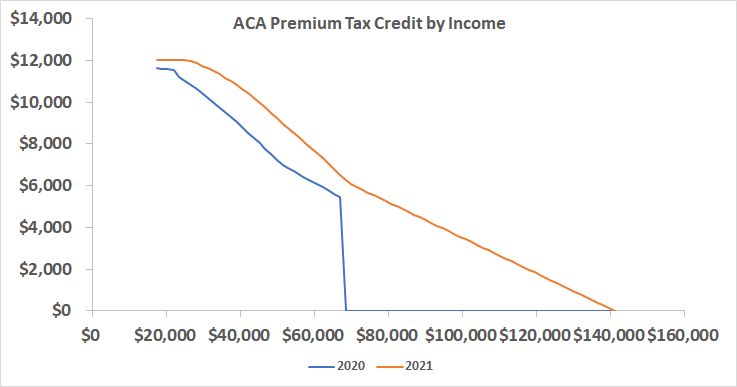

Aca Premium Subsidy Cliff Turns Into A Slope In 2021 And 2022

Aca Premium Subsidy Cliff Turns Into A Slope In 2021 And 2022

/media/img/mt/2013/11/Screen_Shot_2013_11_01_at_6.08.17_PM/original.png) The Infinite Bewilderment Of Signing Up For Obamacare Subsidies The Atlantic

The Infinite Bewilderment Of Signing Up For Obamacare Subsidies The Atlantic

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

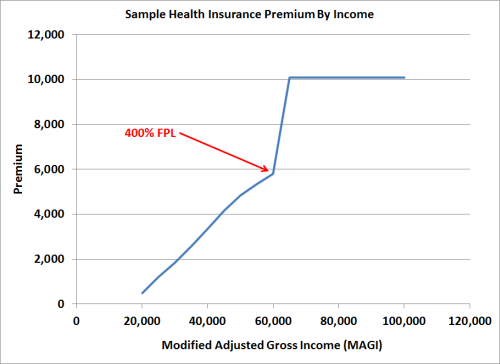

Converting To Roth And Harvesting Capital Gains Under Obamacare Aca Premium Subsidy

Converting To Roth And Harvesting Capital Gains Under Obamacare Aca Premium Subsidy

If I Get An Obamacare Subsidy In The Exchange Is The Subsidy Amount Considered Income Healthinsurance Org

If I Get An Obamacare Subsidy In The Exchange Is The Subsidy Amount Considered Income Healthinsurance Org

/obamacare-explained-1272f608281e4887969aa0a14b1bff1c.png) Obamacare Explained What You Need To Know Now

Obamacare Explained What You Need To Know Now

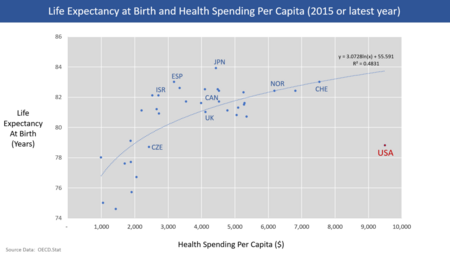

Health Care Finance In The United States Wikipedia

Health Care Finance In The United States Wikipedia

The Infinite Bewilderment Of Signing Up For Obamacare Subsidies The Atlantic

The Infinite Bewilderment Of Signing Up For Obamacare Subsidies The Atlantic

:max_bytes(150000):strip_icc()/obamacare-pros-and-cons-3306059-final-HL-75d611454d684942a27cf4463e4841a6.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.