The Bronze or Silver plan is usually a popular choice for people who not have health. For Silver-tier plans members are required to pay 30 of the plan cost whereas insurers are required to pay 70 of the plans cost.

How To Choose Between Bronze Silver Gold And Platinum Health Insurance Plans

How To Choose Between Bronze Silver Gold And Platinum Health Insurance Plans

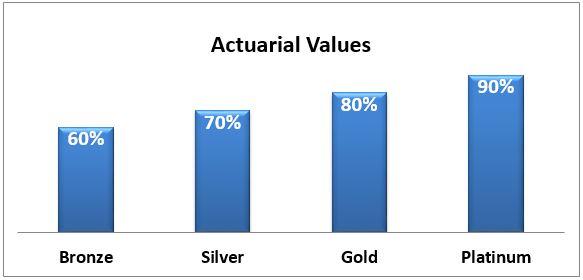

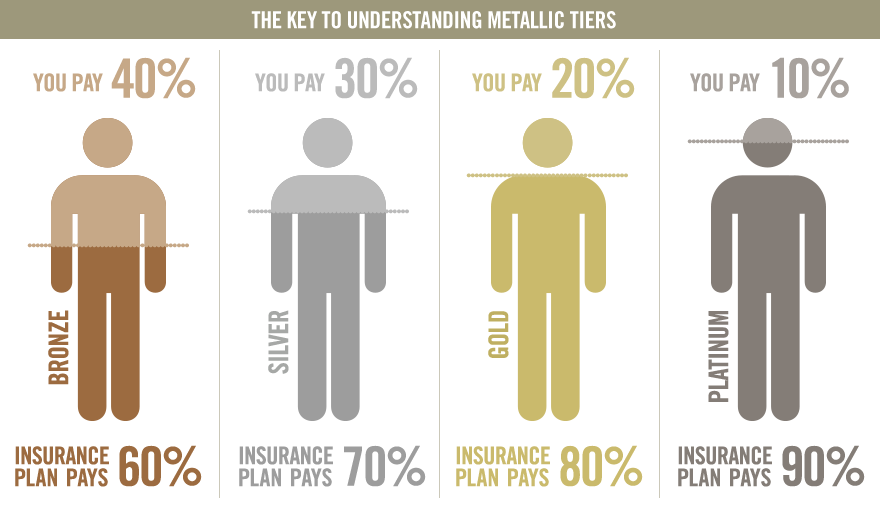

A Bronze Plan will cover 60 of health care costs with the consumer responsible for paying 40.

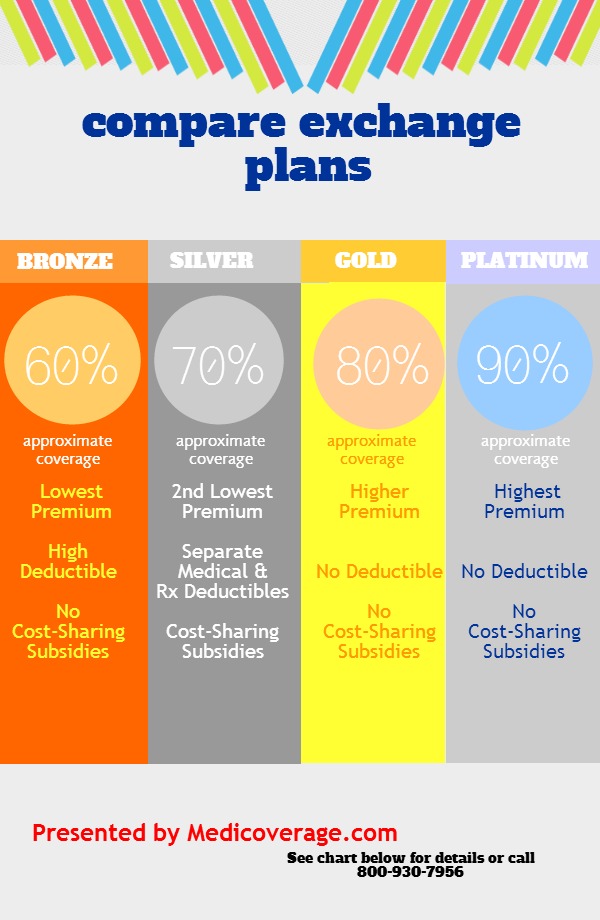

What is difference between bronze and silver health plans. In order to be included in the Health Insurance Marketplace each insurance company can offer four different types of qualified health insurance plans Bronze Silver Gold and Platinum. Silver deductibles the costs you pay yourself before your plan pays anything are usually lower than those of Bronze plans. Monthly payments lower than a gold plan but more than bronze.

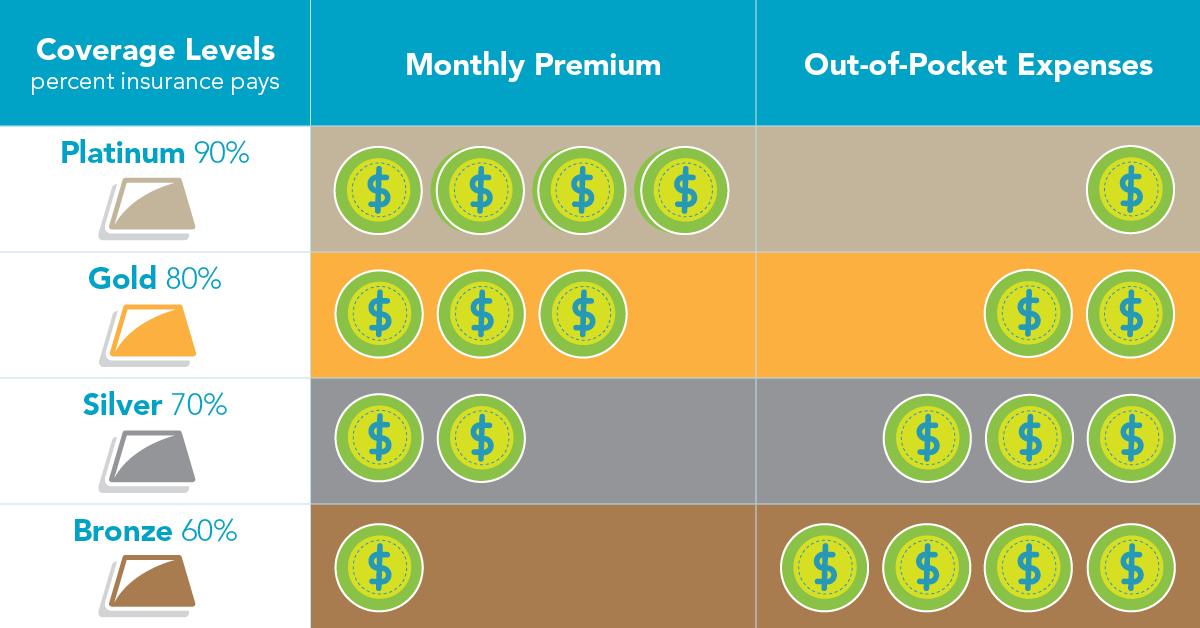

In general the more the company covers the more the consumer will pay for the premiums. Does a Bronze Plan Cover the Same Services as a Silver Gold or Platinum Health Insurance Plan. These categories show how you and your plan share costs.

Does a Bronze Plan Cover the Same Services as a Silver Gold or Platinum Health. Lower monthly payments but higher out-of-pocket costs. Your out-of-pocket costs will be less than a bronze plan but more than a gold plan unless youre eligible for cost sharing reduction.

Silver is basically the middle ground between the lowest level plan and the platinum one. Higher monthly payments but lower out-of-pocket costs. Conversely your monthly premium will be lower if you choose a Bronze or Silver plan but you will pay more for each doctor visit prescription or health care service that you use.

For Silver plans insurance companies pay 70 of costs and the consumer pays 30. For information about specific details of health plans in your state call 800-930-7956. First of all the Bronze and Silver are generally the least expensive plans available for people over age 30.

Plan categories have nothing to do with quality of care. Knowing just a few things before you compare plans can make it simpler. However it also means that youre going to have a higher deductible and that if an emergency happens to your family at some point throughout the year then you may not receive reimbursement or a benefit safety net.

For Silver plans insurance companies pay 70 of costs and the consumer pays 30. Choosing a health insurance plan can be complicated. Silver plans are what most people buy.

If you qualify for cost-sharing reductions you must pick a Silver plan to get the extra savings. The silver level is usually a pretty affordable plan for just about any family. There are 4 categories of health insurance plans.

A Bronze Plan will cover 60 of health care costs with the consumer responsible for paying 40. Some of the benefits that are required of a silver policy but not bronze including treatment for the heart and vascular system lungs and chest and the back neck and spine. For Gold Plans the split is 80-20 and for Platinum the split is 90-10.

You can save hundreds or even thousands of. Bronze Silver Gold and Platinum. Although Bronze and Silver insurance plans offer similar coverage there are a couple of key distinctions aside from the variation in premiums and out-of-pocket costs.

The 4 metal categories. Silver is the better choice than Bronze if you can afford it because of its lower deductible more benefits before hitting the deductible and the only plan that is eligible for cost-sharing subsidies. Many Bronze plans are considered high-deductible health plans HDHPs and some can be combined with a health savings account HSA to help employees pay for out-of-pocket expenses.

The cost-sharing breakdown for Bronze and Silver Plans For the Bronze metal tier plan members are required to pay 40 of the plan cost whereas the insurer pays 60 of the plan cost. Silver health insurance Silver health insurance has to cover the same three restricted categories at basic and bronze as well 26 other clinical categories. Bronze insurance plans.

These plans pay an average of 70 of an individuals covered medical costs and usually have lower deductibles than bronze plans. Conversely your monthly premium will be lower if you choose a Bronze or Silver plan but you will pay more for each doctor visit prescription or healthcare service that you use. If a person is eligible for a subsidy it will apply evenly to any plan choice.

An Image Of A Health Insurance Plan Chart With Bronze Silver Royalty Free Cliparts Vectors And Stock Illustration Image 96250700

An Image Of A Health Insurance Plan Chart With Bronze Silver Royalty Free Cliparts Vectors And Stock Illustration Image 96250700

How Much Does Individual Health Insurance Cost Ehealth Insurance

How Much Does Individual Health Insurance Cost Ehealth Insurance

Understanding The Metal Levels In The Affordable Care Act Aca Mnj Insurance Solutions

Understanding The Metal Levels In The Affordable Care Act Aca Mnj Insurance Solutions

Marketplace Metal Level Health Plans Bewellnm

Marketplace Metal Level Health Plans Bewellnm

Comparing Exchange Plans Bronze Silver Gold Platinum Medicoverage Com

Comparing Exchange Plans Bronze Silver Gold Platinum Medicoverage Com

Choosing Bronze Silver Gold Or Platinum Health Plans New Youtube

Choosing Bronze Silver Gold Or Platinum Health Plans New Youtube

What Are The Differences In Choosing A Platinum Gold Silver Or Bronze Health Insurance Plan Fortier Insurance

What Are The Differences In Choosing A Platinum Gold Silver Or Bronze Health Insurance Plan Fortier Insurance

The Health Insurance Tier System Explained Smartfinancial

The Health Insurance Tier System Explained Smartfinancial

/ChooseAmongBronzeSilverGoldAndPlatinumHealthPlans2-d91b2944d5494cd8818e76d01230a608.png) Choose Among Bronze Silver Gold And Platinum Health Plans

Choose Among Bronze Silver Gold And Platinum Health Plans

Health Plans Are Categorized As Bronze Silver Gold Or Catastrophic What Does This Mean Maryland Health Connection

Health Plans Are Categorized As Bronze Silver Gold Or Catastrophic What Does This Mean Maryland Health Connection

How To Choose The Right Metal Level For Your Health Insurance Plan

How To Choose The Right Metal Level For Your Health Insurance Plan

/ChooseAmongBronzeSilverGoldAndPlatinumHealthPlans2-d91b2944d5494cd8818e76d01230a608.png) Choose Among Bronze Silver Gold And Platinum Health Plans

Choose Among Bronze Silver Gold And Platinum Health Plans

What Do The Bronze Silver Gold And Platinum Designations Mean Realtors Insurance Place

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.