Enroll in Medicare when you turn 65. Does Medicare cover peoples spouses.

Medicare And Work History Eligibility Options And Costs

Medicare And Work History Eligibility Options And Costs

When you turn age 62 and your spouse is age 65 your spouse can usually receive premium-free Medicare benefits.

Medicare and spouse coverage. For individuals who are covered by a spouses employer health care plan it may not be necessary or ideal to enroll in Medicare immediately upon turning 65. Traditional Medicare includes Part A hospital insurance and Part B medical insurance. Until youre age 62 your spouse can receive Medicare Part A but will have to pay.

Say the working spouse turns 65 retires and claims Medicare. Unfortunately Medicare only covers the qualifying individual meaning it does not offer any family benefits. For your spouse to have Medicare coverage he or she must have a separate individual policy.

Anzeige Shop Medicare plans from Aetna Humana UnitedHealthcare Wellcare Cigna Kaiser more. Featured Financial News Healthcare News Lifestyle News Medicare Education Medicare News. The other spouse is.

Medicare will only cover you not your spouse or children if they are not eligible on their own. For a person or their spouse to qualify for Medicare they will need. In most cases you dont need to do anything until you or your spouse retire or you lose the employer coverage.

Find affordable quality Medicare insurance plans that meet your needs. Tara Moore Getty Images Its important to understand that if your spouse is enrolling in Medicare but continuing to work past the age of 65 he or she can continue to have employer-sponsored coverage and you can continue to be covered as a spouse on that planMany people who continue to work past age 65 have simultaneous coverage under Medicare. Medicare Part A hospital coverage has no monthly cost for most people who worked or have a spouse who worked.

Heres what to know about costs. Find affordable quality Medicare insurance plans that meet your needs. Your non-working spouse is eligible for premium-free Medicare Part A coverage at the age of 65 based on your work record and if you meet the necessary requirements for Medicare coverage mentioned above.

Age of a spouse doesnt factor into this equation either. If you lose Medicare coverage due to the death of a spouse you become eligible for a Special Election Period. The spouse of a.

I have dropped employer-offered coverage. But in some cases a younger spouse can help you get Medicare Part A with no monthly premium. A person may qualify for Medicare based on the work record of their spouse.

If you didnt enroll when you were first eligible the size of the employer determines whether you have to pay a penalty if you enroll later. This is where problems begin especially when a working spouse is older than a non-working spouse. You and your spouse might not start getting Medicare benefits at the same time Most people are eligible for Medicare benefits when they turn age 65.

Medicare After Death of a Spouse. Spouse coverage and Social Security work credits. If your spouse is younger than 62 when you turn 65 you wont qualify for premium-free Part A until your spouse turns 62 if your spouse has worked and paid Medicare taxes for at least 10 years.

If you are covered by your spouses employer plan and eligible for Medicare you may have a few options when it comes to getting Medicare. Medicare is individual coverage. Anzeige Shop Medicare plans from Aetna Humana UnitedHealthcare Wellcare Cigna Kaiser more.

If neither you nor your spouse worked at least 10 years in Medicare-covered employment each of you may qualify for Medicare upon turning 65 but you may both have to. Lets examine how Medicare benefits work if you are married. If you dont take employer coverage when its first offered to you you might not get another chance to sign up.

If youre 65 or older Medicare pays first unless these apply. Your Medicare insurance doesnt cover your spouse no matter whether your spouse is 62 65 or any age. The death of a spouse can change many aspects of your life including health policies.

The beneficiary of the Medicare plan is the sole entity who can receive benefits from the plan and upon death there are no benefits that transfer to a surviving spouse. Medicare spousal coverage isnt necessarily simple but its important to know the facts in order to maintain the proper coverage for you and your spouse. Medicare coverage explained If your spouse is younger they must be at least 62 years old the age at which they can qualify for Social Security retirement benefits.

Spousal age gaps. Your spouses employer has at least 20 employees. There is no such thing as Medicare family coverage.

You have coverage through an employed spouse. If you get benefits under your spouses retirement plan coverage may change after they pass away. Medicare automatically enrolls you.

Spouse Medicare 101 Medicare Plan Finder

Spouse Medicare 101 Medicare Plan Finder

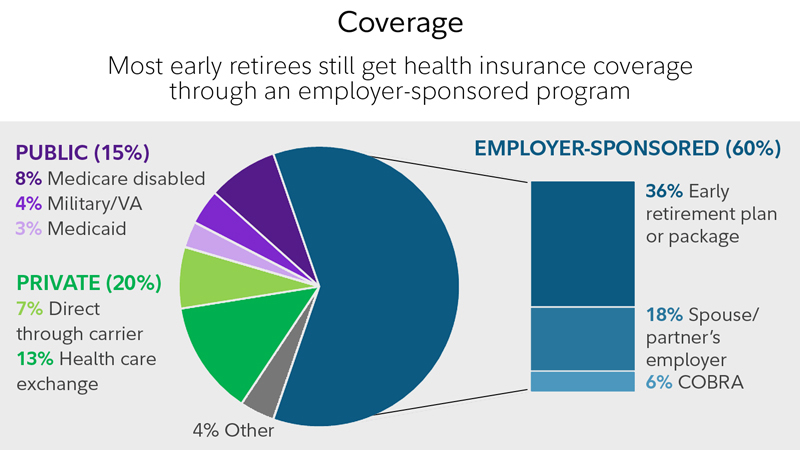

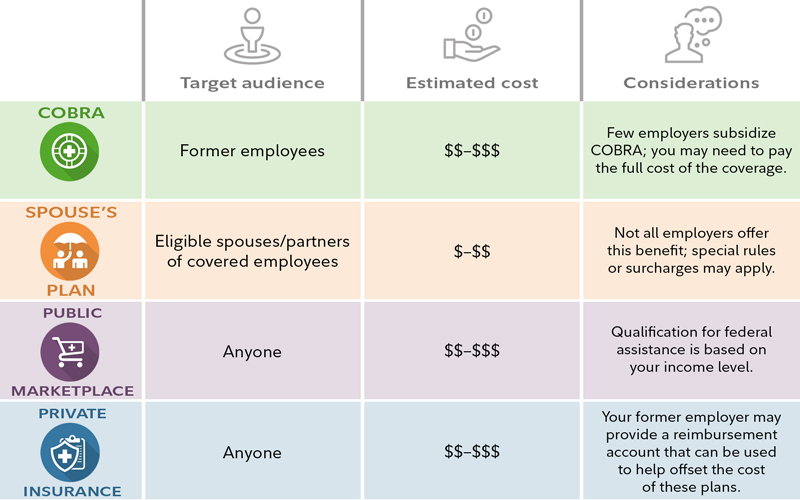

Bridging The Health Care Coverage Gap Fidelity

Bridging The Health Care Coverage Gap Fidelity

Medicare Group Health Insurance Medicare Mindset Llc

Medicare Group Health Insurance Medicare Mindset Llc

Medicare Coverage For Spouses Healthline Com

Medicare Coverage For Spouses Healthline Com

Should I Stay On My Spouse S Group Coverage Or Switch To Medicare

Should I Stay On My Spouse S Group Coverage Or Switch To Medicare

Medicare Coverage For Non Working Spouses Aarp Medicare Plans

Medicare Coverage For Non Working Spouses Aarp Medicare Plans

Bridging The Health Care Coverage Gap Fidelity

Bridging The Health Care Coverage Gap Fidelity

Medicare Coverage For Spouses Healthline Com

Medicare Coverage For Spouses Healthline Com

Medicare Mythbuster A Domestic Partner Is A Spouse For Medicare Coverage

Medicare Mythbuster A Domestic Partner Is A Spouse For Medicare Coverage

/GettyImages-478545993-5c047d7346e0fb00013a8bfc.jpg) Losing Health Insurance When Your Spouse Gets Medicare

Losing Health Insurance When Your Spouse Gets Medicare

Medicare Spouse Coverage Eligibility And Criteria

Medicare Spouse Coverage Eligibility And Criteria

Medicare And Employer Coverage Boomer Benefits

Medicare And Employer Coverage Boomer Benefits

Do I Need Medicare With Spouse S Insurance Plan Aarp Medicare Plans

Do I Need Medicare With Spouse S Insurance Plan Aarp Medicare Plans

Medicare And Spousal Benefits Stevens Associates Insurance Agency Inc

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.