If you turn 65 on or after January 1 2020 you cannot get Medigap Plan F or C. Medicare Supplement Plan G is almost identical to Plan F except for the Part B deductible.

Choosing Between Medigap Plan G And Plan N 65medicare Org

Choosing Between Medigap Plan G And Plan N 65medicare Org

Medicare has several options or parts you can enroll in to obtain health insurance coverage.

Medicare part f explained. If you select Plan G youll need to pay your Part B deductible 203 for 2021 yourself. This is simply due to similar wording with Medicare supplement insurance Medigap policies offering Plan A B C D F G K L M and N. There are four parts of Medicare.

Plan G is the same as Plan F with only one difference. But monthly premiums are typically higher than other plans so if Plan F has more coverage than you need this might not be the plan for you. Some companies may offer additional innovative benefits.

Plan F also pays the 20 for a long list of other Part B services. Currently the four parts of Medicare are. Plan F coverage also includes your other doctor visits for illnesses and injuries.

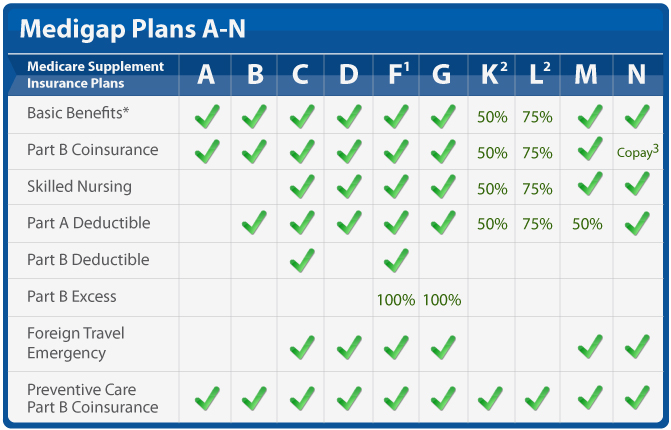

Part A hospital and coinsurance costs up to an additional 356 days after Medicare benefits are exhausted Medicare Part A hospice care copayment or coinsurance Medicare Part B coinsurance. Medicare Part B deductible. Medicare Supplement Plan F like other Medigap plan options signified by a letter A-D F-G K-N contains standardized benefits in most states.

Below is a list of costs and benefits covered by Medicare Supplement Plan F. Medigap plans sold to people who are newly eligible for Medicare arent allowed to cover the Part B deductible. Medicare Part A is hospital insurance.

You may have also heard of something called Medicare Supplement Plan F. By definition Medigap Plan F is the Medicare Supplement policy with the most benefits. It also covers the Part B excess charge a benefit thats just as rare.

Part A Part B Part C and Part D. Part B excess charges. Sometimes people refer to Plan F as Medicare Part F or Medigap Part F but correct terminology is Plan F.

12 rânduri With this option you must pay for Medicare-covered costs coinsurance copayments. When people begin talking about Part F or Part G they have likely confused Medigap Plans with the parts of the Medicare program itself. Medicare Part F is the most comprehensive plan offered and the most popular among the 10 Medicare Supplement plans.

It covers you during short-term inpatient stays in hospitals and for services like hospice. Even though it has similar coverage Medigap Plan Gs monthly. According to CSG Actuarial 40 percent of the people who have Part F.

Unlike Part A Part B involves more costs and you may want to defer signing up for it if you are still working and have insurance through your job or are covered by your spouses health plan. This part of Medicare covers doctor visits lab tests diagnostic screenings medical equipment ambulance transportation and other outpatient services. Medicare Part B first pays 80.

Doctors who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for services and items they provide. You must have coverage under Medicare Parts A and B before you can enroll in Part F. Plan G does not cover the Medicare Part B deductible.

Because of this Plans C and F arent available to people newly eligible for Medicare on or after January 1 2020. This standardization means youll get the same coverage for a Plan F wherever you buy from except in Massachusetts Minnesota and Wisconsin. If you already have or were covered by Plan C or F or the Plan F high deductible version before January 1.

Lots of people currently have a lot to learn whenever it medicare part f explained their particular government heath care treatment gain often known as Medicare. Medicare Plan F covers more expenses than other supplement plans and its one of just two plans that pay for the Part B deductible. 1 In general the four Medicare parts cover different services so its essential that you understand the options so you.

Medicare was created to give you the majority of a elderly citizens health and fitness treatment costs. Some doctors charge a 15 excess charge beyond what Medicare pays. Unless you fall into the Medicare Part A Effective Date Category explained above Now if you are someone who turns 65 after the cut-off dont fear.

Plan F covers that for you. Medicare Supplement Plan F vs. This includes durable medical equipment lab work tests.

After you pay your deductible you have no other out-of-pocket costs just like the Plan F. Medicare Supplement Plan F provides coverage for two areas that Plan N does not. Only Medicare itself has Parts GET HELP NOW.

Then your Plan F supplement pays your deductible and the other 20.

Medigap Plan F The Most Common And Comprehensive Plan

Medicare Plan G Review Medicare Nationwide

Medicare Plan G Review Medicare Nationwide

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plans Comparison Chart 2021

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plan Comparison Bobby Brock Insurance

Medicare Supplement Plan Comparison Bobby Brock Insurance

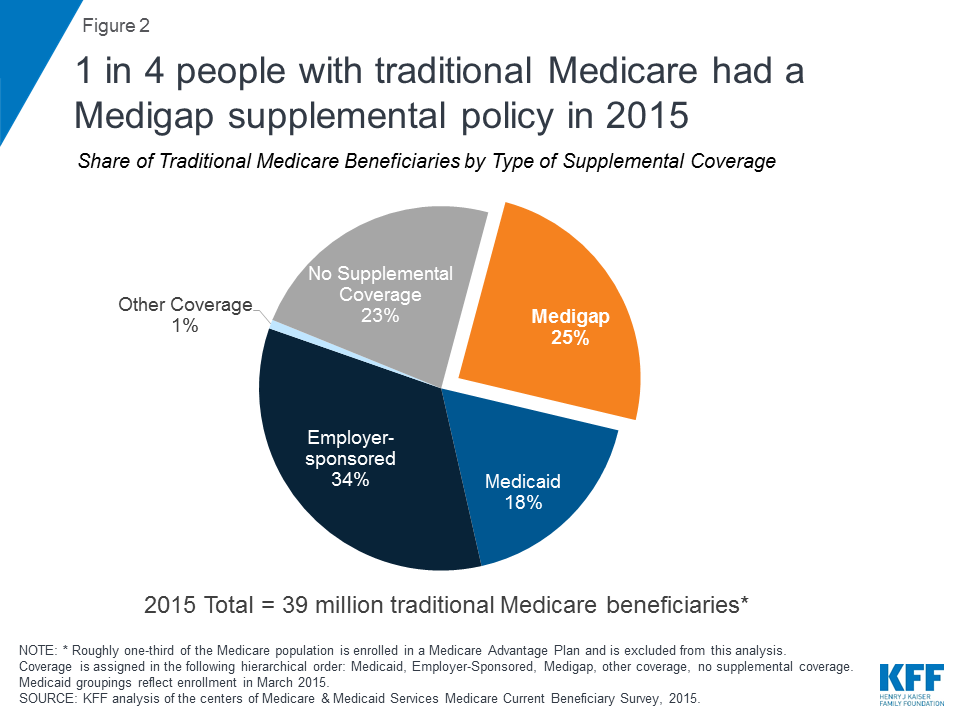

Medigap Enrollment And Consumer Protections Vary Across States Kff

Medigap Enrollment And Consumer Protections Vary Across States Kff

Cost Of Supplemental Health Insurance For Seniors

Cost Of Supplemental Health Insurance For Seniors

What Is Medicare Plan F Medicare Life Health Medigap Made Simple

What Is Medicare Plan F Medicare Life Health Medigap Made Simple

Is Plan F Going Away Medigap Plan F Discontinued Boomer Benefits

Is Plan F Going Away Medigap Plan F Discontinued Boomer Benefits

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.