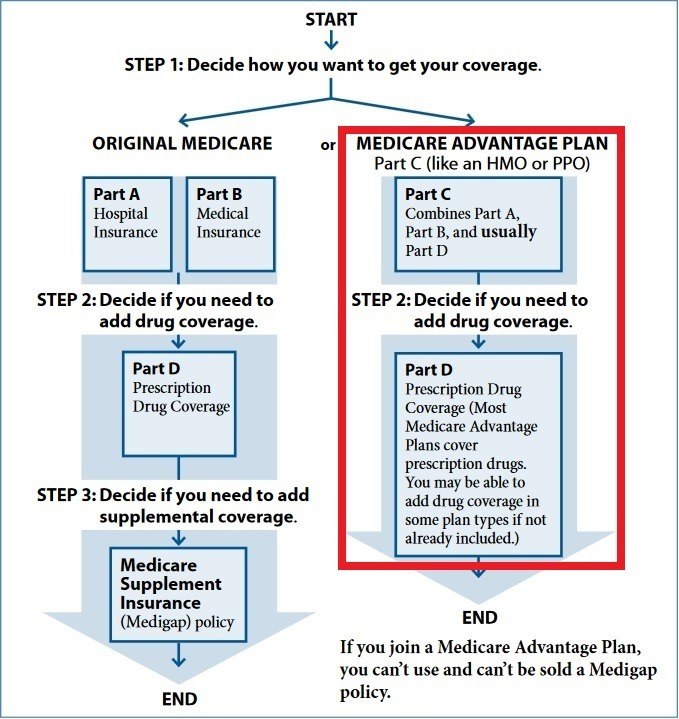

HMO plans are the most popular type of Medicare Advantage plan in the US. If you want to see a specialist an HMO.

Medicare Part C Medicare Advantage Paramount Retirement Solutions

Medicare Part C Medicare Advantage Paramount Retirement Solutions

Medicare HMO Medicare PPO.

Medicare advantage hmo or ppo. Its important to consider and compare the differences between Medicare Advantage HMO and PPO plans. An HMO will generally have a lower out-of-pocket cost so if price point is most important to you an HMO Medicare Advantage plan may be a good option. POS stands for point of service.

HMO POS PPO all of these signify different plan types. Was beinhaltet das HMO-Modell. Finden Sie es direkt auf Comparis heraus.

Many Medicare Advantage HMO and PPO plans provide additional benefits such as Medicare Part D prescription drug. This communication doesnt guarantee benefits and doesnt indicate all services received will be covered by your plan. HMOs are among the most common and popular choices for Medicare Advantage users.

The biggest difference between the two being provider flexibility among other things. Yes most Medicare Advantage HMOs and PPOs offer Medicare Advantage Prescription Drug plans as part of their plan benefits. Medicare Advantage plans are a type of umbrella plan that combines hospital medical and prescription coverage through a private insurance company.

Allows you to only consult providers in the network. Medicare Advantage plans are often HMO PPO or PFFS plans. Enrollment in any Humana plan depends on contract renewal.

There are several differences in costs and coverage among Original Medicare Preferred Provider Organizations PPOs and Health Maintenance Organizations HMOs. But there are a few HMO vs. So we put together this article to help explain the differences.

In 2021 62 percent of all Medicare Advantage plans offered are Medicare HMO plans. The four available forms of Medicare Advantage plans are as follows. Medicare Advantage plans come in several different structures including both HMOs and PPOs.

Was beinhaltet das HMO-Modell. PPO stands for preferred provider organization. If youve been shopping for Medicare Advantage plans youve probably noticed a lot of acronyms.

If you are interested in joining a PPO make sure to speak to a plan representative for more information. However if you value flexibility and are willing to pay a bit extra to be able to see whatever providers you want a PPO Medicare Advantage plan might be the better option. Anzeige Welche Leistungen sind im HMO-Modell inbegriffen.

Well spell it out for you. HMO plans typically have lower premiums and less out-of-pocket costs. Finden Sie es heraus.

Allows you to consult any health care provider. Additionally they have special plans set up for people with special needs When you are choosing a Medicare Advantage Plan you will need to consider everything we discussed about HMOs and PPOs as they will apply to these private insurance plans and how they set-up their provider networks. Private insurance companies contracted with Medicare offer Medicare Advantage HMO and PPO plans under the Medicare.

Health Maintenance Organizations HMO and Preferred Provider Organizations PPO have been around for a long time in the insurance market. Medicare Advantage HMO vs. Because HMOs are a closed network you generally wont have to file your claims with an HMO Medicare Advantage plan.

33 percent of all available Medicare Advantage plans are Medicare PPO plans in 2021. Well start with a basic definition of Medicare Advantage and then explain HMO and PPO options. Most differences between the two types of plans are.

Health Maintenance Organization HMO. Will I have to manage my claims. The table below compares these three types of Medicare plans.

There are a lot of similarities between Medicare Advantage PPO and HMO plans such as the costs of premiums deductibles and other plan fees. What do they have in common. Humana is a Medicare Advantage HMO PPO and PFFS organization and a stand-alone prescription drug plan with a Medicare contract.

Anzeige Welche Leistungen sind im HMO-Modell inbegriffen. Gives you the advantage of consulting any health care provider and using any health care facility that accepts Medicare plans. These plans are similar to traditional insurance as they operate off of a network like an HMO or PPO.

We get asked about Medicare Advantage every day. Finden Sie es heraus. Can I get prescription drug coverage under an HMO or PPO.

Most Medicare Advantage Plans are managed care plans typically HMO health maintenance organization or PPO preferred provider organization but you will also find Private-Fee-for-Service PFFS plans. Although they generally have provider networks Medicare Advantage PPOs let you see doctors outside the plan network. Folks call CoverageCoach wondering about the differences between Medicare Advantage HMOs and PPOs.

By a fairly large margin. Finden Sie es direkt auf Comparis heraus. 1 Is a Medicare HMO or a PPO plan more affordable.

HMO stands for health maintenance organization. You dont have to choose a primary care provider with a Medicare PPO but you do with an HMO. PPO plans have higher premiums and cost sharing but greater flexibility to choose your doctor or other health care provider.