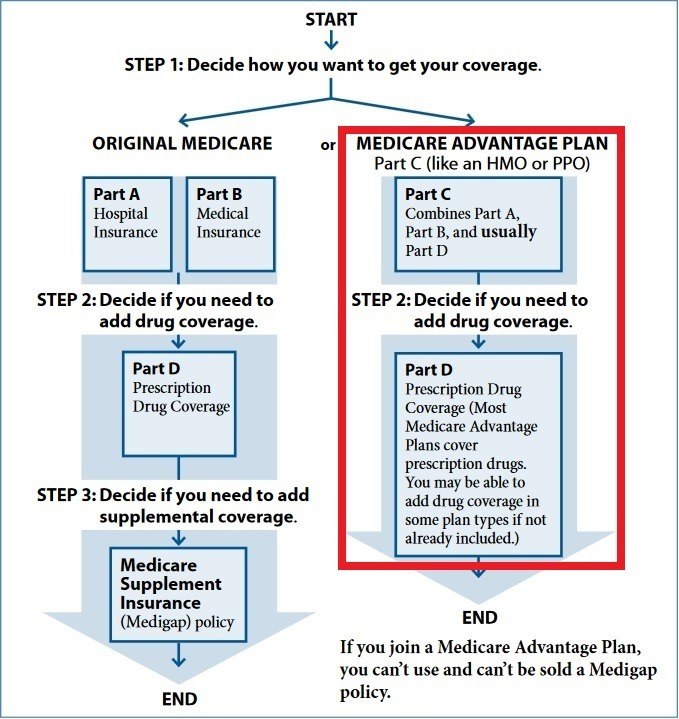

Medicare Part C or Medicare Advantage plan is a health plan that will help in reducing your overall healthcare costs. Medicare Parts A B C and D Cost.

Medicare Part C Plans Cost Coverage Enrollment Louisville Ky

Medicare Part C Plans Cost Coverage Enrollment Louisville Ky

In 2021 the average monthly premium for Medicare Advantage plans with prescription drug coverage is 3357 per month.

Medicare part c cost. Costs and coverage explained. If you paid Medicare taxes for 30-39 quarters the standard Part A premium is 259. How Much Does Medicare Part C Cost.

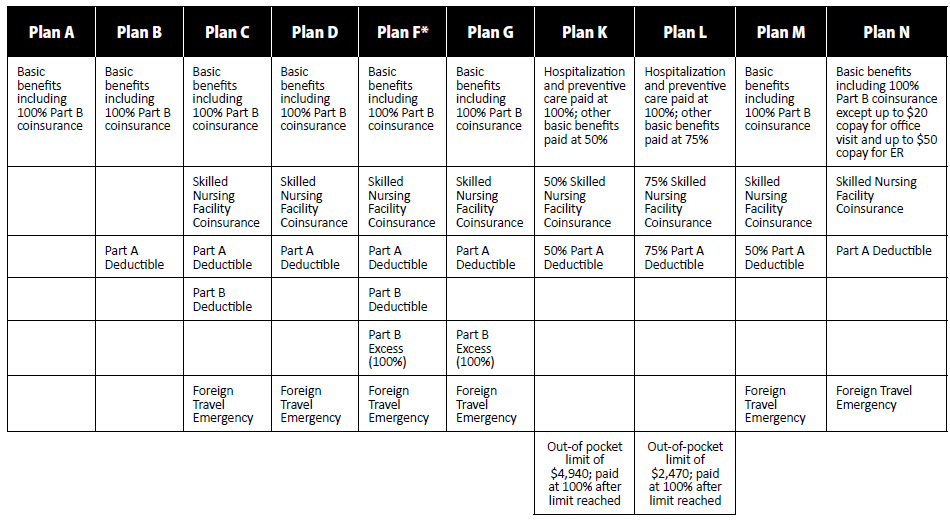

The cost of Medicare Part C plans varies depending on several factors including the plans benefits and the persons location age and sex. 52 rows by Christian Worstell Published December 17 2020 Reviewed by John Krahnert. These plans often offer additional coverage for services like prescription drugs vision and dental care.

The price can vary based on numerous factors like your age the amount of coverage the plan provides which insurance company you choose and where you live. Weve broken them down for you here to help make them easier to understand. Medicare Part C also known as Medicare Advantage is sold by private insurance companies.

Your out-of-pocket costs in a Medicare Advantage Plan Part C depend on. Some premiums are 0. If you paid Medicare taxes for less than 30 quarters the standard Part A premium is 471.

Medicare Part C Medicare Advantage Summary. The average premium. Deductibles copays and coinsurance for Medicare Part C vary by plan.

Out-of-pocket costs for medical services are generally lower than the costs of Original Medicare Part A and Part B and theres usually a yearly limit. Remember that all your Part D spending does not contribute to this out-of-pocket maximum amount. There are many different parts of Medicare each with their own costs and coverage levels.

However there are different plans with different rates and some can be more affordable. 1484 deductible for each benefit period. On average though Medicare Part C tends to be closer to 150 a month rather than one of the extreme high or low prices we told you about already.

If you buy Part A youll pay up to 471 each month in 2021. 1 Depending on your location 0 premium plans may be available in your area. With each plan there is an out-of-pocket maximum OOP that the plan must have.

After that limit your Medicare Part C plan will pick up all the remaining cost of covered health care services. The cost of Medicare Advantage Part C coverage depends on your plan type and where you live. However there is a limit to how much you can spend on out-of-pocket expenses.

The monthly premium varies based on the type of plan and the coverage. If you enroll in a plan that does charge a premium you pay this in addition to the Part B premium. What Does Medicare Part C Cost.

The premium for Medicare Part C. Each Medicare Advantage Part C plan sets its own specific costs but the types of costs they include are similar. This OOP is set by Medicare and is the highest amount allowable each year.

Lets look at the numbers. The cost of a Part C plan depends on a variety of factors including monthly and yearly costs copayments and your medical needs. Part A hospital inpatient deductible and coinsurance.

For Part C this amount is 6700 in 2020 and 7550 in 2021. However that may not be an accurate average for where you live. You wont pay anything for covered medical services after you reach the maximum.

The out-of-pocket limit for Medicare Advantage cant exceed 7550 a year for in-network services. We can tell you that the average price is about 30 a month. What is the cost of Medicare Part C.

When enrolling in Medicare Part C most of them can run about 150 per month. As well as paying the Part B deductible a person with Medicare Part C will pay a monthly premium. Medicare Part C also known as Medicare Advantage is an alternative way to get your Original Medicare benefits.

That all depends on what level of coverage you are getting which insurance company you buy yours from and what kind of preexisting medical conditions you have. Medicare Parts A B C and D. The table below shows the types of costs that plans may apply but you need to look at.

When you look for Medicare Advantage plans to purchase Part C you will notice rates vary greatly and they change frequently. Whether the plan charges a monthly Premium. Many Medicare Advantage Plans have a 0 premium.

Plans vary in terms of both cost and benefits. Visit Medicaregov to find a Medicare Part C plan that works for. 6 rows One advantage of Medicare Part C is that all Medicare Advantage plans have an out-of-pocket.

Thats why before you decide to purchase this plan make sure that you have evaluated your budget and determine if you can afford its monthly cost and out-of-pocket expenses. How much will you pay for yours. However this plan comes at a high cost.