For individuals who want to keep their teeth healthy Encore Dental is the right choice. Passive PPO The term passive PPO means that innetwork benefits are.

Dental Insurance Understand How It Works Compare Your Options

Dental Insurance Understand How It Works Compare Your Options

The CBIA Health Connections voluntary dental program includes passive and active PPO plans.

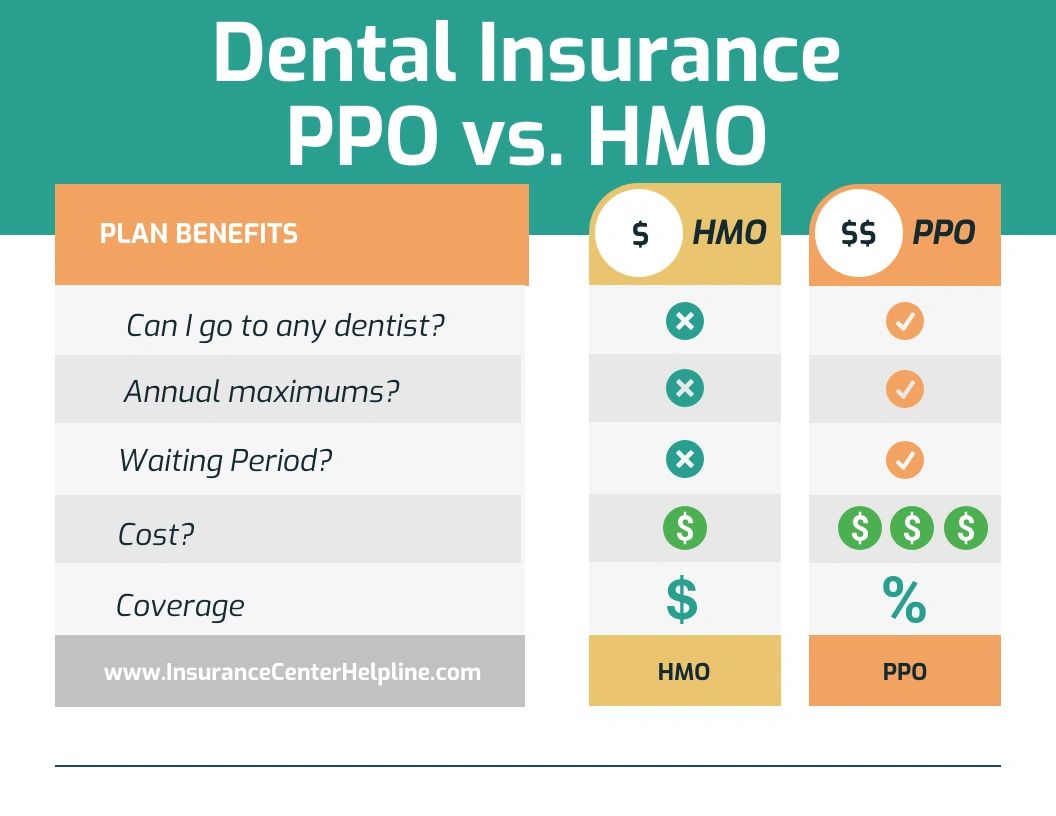

Ppo dental insurance definition. In fact more than 80 of dental insurance plans are PPOs. Thats called getting your dental care in-network. Instead you can choose any dentist in or out of network though your costs will be higher with out-of-network dentists.

Save Money on Dental Insurance. Advertentie Unlimited access to Dental Insurance market reports on 180 countries. The best part about PPO dental insurance is you have the ability to see whoever you want whether they are in network or out of network and dont need any approval in order to do so.

But youll pay less when you see a dentist in our preferred PPO network. For PPO plans an insurance company has contracts with a network of dentists who have agreed to charge certain fees for approved services. PPO stands for Preferred Provider Organization.

Customers covered by PPOs are able to select their own provider but it must be within the plans list of preferred providers or you will have to pay. However the deductibles are very small. A PPO dental plan includes the insurance company the insured members and networked providers.

Encore For Optimum Dental Protection Encore Dental is one of the dental insurance programs available today and it is offered by Stonebridge Life Insurance Company. A preferred provider organization PPO puts forward a network of dentists who provide services at a discounted price. Humanas affordable PPO Preventive Plus dental insurance plan covers your and your familys preventive care and basic services.

When you get in-network dental coverage the provider agrees to contracted rates with your insurance company. PPO dentists participate in the network thereby agreeing to accept contracted fees as payment in full rather than their usual fee for patients with the PPO. PPOs offer affordable programs to address basic needs like checkups and cavity fillings.

Advertentie Unlimited access to Dental Insurance market reports on 180 countries. Tap into millions of market reports with one search. They can range from 25.

Dental PPO Preferred Provider Organization plans offer a network feature and usually offer a balance between lower costs and dentist choice. Tap into millions of market reports with one search. Dental PPO insurance plans also known as dental preferred provider organizations or DPPOs are a popular dental insurance option due to their flexibility in allowing insured members to choose dentists and dental specialists.

A preferred provider organization PPO is a medical care arrangement in which medical professionals and facilities provide services to subscribed clients at reduced rates. EPO stands for exclusive provider organization and doesnt cover any out-of-network care. With a PPO dental insurance plan unlike with an HMO you do have an annual deductible and maximum.

Because PPO plans offer clear advantages as suggested below. Medical fixed indemnity plans are considered excepted benefits under the Affordable Care Act and are not subject to its regulations. However patients are allowed to use their benefits at any dentist regardless of whether they are in their plans network.

A Blue Dental EPO plan only covers services from in-network PPO dentists. Coverage under a fixed indemnity plan is not considered minimum essential coverage. Dental indemnity plans are still fairly common but virtually all commercial major medical plans utilize managed care.

This PPO plan does not require you to choose a primary care dentist. 1 So why have PPO plans emerged as the popular and smart choice. What does PPO mean in insurance.

This reduces costs so your monthly payments will be lower. You can choose from many different kinds of dental plans but Preferred Provider Organizations PPO are by far the most popular. Adental PPO or preferred provider organization is a dental insurance plan that allows patients to obtain dental care at affordable prices.

Therefore your co-payment and coinsurance responsibilities typically are limited by the policy terms.