For a little more than 15 a month you can add dental vision and hearing coverage to your Medicare Supplement plan. Seniors can choose from the nice lineup of BCBS Medicare Supplement plans for 2021.

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

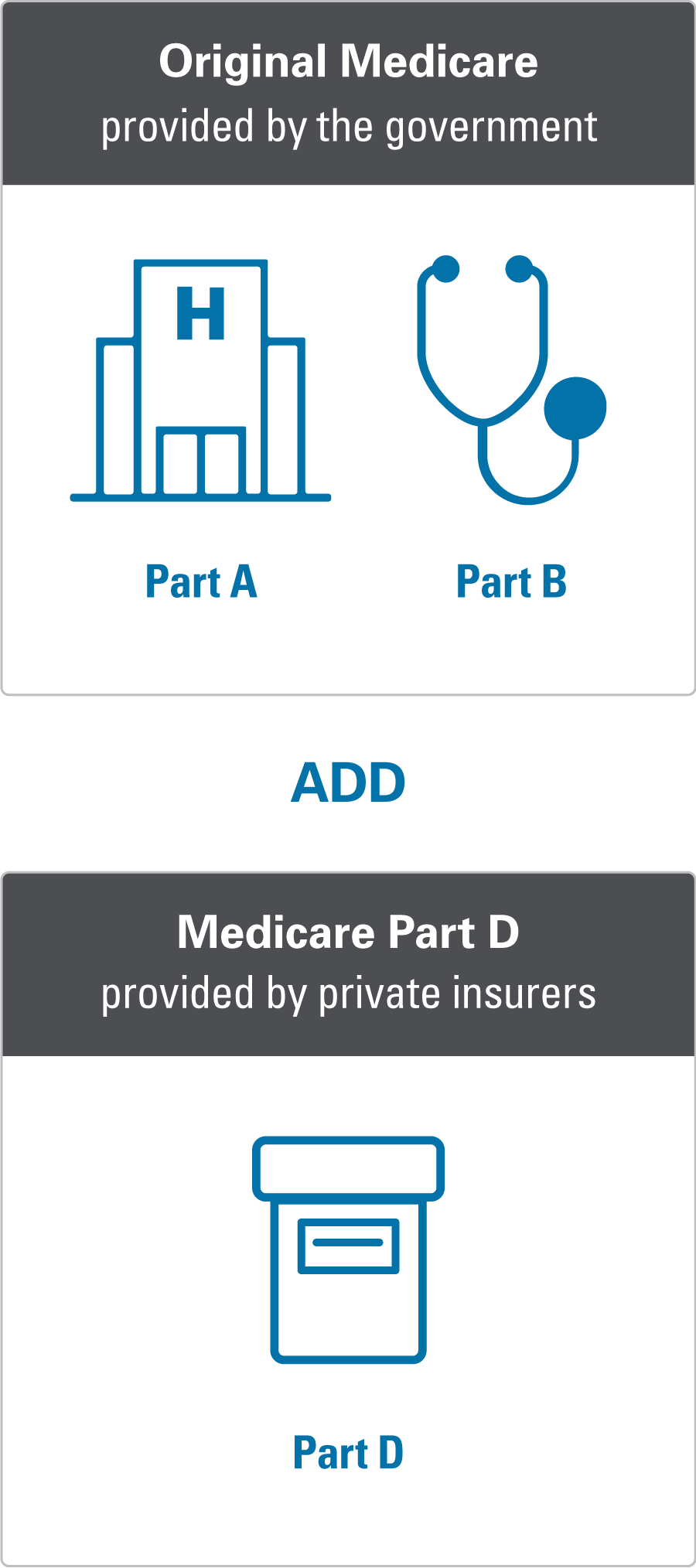

A Medicare Supplement Insurance Plan covers the costs that Original Medicare doesnt like.

Bcbs supplement plans. Medicare has been in operation for over a decade. Blue Cross Blue Shield High Deductible Plan F. That discount is lower than many other insurers who typically offer anywhere from 7 to 15 off and sometimes that applies even if no one else is currently enrolled with you.

These plans are compatible with Original medicare. BlueCross plans offer 0 hospital copays the LOWEST price in South Carolina. The Medicare Supplement insurance plans that are offered via BCBS provide an affordable method of covering what would otherwise be out-of-pocket Medicare costs for enrollees.

They will cover you for the items that arent part of the traditional Medicare. Middle of the road premiums. It focuses on covering some of the copays and coinsurance associated with Medicare Part A and Part B.

No-cost gym memberships at-home fitness programs and one-on-one health coaching. Blue Medicare Supplement Insurance Plan Compare All Medicare Supplement Insurance Plans Medicare Supplement Insurance Plans are identified by the letters A B C D F G K L M and N. Plan A is the most basic type of Medigap plan.

Those plans cover all the benefits that Original Medicare covers while a Supplement Plan is just thatsupplementary. BCBS Medicare Supplement Plan A. There is also a household discount of 5 if more than one household member is enrolled in a BCBS Medicare Supplement Plan.

Anzeige Exclusive deals savings on Fitness Supplements at MS. Each plan covers a different set of costs. In addition to offering Medicare Supplement coverage Blue Shield also provides Medicare Part D prescription drug plans and Medicare Advantage Medicare Part C coverage.

Starting Feb 1 2021 Blue Cross will offer this package to all Medicare Supplement members. Our Medicare Supplement plans help pay for costs that Original Medicare doesnt cover such as. Medicare can change these amounts each year but Medicare Supplement Insurance Plans adjust to always cover them.

High Deductible Plan F provides the same benefits as the standard Plan F. Plans as low as 35month with nationwide doctor choice. Coverage can begin as early as April 1 2021.

Supplemental insurance from Mosaic Group can extend your coverage to protect your familys finances. BCBS Medicare Supplement Plans 2021. Plan F and G cost a bit more but offer lower out-of-pocket expenses.

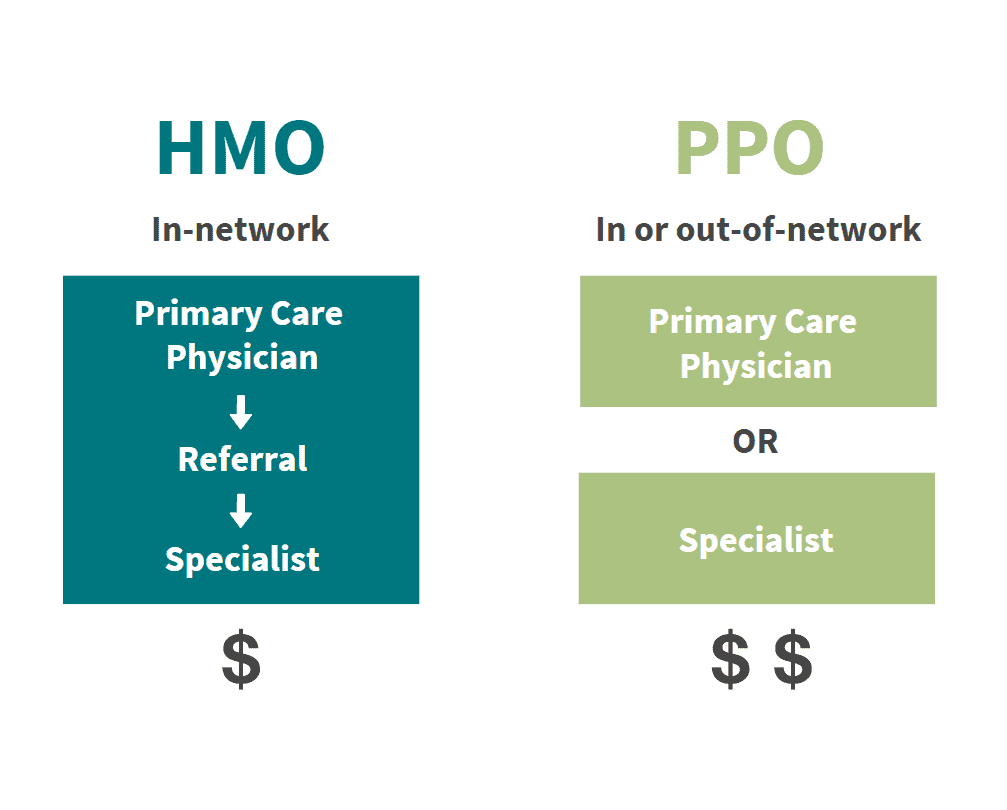

A Medicare Supplement plan is different from Medicare Advantage Plans. The most popular Blue Cross Blue Shield Medicare supplement plans are Plan F Plan G and Plan N. Plan N has lower monthly premium costs with moderate out-of-pocket expenses.

With a BCBS Supplement like Plan F would account for that expense Plan N while comprehensive does not cover this specific deductible. Dental exams and cleanings at no additional cost. Each Blue Cross Blue Shield company is responsible for the information that it provides.

Its the reason they are known as a Supplement plan as it fills in the coverage gaps. Although with this plan a high deductible that must first be satisfied. 2021 BCBS Medicare Supplement Plans Currently Medicare Plan N and G are the most popular and available plans in the market.

Anzeige Exclusive deals savings on Fitness Supplements at MS. This additional coverage gives you. 12-month rate guarantee on all plans.

We have a lot of information online but if you want to chat with someone about purchasing extra coverage for you or your family give us a call at 1-800-324-4973. For more information about Medicare including a complete listing of plans available in your service area please contact the Medicare program at 1-800-MEDICARE TTY users should call 1-877-486-2048 or visit wwwmedicaregov. Plan F has been the most popular supplement plan because it pays for all covered expenses.

Blue Cross Blue Shield Medicare Offers The Health Exchange Agency is offering the BCBS Supplement Plans with fantastic offers for seniors and are ready to help with taking the next steps in planting the foundation for your future. This is after Plan F was removed from the line-up in 2020. In other words you get great coverage at a much lower rate.

BlueCross Medicare Supplement plans offer. Plans are identified by the letters A B C D F G K L M and N.