Premium subsidy eligibility on the other hand is based on annual income. Take your AGI and add the following income if any apply to you.

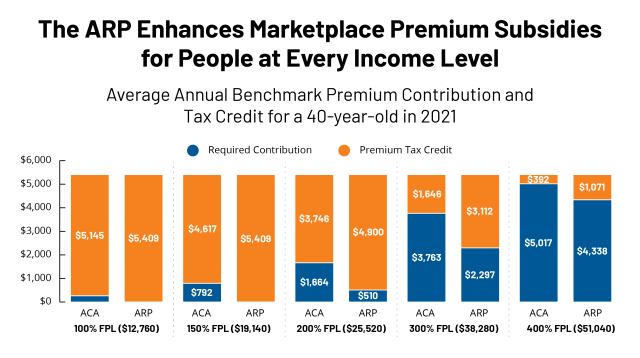

How The American Rescue Plan Will Improve Affordability Of Private Health Coverage Kff

How The American Rescue Plan Will Improve Affordability Of Private Health Coverage Kff

Qualifying for the subsidy.

What is considered income for obamacare subsidies. The discount on your monthly health insurance payment is also known as a premium tax credit. Income determines costs assistance subsidies for tax credits cost-sharing reductions and Medicaid and CHIP eligibility. You must make your best estimate so you qualify for the right amount of savings.

In 2021 Obamacare subsidies begin if your health plan cost is greater than 85 of your household income towards the cost of the benchmark plan or a less expensive plan the benchmark plan is the second-lowest silver plan. For premium subsidies the exchange will keep track of the amount that is paid to your health insurance carrier. Whose income to include in your estimate.

What is considered income for Obamacare subsidies 2020. You need not include. It will be reported to you and to the IRS at the end.

Income is counted for you your spouse and everyone youll claim as a tax dependent on your federal tax return if the dependents are required to file. Add specific tax-exempt income. Is 401k withdrawal considered income for Obamacare.

Retirement or pension income IRA or 401K withdrawals. The subsidies both premium assistance tax credits and cost-sharing are not considered income and are not taxed. Qualified lottery winnings and lump-sum income including inheritances tax refunds etc is only counted in the month its received if its less than 80000.

In fact Obamacare subsidies are designed to help lower- and middle-class Americans living between 100 and 400 of the federal poverty level FPL. This means everything from dividends from investment accounts savings part time job income and public assistance you may already be on. For 2016 individuals with annual taxable income between 11770 and 47070 qualify for such aid.

Any potential and real income can be viewed as income from the Obamacare perspective. For a household of two its 68960 in annual income note that this is based on the 2020 poverty level numbers as the prior years amounts are always used but are compared with the enrollees current income. So yes in years that you claim your son as a tax dependent youre considered a household of two and youd be eligible for a premium subsidy with an income of up to 400 of the poverty level for a household of two for 2021 coverage that will be 68960.

For a family of four applying for 2021 coverage 400 of the poverty level is 104800 in annual income. In 2020 for example thats a family of four with an income between 26200 and 104800 a year. You can be worth millions of dollars and still receive Obamacare subsidies if your income is below 45000 per individual or 95000 for a family of four for example.

Marketplace savings are based on your expected household income for the year you want coverage not last years income. Larger amounts are prorated over a longer timeframe Medicaid eligibility is based on monthly income. You are currently living in the United States You are a US citizen or legal resident You are not currently incarcerated Your income is no more than 400 of the federal poverty level.

There are two features of Obamacares premium tax credits that are important for early retirees to understand. ObamaCare Cost Assistance. For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four.

It depends on the kind of account youre withdrawing from. 20 rijen Marketplace savings are based on your expected household income for the year you want coverage not last years income. Tax-exempt social security benefits including tier 1 railroad retirement benefits.

What is considered income for Obamacare subsidies. Generally the amount of your income from a retirement account distribution depends on the type of retirement account how much you contributed to it and whether you were already taxed on the amount you contributed. For 2020 coverage that upper income cap is 49960 for a single person and 103000 for a family of four But as premiums have grown there are some areas of the country where coverage can easily exceed 25 percent of household income for a family just a little above 400 percent of the poverty level.

You will be asked about your current monthly income and then about your yearly income. First the highest household income that can qualify for a. Obamacare enrollment ticks up slightly with 2 weeks left McClanahans Obamacare.

To qualify for Obamacare subsidies you must meet the following criteria. To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level. The minimum income required to participate in Obamacare benefits is 100 percent of the federal poverty level.

If I get an Obamacare subsidy in the exchange is the subsidy amount considered income. Supplemental Security Income child support food stamps Temporary Assistance for Needy Families TANF gifts workers compensation Veterans disability payments cash withdrawals from savings qualified withdrawals from Roth IRAs or proceeds from loans like student loans home equity loans or bank. The income limit for subsidy eligibility is based on the size of your tax household.

Other income such as prizes awards and gambling winnings. Include their income even if they dont need health coverage. The types of assistance offered under the Affordable Care Act are.