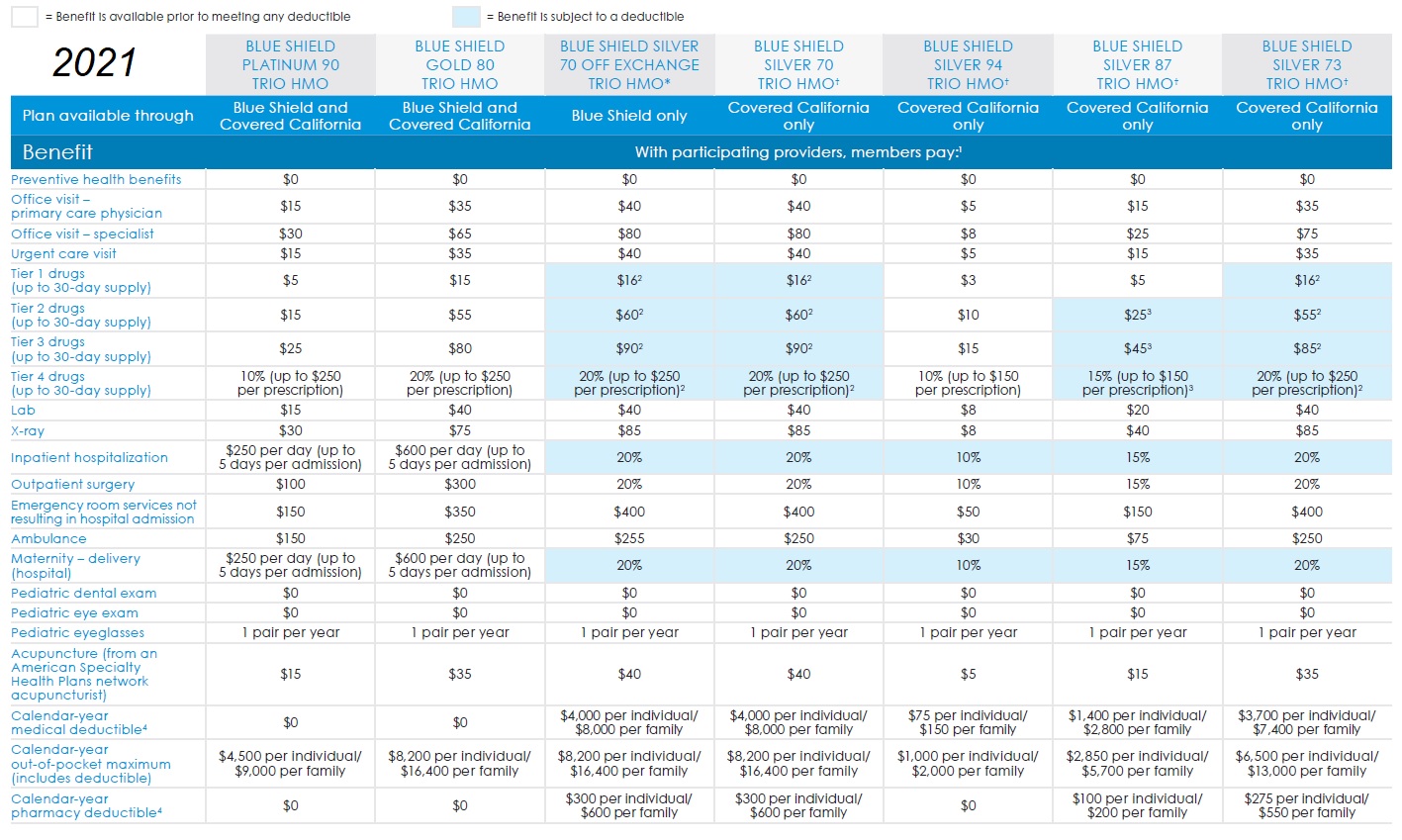

MOOPs Under the Affordable Care Act. What you pay goes toward your deductible first.

What Are Deductibles And Out Of Pocket Maximums Youtube

What Are Deductibles And Out Of Pocket Maximums Youtube

There are a few basic differences between your deductible vs maximum out of pocket.

Deductible vs out of pocket health insurance. The annual deductible for a health plan can be anywhere between 500 to a few thousand dollars if youre an individual. For example monthly premiums will typically not help you meet the deductible nor will copays. Copays are a fixed fee you pay when you receive covered care like an office visit or pick up prescription drugs.

Health Insurance Deductible vs. A deductible is the amount of money you must pay out-of-pocket toward covered benefits before your health insurance company starts paying. If you are lucky enough to have it it can help mitigate the financial risk of individual family.

Also not all out-of-pocket expenses count towards the insurance deductible. Its important to note that not all plans have deductibles but. Once youve met that amount.

Deductible An out-of-pocket maximum differs from the plans deductible. In basic terms a deductible is a prerequisite requirement you need to spend first before the insurance company starts paying the claim. Once the deductible is met the.

Need an explanation of health care terms we use. The deductible is the amount of allowed expenses the policyholder must pay before benefits begin. The highest out-of-pocket maximum for 2021 plans is 8550 for individual plans and 17100 for family plans inclusive.

When you reach it your insurer will pay for all covered services. It is the most you will ever have to pay out of your pocket for health care during the year not including premiums but definitely including the deductible AND the copays and coinsurance you will. A deductible is an accumulation of out of pocket claims.

As mentioned before out-of-pocket costs include a handful of different expenses including your deductible. Your deductible is one component of these expenses. If a plan has a higher deductible you may pay more in out-of-pocket expenses.

A deductible is the amount of money a member pays out-of-pocket before paying a copay or coinsurance. However it doesnt include insurance premiums. Your deductible one of the many out-of-pocket expenses is the amount of money you pay out of your own pocket before your benefits kick in.

A copay is a common form of cost-sharing under many insurance plans. The out of pocket medical expense is the portion of provider fees left over after the health insurance policy made its claims payments. Out-of-pocket limits are often confused with deductibles the amount you pay out-of-pocket before coinsurance kicks in.

This is sometimes referred to as an embedded deductible system. OOPM Copayments Deductible Coinsurance. Deductible Vs Out of Pocket Maximum This is the point where we learned about coinsurance deductibles percentages and that both of us have our own separate numbers to hit.

Since I prefer simple terms I normally call it a per-person deductible. I like this model. Deductibles With health insurance the deductible is the amount you pay each year for covered costs before insurance kicks in.

Deductible vs out-of-pocket maximum In 2021 deductibles on the health insurance marketplace range from 0 to 8550 for an individual and 17100 for a. In my experience a decent number of health insurance plans carve out an individual deductible separate from the family deductible. This is a separate out-of-pocket item not to be confused with the copayments and coinsurance costs associated with using your health insurance for coverage1.

So once your deductible is met your health insurance will start to cover your bills and you will only be left with copays and coinsurance. Out-of-Pocket Maximum vs. OOPM includes copayments deductible coinsurance paid for covered services.

Limits on annual spending. A deductible is a specified amount of money you pay out of your own pocket before your health plan begins to make payments for claims. To help keep premium costs lower some health care plans have a deductible.

A deductible is the total amount of money a person has to pay for covered medical expenses before your insurance will pay the rest or a percentage of it. Your deductible amount counts toward your out-of-pocket maximum and while copayments do count toward your out-of-pocket limit they do not count toward your deductible. The amount paid goes toward the out-of-pocket maximum.

Out-of-Pocket Maximums vs. Out-of-Pocket Maximum Deductible first then out-of-pocket max. Out-Of-Pocket Maximum or Out-of-Pocket Limit is the most you will have to pay for covered medical services in your plan year.

But if you have a. Amounts you pay for covered services go toward your. Your monthly premium.

/medicare-part-d-overview-4589766-ec01f6e5f22546d8b45249a54d466e53.png)