- Free Quote - Fast Secure - 5 Star Service - Top Providers. Sunday April 26 2009 727 AM Posted by Someone.

Health Insurance Shopping Consumers Rarely Consider Quality Ratings Healthpocket

Health Insurance Shopping Consumers Rarely Consider Quality Ratings Healthpocket

Get the Best Quote and Save 30 Today.

Healthcare insurance ratings. Anzeige Compare Top Expat Health Insurance In Austria. 22 2016 -- Twenty-three insurance plans out of more than 1000 have received the highest score of 50 according to new ratings released Thursday from the National Committee for Quality. Best for HSA Options Kaiser Permanente is one of the most well-known health insurance providers and has 842 22 of the healthcare market share coming in second behind United Healthcare.

Insurance Insights Fitch Ratings Insurance Insights newsletter provides a monthly global round up of our key research rating actions and comments for the insurance markets. Compare the best health insurance using expert ratings and consumer reviews in the official ConsumerAffairs buyers guide. Anzeige Get 247 Virtual Appointments Via Video or Phone With Our Global Network Of Consultants.

All companies have negative reviews online. Personal Health Insurance Plans. HealthCaregov offers a health insurance plan quality ratings or star ratings program.

Fitch Ratings Jim Auden explores in Medical Liability Monitor the US medical professional liability insurance industry underwriting performance. Accreditation status is as of June 30 2019. Overall health insurance plan quality ratings.

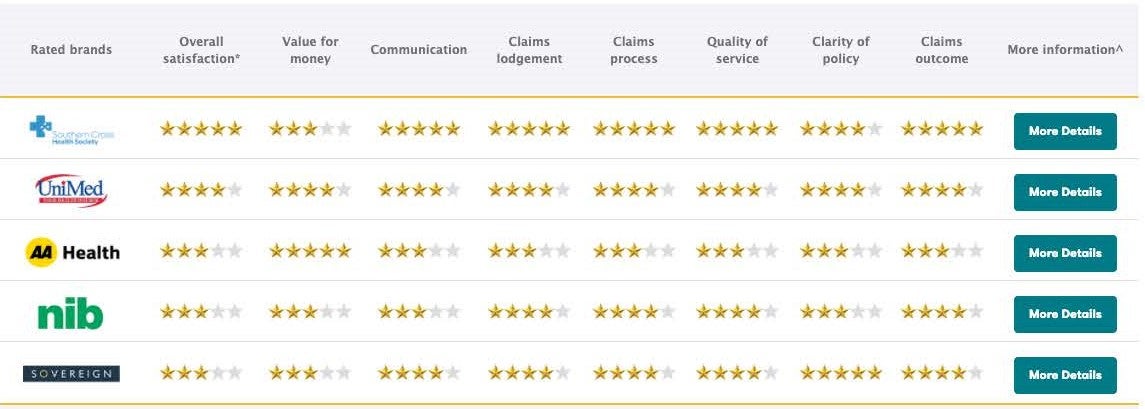

NCQAs Health Insurance Plan Ratings 20192020 list private commercial Medicare and Medicaid health insurance plans based on their combined HEDIS CAHPS and NCQA Accreditation standards scores. Depends on the health insurance provider. Health insurance like a lot of the industries we cover is not exactly the kind of subject people gush over review-wise when they.

- Free Quote - Fast Secure - 5 Star Service - Top Providers. Each rated health plan has an Overall quality rating of 1 to 5 stars 5 is highest which accounts for member experience medical care and health plan administration. Get the Best Quote and Save 30 Today.

The Next Level Of International Private Healthcare With Cover Across The World. Similar exemptions apply depending upon the policy which is bought. Anzeige Compare Top Expat Health Insurance In Austria.

UnitedHealthCare has a large chosen supplier network of over 790000 participating doctors. Blue Shield of California. Anzeige Get 247 Virtual Appointments Via Video or Phone With Our Global Network Of Consultants.

The online platform allows consumers to get free quotes and explore multiple health insurance coverage with just a few clicks. The Next Level Of International Private Healthcare With Cover Across The World.

/medicare-part-d-overview-4589766-ec01f6e5f22546d8b45249a54d466e53.png)