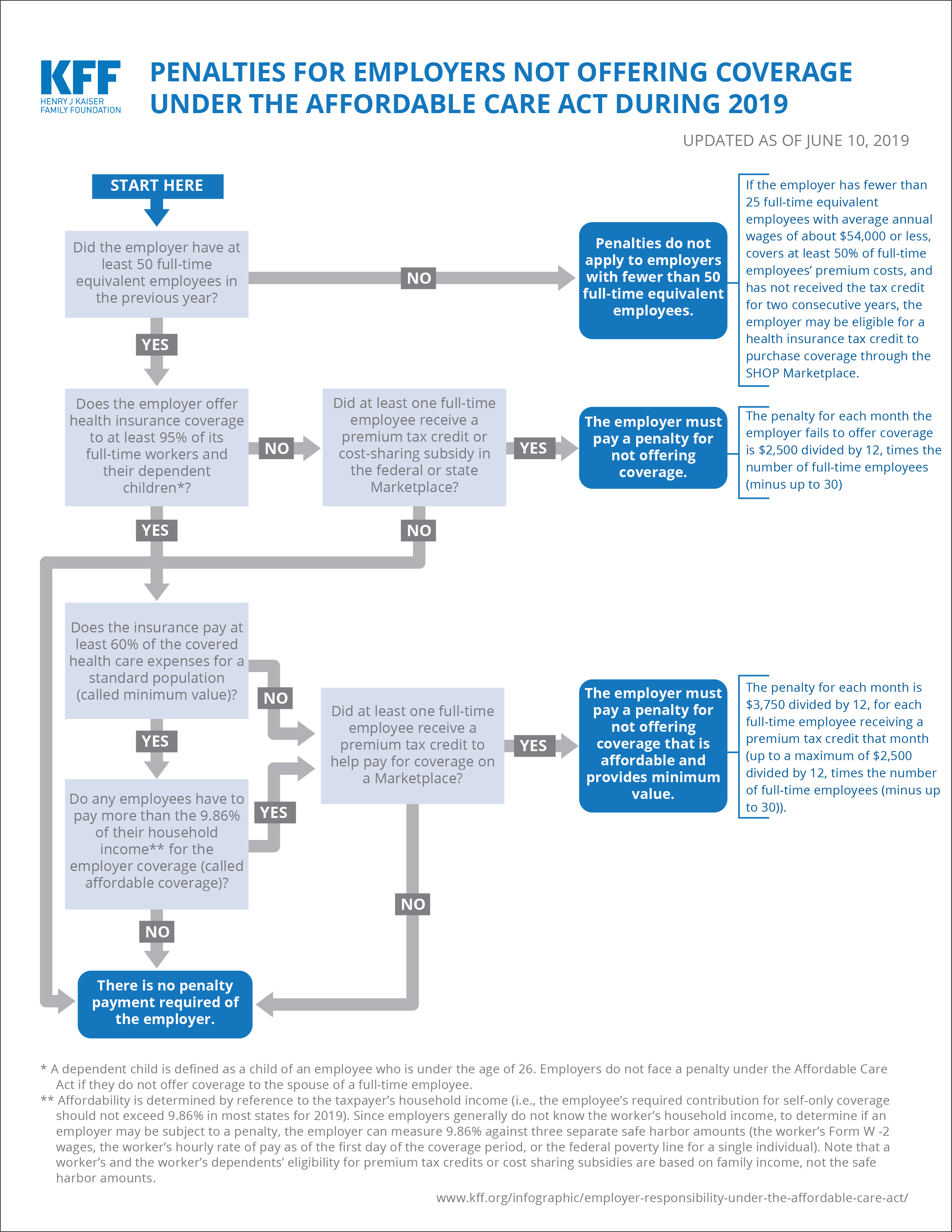

Allow an employer to provide a consistent benefit package in all locations even if employees reside in several states. If you have fewer than 50 full time equivalents as.

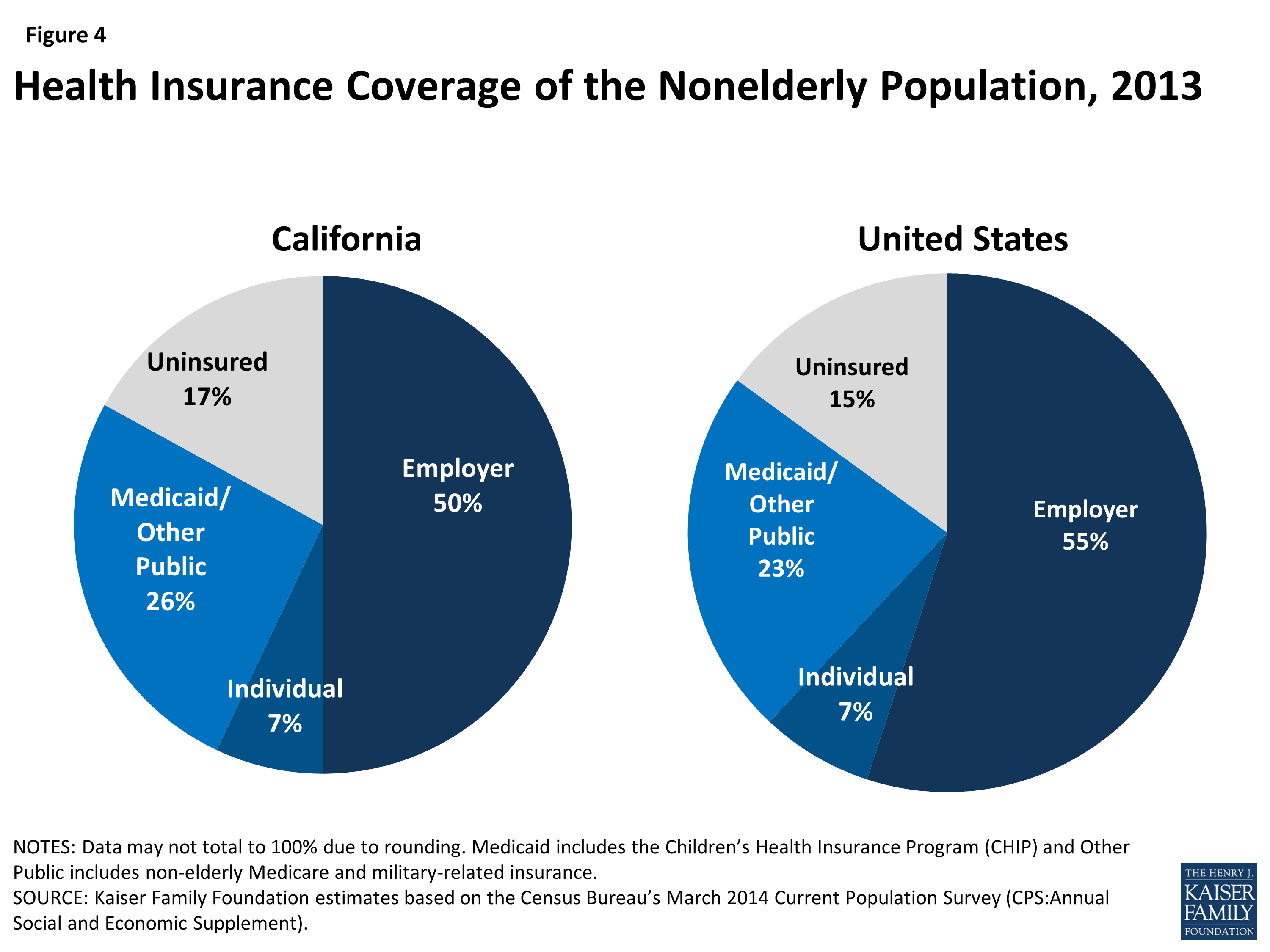

The California Health Care Landscape Kff

The California Health Care Landscape Kff

Offer medical insurance coverage to all eligible full- and part-time employees.

California employer insurance requirements. All employees eligible for coverage should get a 1095-C regardless of whether they actually participate in the employers health plan. If a business employs one or more employees it must satisfy the requirement of the law. Have been in business longer than two months.

There is currently no state law requiring employers to offer group healthcare insurance to their employees but most employers do provide this benefit. Under fully insured plans the carrier is. Electronic Reporting and Payment Requirement.

15000 for injurydeath to one person. California health insurance companies require that an employer contribute at least 50 percent of the employee only monthly cost or premium So for example if the monthly cost for one employee not including dependents is 300 then the employer must pay at least 150. For employers and other health insurance sponsors for example labor trusts and associations self-insuring may be attractive for several reasons.

There is currently no state law obliging employers to offer group health insurance to employees but most employers provide this benefit. Training Requirements Employers with 5 or more employees that operate in California must provide two hours of sexual harassment prevention training to supervisors and at least one hour of sexual harassment prevention training to all nonsupervisory employees within 6 months of hire and within 6 months of becoming a supervisor where applicable. See Group Life Insurance.

All employers must electronically submit employment tax returns wage reports and payroll tax deposits to the Employment. This insurance must pay for at least 60 of covered services. If a California employer offers group life insurance premiums for the policies may be paid by different sources.

Some insurance companies allow a lower employer contribution. Additionally employees who are offered affordable minimum essential coverage by their employers are not eligible for premium tax credits if they purchase a plan through Covered California. California state law AB1672 says that small employers cannot be denied coverage as long as they.

If an employer provides health insurance Californias insurance laws require policies to cover certain benefits mandated benefits and give employees the right to continue group coverage in certain circumstances if the employee. 5000 for damage to property. The Employer Mandate for Large Employers The ACA employer mandate requires large employers to provide a specified percentage of their full-time equivalent employees and those employees families with minimum essential healthcare insurance.

If your employer provides health insurance California insurance law requires policies that cover certain benefits mandatory benefits and give employees the right to continue group insurance. If life insurance benefits are provided certain requirements must be met. Under the current ACA law theres dividing line based on the.

California employer requirements for health insurance. California small business insurance needs costs and coverages are different for each industry and CA region. Who Is Required to Purchase Workers Compensation Insurance.

California employees who work at least 30 days within a year from beginning their employment earn at least one hour of paid leave for every 30 hours worked beginning on the first day of employment. All California employers must provide workers compensation benefits to their employees under California Labor Code Section 3700. Health insurers must provide equal coverage for mental and physical health issues.

30000 for injurydeath to more than one person. Comply with insurer requirements regarding employer contribution and employee participation. Does a Company Have to Offer Health Insurance in California.

Here are the minimum liability insurance requirements per California Insurance Code 115801b. California law requires that employers provide paid leave to workers who fall ill or who must take care of a sick family member. While not an exhaustive list to properly protect your business against lawsuits - consider these additional policies that fall under commercial property andor casualty insurance.

Are California employers required to provide health insurance. The IRS uses the information on form 1095-C to confirm that no employees who have been offered affordable minimum essential coverage by their employer. California employers are not required to provide life insurance benefits.

All insurance policies sold in California are required to provide coverage for mental health and substance use disorder services. 50 Full time equivalent number for health insurance requirements. For example your insurer cannot charge you more for a visit to a mental health provider than they do for a visit to a similar physical health provider.