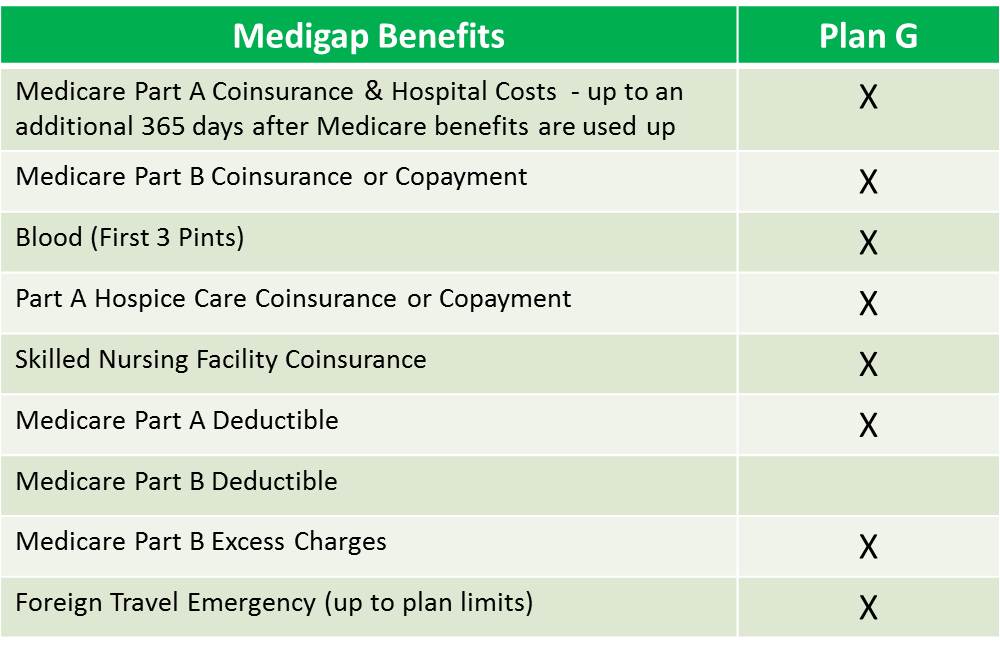

Medigap Plan G is a Medicare supplement insurance plan. Even though you will have to pay the one time 203 for the Part B deductible on Medigap G the monthly savings will be worth it in the long run.

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

The order for that delisting came through a few years ago but it has only recently gone into effect.

Medicare supplement plan f or g. Plan F is the only supplement that offers more benefits than Medicare Plan G but the plan F is not available for people entering Medicare as of 01012020 making the Medicare part G the most comprehensive plan on the market. Plan G is often considerably less expensive than Plan F. If you go to the pharmacy a lot and you want the freedom to choose any doctor or hospital that accepts Medicare this plan might be right for you.

The reasoning for this is because Plan F can be quite expensive. Lower premiums are a great start but there is another reason why Medicare Plan G has become a consumer favorite. Medigap is supplemental insurance plan sold by private companies to help cover original Medicare costs such as deductibles copayments and coinsurance.

It is because Medigap Plan G is also a long-term rate saver. Plan G covers everything listed on the benefits chart with the. For the premium which is higher than for other Medigap policies youll get more comprehensive coverage.

1-888-563-3307 or TTY 711. It was developed to pay out what remains once the basic Medicare fulfills its share of a clients claims. The Medicare Part F policies are first-dollar coverage.

2021 Blue Cross Medicare Supplement Plan G. Just as the rest of the parts F deals with drugs administrated in the clinic but has nothing to do with retail prescriptions. Medicare Supplement Plans F and G are identical with the exception of one thing.

It is considered a prestige plan with. 8 Zeilen Medicare Supplement Plan G is almost identical to Plan F except for the Part B. With Plan G you will need to pay your Medicare Part B deductible.

Plan F and Plan G are the most comprehensive Medicare Supplement Insurance plans available. As you explore ways to expand coverage and protect yourself from potentially overwhelming medical expenses now and in the years ahead you may consider purchasing supplemental insurance to help you pay for some of the healthcare costs associated with Original Medicare. The Part B deductible for 2021 is 203.

It covers a variety of expenses that arent covered by Medicare parts A and B such as coinsurance copays and some deductibles. You can often save 50 a month moving from F to G. In Washington a Plan Fs premium is 2568 and the Plan G1896 a.

The Medicare supplement insurance Plan F covers all the cost-sharing for Medicare Part A and B services. Depending on where you live in the country it can range from 99 per month to 509 per month for the plan premium which is 1108 to 6108 per year. This means that you will have to pay 183 annually before Plan G begins to cover anything.

9 Zeilen Medicare supplemental health insurance plans also called Medigap work with original. What Does Medicare Supplement Plan G Cover. Medicare Supplement Plan F is one of those delisted plans.

In Florida one company charges an annual premium of 2738 for Plan F and 2496 for Plan G a difference of 242. Discover the key differences between Medicare Supplement Insurance Plan F and the Medigap plan that may soon become the most popular Medigap plan Medigap Plan G. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

Medigap Plan G is a Medicare. Now anyone enrolling in Medicare after January 2020 is no longer able to enroll in Plan F as well as other delisted plans. Medicare Supplement Plan G Coverage Like other plans Plan G fills in the gaps that Original Medicare leaves uncovered.

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to with one exception. Is this plan for you. If you are turning 65 soon you may be considering your Medicare options.

2 Plan G will be a. Medicare Supplement Medigap Plan F. Plan G is the top-of-the-line Medigap option if youre newly eligible for Medicare.

Plan G does not cover the Part B deductible the Part B deductible for 2018 is 183.